How to Establish Tradelines—Insider’s Guide

Watch Out for These Tradeline Myths

03/27/2023

At What Age Can You Start Building Credit?

04/12/2023 Establishing tradelines is an essential part of your credit. In fact, all credit ultimately boils down to tradelines, because your credit standing depends entirely on what tradelines you have and how you manage them.

Establishing tradelines is an essential part of your credit. In fact, all credit ultimately boils down to tradelines, because your credit standing depends entirely on what tradelines you have and how you manage them.

These invaluable items are simply the accounts that you have on your credit report. Each account on your credit report, whether it is a mortgage, student loan, credit card, or some other type of credit, is referred to as a tradeline or line of trade.

Because credit is a necessary part of modern life for most people, you need to know why tradelines matter, the best ways to establish tradelines, tradeline factors to consider, and how to tell which tradelines to avoid and which are a good fit for you. So if that’s what you’re after, keep reading this article, where we talk all about how to establish tradelines.

Why Tradelines Matter

Your Credit Reports and Credit Scores Are Based on Tradelines

As we touched on above, tradelines are the foundation of all credit. Your credit report primarily consists of information about your tradelines, such as:

- The name of the financial institution you have an account with

- When the account was opened

- What type of tradeline it is

- The credit limit or loan amount and the current balance on the account

- The payment history of the account (i.e. whether you made all of your payments on time or not)

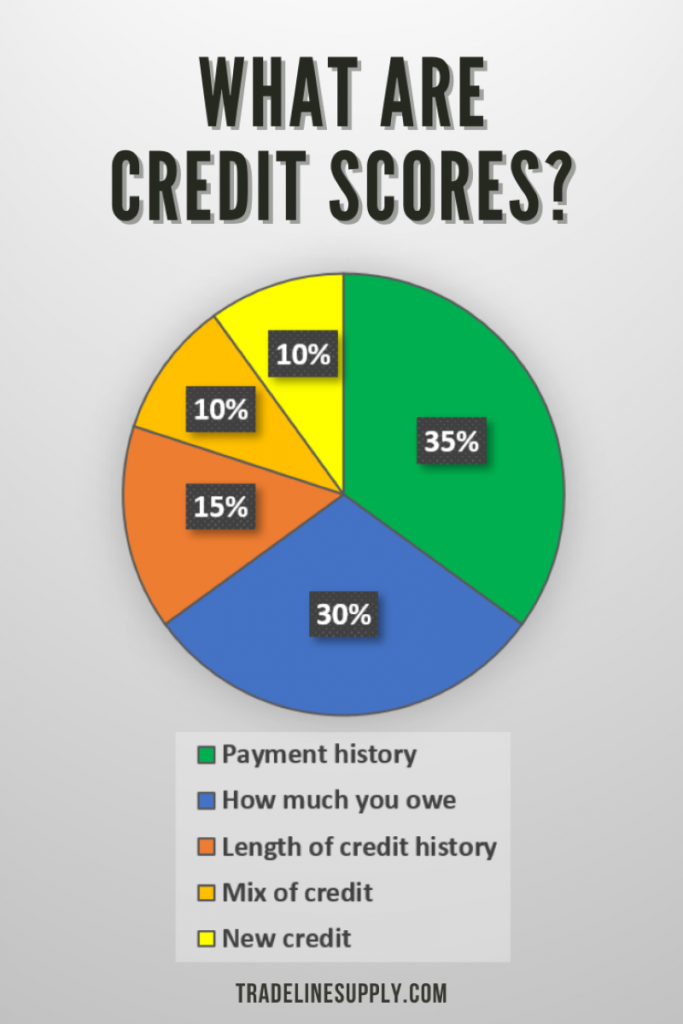

Your credit scores are based on the information in your credit report, so by extension, they also depend on your tradelines and how you manage them. Tradeline characteristics considered in your credit scores include:

- The age of your tradelines (length of credit history)

The payment history of each tradeline

The payment history of each tradeline- The number and types of tradelines in your credit file (credit mix)

- The balances, credit limits, and credit utilization ratios of revolving accounts and loan amounts, balances, and the proportion of loan balances to loan amounts of installment loans

- Inquiries acquired by applying for new tradelines

You can read more about how tradelines build credit in Tradelines: What You Should Know About Building Credit.

