Credit Mix: Do You Need to Care About Types of Credit? [Infographic]

What Is a Derogatory Item on Your Credit Report?

05/30/2024

Americans Are Taking Out More Personal Loans: What You Need to Know

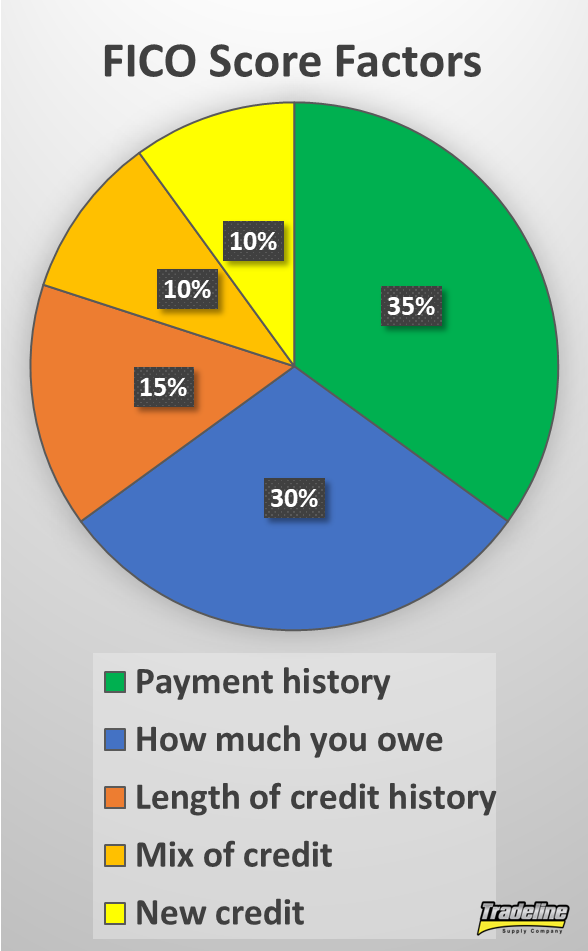

06/21/2024Credit mix, also called mix of credit, is one of the factors that your credit score takes into account. It is one of the least important factors, weighing in at 10% of a FICO score.

However, it’s still important to consider when building credit, especially if you want to get the best possible credit score.

Check out our infographic on credit mix and types of credit, then get all the details in the article below.

![Credit Mix - Types of Credit Accounts [Infographic]](https://tradelinesupply.com/wp-content/uploads/2020/02/Credit-Mix-Types-of-Credit-Accounts-final.jpg)

What Is “Credit Mix” or “Mix of Credit”?

Your credit mix is the diversity of types of credit accounts in your credit report.

Having different types of credit accounts in good standing in your credit file demonstrates that you can use credit responsibly. Lenders ideally want to see that you have successfully managed a variety of types of accounts.

Types of Credit Accounts

According to Experian, there are four types of credit:

Revolving Credit

Revolving credit or revolving debt is a form of credit that you can “revolve,” meaning you can carry a balance from month to month. You are assigned a credit limit that you can charge up to and you make a payment each month. Interest will typically be charged if you carry a balance from month to month. Credit cards and lines of credit are the most common types of revolving credit accounts.

Examples of Revolving Credit

The two most common types of revolving credit are credit cards and lines of credit.

- Credit cards include those issued by banks such as Bank of America and Chase, as well as retail store cards, which can typically only be used at a particular retailer.

- Lines of credit are similar to credit cards in that you have access to a set amount of money—your credit limit—that you can draw from. After you borrow money from your line of credit, the balance starts accruing interest, and when you pay it back, that credit is then available again for you to use. This is why it’s considered revolving credit: you can use it again and again as long as you keep paying it back.

Types of Lines of Credit

Lines of credit can be either secured, which means the borrower has provided collateral to back the line of credit in case of default, or unsecured, meaning no collateral is required.

Beyond those general categories, there are three main types of lines of credit.

