Why Age Is the Most Valuable Factor of a Tradeline

How to Make Easy Money Selling Tradelines

09/30/2021

The #1 Secret on How to Unlock the Power of Tradelines

10/18/2021

Length of credit history, also referred to generally as credit “age,” is one of the five main factors in the credit score algorithm, making up roughly 15% of one’s credit score.

FICO breaks up this general category into three parts:

- How long each individual account has been open

- How long certain types of accounts have been open (e.g. revolving accounts vs. installment accounts)

- The amount of time since those accounts were last used

Since a longer credit history provides more evidence that you have responsibly handled credit, generally, those with longer credit histories tend to have higher credit scores than those with shorter credit histories. When it comes to age, more is always better.

Account Age & Payment History Are Linked Together

Age always goes hand-in-hand with payment history, which contributes about 35% of your credit score, making it the most heavily weighted category. Obviously, an account needs to have age in order to have a payment history, and as an account ages, it acquires more payment history.

Age also affects the power of blemishes in your payment history. For example, a missed payment can cause a big drop in your credit score at first, but as the account ages, the effect will gradually be diminished until the missed payment falls off of your credit report completely.

Since the length of credit history (i.e. age) and payment history categories are closely linked, we can add them together to find out their combined power, which turns out to be 50% of a credit score! Therefore, age-related factors are going to be extremely important when it comes to choosing tradelines.

Some Age Levels May Hold More Weight Than Others

Since age is such a big part of credit, there is a lot of speculation about the specific age-related factors that may play a role in credit scoring algorithms. For example, it is commonly believed that there are certain age levels after which an account has a more powerful positive impact on one’s credit.

The older an account is, the more value it has to your credit score.

In other words, the positive effect of age on an account is not thought to be a gradual and continuous increase in score over time, but rather, a series of jumps upward that happen at certain points in time, such as after a specific number of years or months have passed.

As we said, many speculate on this topic, and we don’t pretend to have the definitive answer. FICO, VantageScore, and other credit scoring companies intentionally keep the details of their credit scoring formulas under wraps. However, based on the examples that we have seen, we have come up with our own observations on the question of which age levels are particularly beneficial for credit.

Age Bracket Experiment

To test out our theory, we conducted an experiment. We chose to use the myFICO Score Estimator specifically since this credit score estimator is owned by FICO themselves, who are the creators of the most widely used and trusted credit score. It stands to reason that using a product straight from the source of the FICO score would give the most accurate findings.

Educational scores such as the VantageScore use different algorithms and are not widely used by lenders. Therefore, since our priority is to understand our FICO score, the FICO score estimator will be the most useful.

We used this credit score estimator to estimate credit score ranges with a different age of oldest account each time, holding all other inputs constant. To minimize any negative impact from other factors that could affect the results, such as late payments or high balances, we chose the options that should represent the best impact on credit while still establishing a credit history.

How Do Credit Card Age Levels Affect Credit?

Here are the answers we gave to each question in the credit score estimator:

- How many credit cards do you have? 1

- How long ago did you get your first credit card? (This is what we were testing, so it changed each time.)

- How long ago did you get your first loan? (i.e., auto loan, mortgage or student loan, etc.) Never

- How many loans or credit cards have you applied for in the last year? 0

- When was the last time you opened a new loan or credit card? More than 6 months ago

- How many of your loans and/or credit cards currently have a balance? 0-4

- Besides any mortgages, what is the total balance on all your loans and credit cards combined? Less than $500

- When did you last miss a loan or credit card payment? Never

- How many of your loans and/or credit cards are currently past due? 0

- What percent of your total credit card limits do your credit card balances represent? 0% to 9%

- In the last 10 years, have you ever experienced bankruptcy, repossession or an account in collections? No

FICO’s Age Brackets

If you take the quiz, you’ll notice that the myFICO credit score estimator gives a hint as to potentially important age levels right in the first question.

The myFICO credit score simulator gives a hint as to potentially important age levels in the first question.