Tradelines Show Lenders How You Handle Credit

When you apply for credit, lenders need to know that you can manage your payments responsibly, and they try to find this out by looking at your credit history. If your credit report shows a long history of on-time payments, low credit utilization, a balanced mix of credit, and few recent inquiries, lenders can rest assured that you are safe to lend money to, and your high credit score will reflect this.

With a positive credit record and healthy credit score, you’ll be able to take advantage of:

- Higher approval odds when you apply for credit

- Higher credit limits

- Lower interest rates

- Better credit card perks

- Lower security deposits for utilities and rentals

- Lower insurance premiums

You Need Several Tradelines to Have a High Credit Score

Because tradelines are such a valuable indicator of how you manage your credit and pay your bills, it’s ideal for your credit score to have at least a few tradelines of different types in your credit profile.

In How to Get an 850 Credit Score, we learned that FICO high scorers have an average of seven credit cards in their credit history, including both open and closed accounts. You don’t need to have a ton of credit cards to have a high credit score, but in general, having more accounts is better for your score, because it demonstrates that you can manage multiple lines of credit.

In addition, it’s important to have both revolving tradelines (e.g. credit cards, home equity lines of credit) and installment tradelines (e.g. auto loans, mortgage loans) to have a balanced credit mix.

In order to have good credit, it matters how many tradelines you have as well as the quality of the tradelines.

Differences Between Personal Consumer Tradelines and Business Tradelines

Tradelines are the basis of all credit, and business credit is no exception. However, business credit and personal consumer credit operate within different systems, so business tradelines and personal tradelines are not interchangeable.

While the business credit system has different credit reporting and scoring practices than the personal credit system, what they both have in common is the importance of establishing a good credit history.

Business Tradelines

Business tradelines may include business loans, business credit cards, business lines of credit, and vendor accounts. These tradelines report how quickly your business pays its bills to the business credit bureaus: Dun & Bradstreet, Equifax, and Experian.

Since they are associated with a business and not with an individual consumer, business tradelines do not appear on your personal credit report and do not affect your personal credit score. Similarly, your personal tradelines do not directly affect your business credit record.

However, this does not mean that personal credit is not important if you want to establish business credit. Read about how you can use your personal credit to get your business off the ground in Business Credit Starts With Personal Tradelines.

Personal Tradelines

Personal tradelines appear on your personal credit report and are what your personal credit scores are based on, as we discussed above. Personal tradelines do not appear on your business credit report.

When you’re working on establishing tradelines, it’s crucial that you know what your goal is in order to avoid wasting your effort and money. If you want to build personal credit, don’t go after business credit tradelines. Instead, focus on building your consumer credit report by establishing personal tradelines.

Top 5 Credit Tradelines Considerations

#5 Not All Tradelines Post to the Credit Bureaus—Use the Ones That Do

If your goal is to add more tradelines to your credit, one of the most important things you need to know is whether each tradeline you are considering actually reports to the three major credit bureaus.

When it comes to authorized user (AU) tradelines, not all banks report AU data to the credit bureaus. Some report partial AU data, but not the full age of the tradeline, while others may not report AU tradelines at all or report unreliably.

Therefore, when planning to become an AU on a credit card, you’ll want to check with the credit card issuer about their AU tradeline reporting practices. If you purchase a tradeline from Tradeline Supply Company, LLC, you can be confident that all of the banks we work with have been proven to post reliably and report to all three credit bureaus.

#4 Understand How to Choose Tradelines

Even if a tradeline reports to the credit bureaus, you still need to do your due diligence in choosing the best tradelines for you.

Due to the complexity and proprietary nature of credit scoring models, the impact of any given tradeline cannot be exactly predicted. The outcome also depends on what your existing credit history looks like.

In general, a good rule of thumb to get the best results from tradelines is to prioritize the age of the tradeline.

Read more about How to Choose a Tradeline here.

#3 Primary Account Behavior Impacts Your Reputation, So Pick Guaranteed Primaries

As an authorized user, it’s important to remember that anything the primary cardholder does with the account will be reflected in your credit report as well. So if they run into financial trouble and start running up high balances or missing their credit card payments, those actions can show up on your credit report and negatively impact your credit score.

This is why tradelines can, in some cases, cause you to have a lower score.