- A home equity line of credit (HELOC) is a line of credit secured by the equity in your home, which is the difference between the value of your home and the amount you still owe on your mortgage. Since your home equity serves as collateral, if you default on a HELOC, you could risk losing your home to foreclosure.

- A personal line of credit is usually unsecured, although sometimes you may be able to provide collateral in the form of savings or investments.

- A business line of credit may be secured or unsecured. They are offered by financial institutions as well as many commercial vendors.

Charge Cards

Charge cards are similar to credit cards, except the balance must be paid in full at the end of every billing cycle. Because you don’t revolve a balance from month to month, you don’t pay any interest, but you usually have to pay an annual fee.

These accounts do not have pre-set credit limits, so the “credit limit” that shows up on your credit report is actually the highest amount you have ever spent on the card.

Charge cards were actually a predecessor to the first credit cards, but these days, they are less common. According to WalletHub, they are meant for consumers and small businesses with good or excellent credit and are usually associated with high-end, exclusive credit card brands like American Express.

In contrast to credit cards, which are accepted by most merchants, charge cards may not be accepted by all merchants.

Service Credit

Service credit includes accounts with your service providers, such as utilities, cell phone service, etc. These are sometimes considered credit accounts because the service is provided before you pay the bill.

Generally, service providers do not report your payment history to the credit bureaus, so the only time these accounts will affect your credit is if you default on a contract with your service provider and the account goes into collections. However, new “alternative data” credit scoring models are beginning to incorporate utility payments in order to give a boost to those who may be credit invisible or have thin credit files.

Installment Credit

Installment credit or installment debt refers to a loan of a specific amount that you pay back in regular, fixed payments over a certain period of time. Types of installment loans include car loans, mortgages, student loans, personal loans, etc. Interest rates on installment loans are often—but not always—lower than credit card interest rates.

Examples of Installment Loans

Types of installment credit include:

- Auto loans

- Mortgages

- Student loans

- Personal loans

- Credit-builder loans

- Home equity loans (not to be confused with a HELOC, which falls under revolving credit)

The breakdown of account types outlined above is a simplified version of how credit scoring systems actually categorize different types of accounts. In reality, credit scoring models may consider as many as 75+ account types.

In addition, each type of account could have a different effect on your credit.

How Does Credit Mix Affect Your FICO Score?

As we mentioned at the top of this article, credit mix makes up about 10% of your FICO score. With VantageScore, type of credit and credit age are combined into the same category, which makes up approximately 21% of your VantageScore.

With both types of scores, credit mix is a relatively small portion of what determines a credit score, so having the perfect credit mix is not necessarily essential in order to have good credit. However, it’s still a good thing to aim for, especially if you want to get a perfect 850 credit score or somewhere close to it.

In addition, the importance of credit mix could be more significant for those that have thin credit files, says credit expert John Ulzheimer.

Revolving Credit Holds More Weight Than Installment Credit

Keep in mind that not all credit accounts have the same impact on your credit score. Revolving accounts are weighed more heavily by credit scoring models because they are a better predictor of credit risk than installment accounts.

While both account types affect your payment history, revolving debt has a much greater impact on your credit utilization since you can choose how much of your credit limit to utilize and pay back each month.

Since credit utilization makes up a large portion of your credit score (30% for FICO scores and 20% for VantageScores), this gives revolving accounts a lot of influence over your score.

For an in-depth discussion of this topic, see our article, “Are Revolving Accounts More Powerful Than Installment Accounts?”

Photo by Hloom on Flickr.

What Is a Good Credit Mix?

When it comes to your credit score, the most important thing is to demonstrate that you have managed both revolving and installment accounts. Therefore, it’s best to have at least one account of each type.

For example, you might have a credit card (revolving) and an auto loan or student loan (installment). Or, you could have a mortgage (installment) and a HELOC (revolving). Any combination of one revolving account and one installment account is a good start for your credit mix.

FICO supports this idea, saying, “Having credit cards and installment loans with a good credit history will raise your FICO Scores.”