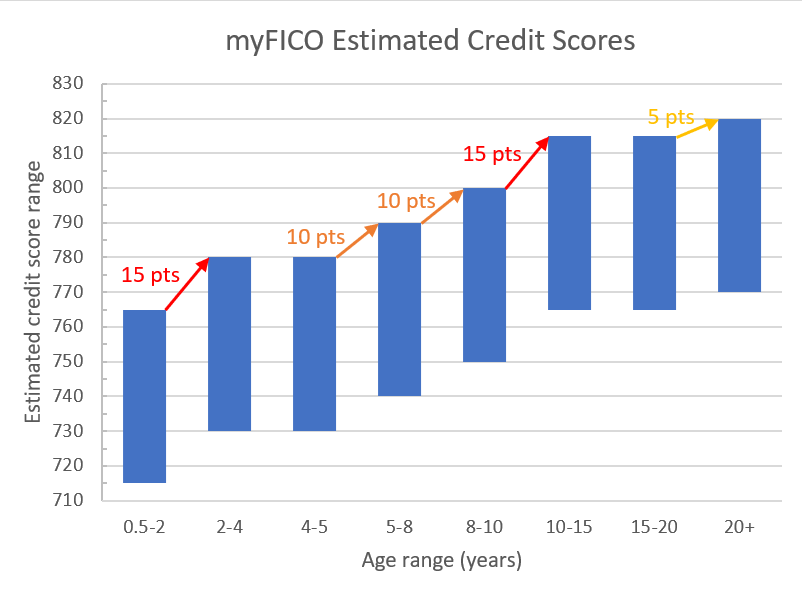

We tested each of the options shown in the screenshot while keeping all other answers the same, as we described. Keep in mind that the score estimator does not give a single number for the answer, but a range of 50 points (e.g. 730-780). You can see the results of our credit score experiment below.

The myFICO Score Estimator predicts that when all other factors are held constant, credit score increases occur after 2 years, 5 years, 8 years, 10 years, and 20 years. The biggest jumps happen at 2 years and 10 years, but the highest credit score can be achieved after 20 or more years.

The myFICO credit score simulator shows credit score boosts after 2 years, 5 years, 8 years, 10 years, and 20 years.

Based on this information, here’s how we would divide up the age levels of tradelines:

| Level 1 | 0.5 – 2 years |

| Level 2 | 2 – 5 years |

| Level 3 | 5 – 8 years |

| Level 4 | 8 – 10 years |

| Level 5 | 10 – 20 years |

| Level 6 | 20+ years |

Why Age Is Top Priority When Buying Tradelines

We have already discussed why we believe age is usually the most important factor when making the decision to purchase tradelines in our buyer’s guide to choosing a tradeline. Since age and payment history are always interconnected, together making up half of the power of a credit score, it is usually most effective to focus on getting a tradeline with as much age as possible.

The information we learned from the myFICO score simulator just goes to show how true that is. There can be a significant difference in the power and value of a tradeline that is 11 years old versus 9 years old or one that is 2 years old versus 1 year old.

Also, keep in mind the importance of your average age of accounts. According to FICO, those with the highest credit scores have an average age of accounts of about 12 years, compared to just 6 years for those with fair credit. Recall from our buyer’s guide that you might be surprised by how old a tradeline would need to be in order to get your average age of accounts up to the next level!

FICO also says that those with credit scores of 795 and above have 27 years of credit history on their oldest tradeline, while those with credit scores of 635 only have 12 years of history on their oldest account.

| Credit score | Average Age of Accounts | Age of Oldest Account |

| 795+ | 12 years | 27 years |

| 635 | 6 years | 12 years |

Source: FICO

Conclusion on the Importance of the Age of a Tradeline

When attempting to understand any system, it is always best to go straight to the source to acquire the most accurate information. Fortunately, FICO provides tools such as their myFICO Score Estimator for everyone to use to experiment with their own credit-related variables.

The payment history of an account is always attached to time; in other words, the age of a tradeline will automatically include the payment history as well. With the length of credit history representing approximately 15% of your credit score, combined with payment history representing approximately 35%, together these add up to approximately 50% of your credit score. This is why the age of a tradeline is almost always the most important variable to consider.

As we can see from the results from this case study, it is also clear that there are key age brackets that hold more weight than others. Knowing this information allows you to set strategic goals and allows you to plan your credit growth more effectively.

Therefore, when choosing tradelines you should keep age as a top priority and aim for the age thresholds that hold the most weight. Make sure to use our tradeline calculator to help you with these calculations so you get the most out of your tradelines.