Fortunately, you can avoid this risk by purchasing tradelines from a reputable supplier. At Tradeline Supply Company, LLC, we guarantee that all of our tradelines have a perfect payment history and a 15% or lower utilization rate.

#2 Avoid CPN Number Tradelines

Tradelines for CPNs are often sold as the ultimate credit-restoring solution, but responsible consumers should avoid using CPNs or doing business with any company selling CPNs or tradelines for CPN numbers.

“CPN” is said to stand for credit profile number or credit privacy number, and they are sold as replacements for Social Security numbers (SSNs) to be used on credit applications if your true credit history is less than ideal.

However, there is plenty of evidence to show that CPNs are illegitimate and illegal to use, including statements from official government agencies, including the Federal Trade Commission, the Social Security Administration, and the Federal Reserve Bank.

Firstly, it is a crime to misrepresent your SSN on credit applications. But it gets worse. These CPN numbers are often stolen SSNs belonging to real people, such as children, the elderly, and the incarcerated. This means that by using a CPN, you are likely also being involved in identity theft.

Still not sure about CPN tradelines? Check out our CPN article, where we go into more detail.

#1 Tradeline Secret: Account Age

Most people assume that the credit limit of a tradeline is more important than its age and consequently pick out tradelines with high credit limits with little or no regard for the age of the account. But they don’t know the top tradeline secret that shoppers should take advantage of.

Here’s the secret: go for age. When shopping for tradelines, it’s generally best to select a tradeline with as much age as possible. This is not to say that the credit limit does not matter at all, but in most cases, the age of a tradeline is far more important than its credit limit.

Top 3 Ways to Establish Your Credit Tradelines

There are several ways to establish credit tradelines, but it’s up to you to decide which methods may work best for you. Here are the top three ways you can establish tradelines.

#3: How to Get Tradelines for Free—And When to Be Careful With These

Before deciding to purchase tradelines, consider whether you might be able to get one for free. But how can you get free tradelines?

Trusted friends or family members could potentially add you as an authorized user to one or more of their accounts. Ask around, and someone may be willing to do you a favor. But remember, a tradeline could hurt your credit if it is derogatory.

This is the danger of asking a friend or family member to add you as an authorized user to one of their credit cards—it’s not a guarantee that your loved one will consistently make payments on time and keep the utilization rate low on the account.

The account has to be in good standing to be worth adding to your credit report, so you’ll need to make sure with the primary account holder that they always use the card responsibly.

#2: Develop Your Own Outstanding Credit Card Reputation

Having someone else add you to their tradeline isn’t the only option for getting tradelines onto your credit report. Many people start out by opening their own credit cards.

Of course, depending on your income and other factors, it can be difficult to get approved for a card with no prior credit history. But there are credit cards that are designed for consumers who are new to credit, such as secured credit cards. Secured credit cards require that you contribute a security deposit, which serves as collateral for the lender in case you do not pay back what you owe on the card.

Some secured cards may upgrade you to an unsecured account after a certain period of timely payments. If that’s not an option, simply keep using the card responsibly and making payments on time every month, and watch your credit score grow. Eventually, your history of responsible credit usage will help you qualify for new credit cards with better terms and higher credit limits.

#1: Buy Qualified Authorized User Tradelines

Want an easy way to avoid the risks of getting a free tradeline and the hassle of a secured credit card? Consider purchasing authorized user tradelines that are guaranteed to have a spotless payment history and low credit utilization.

Just make sure to choose a tradeline company that offers high-quality products and ethical business practices.

How to Know Which Tradelines Are Right for You

When it comes to deciding which tradelines to purchase, it’s important to customize your approach based on your individual needs.

While we do recommend most individuals look for aged tradelines, you can narrow this down even further by taking into account the tradelines you already have and how an additional tradeline would fit into your profile.

First, make sure you read How to Choose a Tradeline for a detailed guide on how to think about the important factors of a tradeline relative to what is already contained in your credit file: age and credit limit.

The next step is to use our custom Tradeline Calculator to calculate your average age of accounts and credit utilization ratios. This will show you where you currently stand with your revolving credit accounts.

Then, you can begin to add hypothetical new tradelines to the calculator so you can see what it takes to significantly change the outcome in terms of age and utilization.