FICO also says that people who have managed credit cards responsibly are better off than consumers who don’t have any credit cards, which can be seen as risky because they have not demonstrated experience using revolving credit.

Statistics show that high FICO score achievers have an average of seven credit cards on their credit reports, which includes both open and closed accounts.

People with credit scores in the 800s also typically have installment loans such as mortgages and auto loans, according to Experian.

The total number of accounts in your file may also play a role. FICO has indicated that those with high credit scores can have 20+ credit accounts in their credit reports.

How Many Credit Cards Is Too Many?

Keep in mind that it is possible to have too many accounts on your credit file. According to the FTC, having too many credit cards could have a negative effect on your credit score, as could having loans from some types of companies.

There is no hard-and-fast rule when it comes to how many credit cards is too many because the impact of any given factor on your credit score depends on what is already in your credit profile, says FICO.

However, in Figure 1 in the article “How Credit Actions Impact FICO Scores,” the hypothetical consumer “Rachel,” who has 33 credit accounts, has a lower credit score than “Maria,” who has 21 accounts.

This would seem to imply that at some number between 21 and 33 accounts, one’s credit score might begin to suffer. However, these two consumers have other differences in their credit profiles, so the difference in their credit scores cannot be solely attributed to the number of accounts in their files.

For more information on this topic, check out “What’s the ‘Right’ Number of Credit Cards?” by credit expert John Ulzheimer and “Is There Such a Thing as Too Much Credit?”

Can Some Account Types Hurt Your Credit?

Certain types of loans on your credit report could make you seem like a more risky consumer and therefore could end up hurting your score instead of helping.

Why? It’s all based on statistics and who the credit score algorithms have deemed to be risky borrowers.

For example, taking out a furniture loan could actually lower your credit score. That’s because furniture loans are often reported as “consumer finance loans,” which are typically reserved for borrowers with bad credit who are statistically more likely to default on loans.

Therefore, having this type of account on your credit report could be viewed as a negative factor by lenders and credit scoring algorithms.

Alternatively, the financing arrangement may be reported as revolving debt, which will appear nearly maxed out until you make enough payments to get the balance to a lower level.

Motorcycle loans are another example of this. Motorcycle loans are risky investments to lenders since there is a higher chance of the borrower not repaying the loan due to injury or death and there is a higher chance of the vehicle being damaged, which would reduce its value as collateral.

Since having a motorcycle loan on your credit report indicates a higher credit risk, this type of account could also hurt your credit.

Payday and title loans, on the other hand, are typically not reported to the credit bureaus, so these types of loans won’t count toward your credit mix or credit score—unless, of course, you default on a loan and it gets sold to a collection agency, who will then report it as a collection account.

Conclusions on Credit Mix

Since credit mix makes up about 10% of your credit score, it is helpful to try to achieve a balanced mix of credit by keeping a few revolving and installment accounts in good standing.

The best credit mix would ideally include several credit cards and at least one or two installment loans, such as a mortgage and an auto loan.

However, it’s also important to note that credit mix is much less important than other credit score factors, such as payment history, credit utilization, and credit age.

Therefore, achieving the perfect credit mix is usually not worth obsessing over because you can’t get an excellent credit score just by having the ideal mix of accounts.

In addition, most people naturally accumulate different types of accounts over time, so it’s often not necessary to start opening new accounts solely for the purpose of building up your credit mix. Plus, this strategy could result in hard inquiries and new accounts bringing your score down in the short term, and having access to credit you don’t need could also encourage extra spending.

However, one way to add to your credit mix without the risks of opening a new primary account is to become a credit card authorized user.

As with all credit-related decisions, it’s up to you to take your overall financial goals and priorities into account before taking action. You might decide that you don’t need to worry too much about improving your credit mix, and that’s perfectly fine. On the other hand, improving your credit mix can only help your credit score, and it is something that you should pay attention to if you aspire to get a perfect 850 credit score.