Try choosing a tradeline from the list and putting it into the calculator. Not getting the results you want? Try another that will get you closer to your goals. Repeat this process until you are happy with your metrics, and then you will know what kind of tradeline would be a good investment for you.

Establishing Tradelines FAQ

How Long Does It Take to Get a Credit Tradeline Onto Your Credit Report?

Once you have been added to a tradeline, it should show up on your credit report during the next reporting period, i.e. the time when the account is reported to the credit bureaus each month. The reporting period is different for every account, so if you want to know when a certain tradeline reports, you’ll need to ask the primary account holder for that information.

If you are purchasing a tradeline from Tradeline Supply Company, LLC, we list the reporting period for each tradeline on our tradeline list as well as the deadline to purchase the tradeline by to ensure it reports during the upcoming reporting period.

As far as placing a tradeline order, we’ve made the process easy with our fully automated online shop. Simply select the tradeline or tradelines you want, provide the required information, and pay. Then, just wait for your tradeline to post!

For more detailed instructions, please see How to Purchase Tradelines and What to Expect.

How Long Do Credit Tradelines Last?

How long a credit tradeline stays on your credit report depends on what kind of tradeline it is. If you obtained a free tradeline through someone you know, you can stay on the tradeline for as long as the primary cardholder allows you to.

When you purchase a credit tradeline from Tradeline Supply Company, LLC, once you are added as an authorized user to the account, you remain an authorized user for two reporting cycles. After the second reporting cycle ends, you are removed from the account.

At this point, the account will likely stay on your credit report as a closed account.

If you need to stay on a tradeline for more than two reporting cycles, you can purchase as many extensions as you need. Extensions orders must be placed within six weeks of your original order date.

See our FAQs for more information about tradeline reporting.

Where to Buy Tradelines

There are a number of different considerations to keep in mind when deciding where to purchase tradelines. Besides the quality and price of the tradelines, you’ll want to get a sense of a tradeline company’s safety and legal compliance, customer service, business practices, and ethics.

Here are some key things to look for in a trustworthy tradeline company:

- How many banks they work with and how reliably the banks report authorized user information to the credit bureaus

- Guaranteed low utilization

- How long you stay on the tradelines

- How quickly the tradelines report

- A strong money-back guarantee if tradelines do not post

- Large inventory with a variety of options for different needs

- Extensive identity verification process

- Specialize in tradelines only

- Do not sell CPN numbers or CPN tradelines

- High-quality website that is easy to use with a secure checkout process

- Knowledgeable customer service representatives who have your best interests in mind

- Free educational resources to help inform consumers about how tradelines work

- Authentic customer reviews

You’ll find additional helpful hints in Buying Tradelines: How to Choose the Best Tradeline Company.

What’s the Difference Between Tradelines and Credit Repair?

Tradelines are pieces of information on your credit report, so adding more tradelines means you are adding information to your credit file.

Credit repair is the opposite: it removes information from your credit report—inaccurate negative information.

So while tradelines and credit repair can complement each other, tradelines should not be thought of as credit repair or as a substitute for credit repair. If you have a lot of errors on your credit report that need to be corrected, it may be wise to start repairing your credit before you set up tradelines, as the negative marks could still weigh down your credit even with additional tradelines.

Bonus!—Avoid These Tradeline Mistakes

Regardless of where you get your tradelines, there are some common mistakes that many consumers make that could prevent you from seeing the results you want as you are establishing tradelines. The last thing you want to do is waste your resources on tradelines that don’t post or aren’t a good fit for you.

Want to know how to steer clear of these issues and keep your tradeline goals on track? Make sure to read Common Mistakes Made When Buying Tradelines. It’s one of our most popular articles, and it may save you a lot of trouble—and money!

Credit Countdown Video: How To Establish Credit Tradelines

Leading credit expert John Ulzeheimer guides you on strategies to establish credit.

Conclusions on Establishing Tradelines

Now you know why tradelines are so important, what to watch out for, and how to establish tradelines. Whether you choose to get a free authorized user tradeline, open a credit card, or purchase a tradeline, get started on establishing tradelines today!

If this article helped you, please share it so we can help more people obtain tradelines. What do you think is the best way to establish tradelines? Be sure to let us know by leaving a comment!

The payment history of each tradeline

The payment history of each tradeline