The Surprising History of the Credit Bureaus

How to Get a High-limit Credit Card With Poor Credit

04/20/2022

How to Use a Budget to Improve Your Credit Score

05/25/2022

Most of us have credit reports assembled about us by the credit bureaus, yet few of us know about the surprising history of credit reporting.

The credit bureaus as we know them today grew from small, local organizations that formed as far back as the 1800s. In contrast, modern credit bureaus market themselves as extensive repositories of consumer information that can be used for an ever-growing number of applications.

Unfortunately, the early credit bureaus were known to use unethical tactics to collect information on consumers and sell this information to businesses.

While it may seem that the problems of these early credit bureaus have been addressed by legislation such as the Fair Credit Reporting Act, the credit reporting system still has serious flaws, some of which we highlight in “What Happened to Equal Credit Opportunity for All?”

In this article, we will explore the story of how the credit reporting industry came to be, how the credit bureaus evolved into what they are today, and the many controversies that have taken place along the way.

What Is a Credit Report?

A credit report contains information about a consumer’s credit history. This includes a list of current and past credit accounts, along with the age, credit limit, balance, and payment history of each account. It also contains identifying information such as your name, address, and social security number.

This information helps lenders evaluate the creditworthiness of potential borrowers so they can decide whether to extend credit and what the terms of the loan should be. Credit scores are the most common example of this.

For more information on credit reports, see our article “Credit Reports: What You Need to Know.”

What Are the Major 3 Credit Bureaus?

Credit bureaus, also known as credit reporting agencies or CRAs, are the companies that gather credit-related information about consumers and distribute it to lenders—and increasingly, other types of businesses that have an interest in checking people’s credit history.

In the United States today, there are three major credit bureaus: Experian, Equifax, and TransUnion. While there are many other credit bureaus, these three companies dominate the industry.

But it wasn’t always this way. The first credit reporting organizations were a far cry from the modern credit bureaus of today, and the unsavory tactics they used to run their businesses may surprise you.

Early Credit Reporting Agencies

The first recorded group that shared credit information about consumers was the colorfully named “Society of Guardians for the Protection of Trade Against Swindlers and Sharpers,” which was founded in London in 1776. The Society produced reports for its members on the credit history of individual customers, which were often full of gossip in addition to credit information.

The earliest credit reporting “agencies” were groups of merchants who would get together to gossip about customers. Painting by Joseph Highmore, public domain.

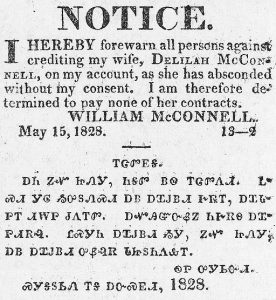

Credit bureaus would check local newspapers for news about consumers.

Like the Society, the early credit reporting agencies were small, local organizations that were essentially groups of merchants sharing information about consumers. This allowed them to offer credit to more people and avoid lending to high-risk individuals.

These organizations were industry-specific and did not share information with each other. In 1960, it is estimated that about 1,500 independent local credit bureaus were in operation in the United States.

According to the Philadelphia Federal Reserve Board, these bureaus were “working with local lenders with incomplete and often unverifiable information.”

The bureaus didn’t just collect the information you might expect, such as your name and loan information. They also gathered sensitive personal information such as marital status, age, gender, race, religion, employment history, driving records, and drinking habits.

The credit bureaus didn’t stop there. They checked the local newspapers for announcements of promotions, marriages, arrests, and deaths, and they attached the newspaper clippings to consumers’ credit reports. They would even go so far as to ask someone’s neighbors and colleagues for testimonies about that person’s character.

Even the local “Welcome Wagon” was working undercover for the credit bureaus. This organization would surreptitiously gather information on new residents of an area under the guise of welcoming them to the neighborhood.

The credit bureaus were focused solely on serving the local creditors that belonged to their respective organizations. As such, they typically only reported derogatory information.

Furthermore, there was no standardized way to evaluate a person’s creditworthiness. It was all based on the subjective whims and prejudices of the creditor looking at their credit file.

The “Welcome Wagon” would secretly collect information on new neighbors for the credit bureaus. Photo by John Fowler on flickr, CC BY 2.0.

What’s worse is that the credit bureaus did not allow consumers to view the information that was being reported about them. There was no way for consumers to verify whether the information was correct or where it came from.

Modernization of Credit Reporting

According to the Harvard Business School paper, over the course of the 1960s, many of these small, local credit bureaus started to join together, forming networks that spanned the nation.

In 1971, the Fair Credit Reporting Act (FCRA) was passed to ensure the “accuracy, fairness, and privacy of information in the files of consumer reporting agencies.”

By establishing requirements as to the accuracy of consumer credit files and access to their information, the FCRA was intended to protect consumers from the unfair practices that were rampant in the credit reporting industry.

The Fair Credit Reporting Act

The FCRA enacted the following rights for consumers:

- Consumers must be notified if negative action is taken against them because of the information in their credit files.

- Consumers must be able to find out what is in their credit files.

- Consumers must be able to dispute inaccurate information and have it corrected or deleted.

- Outdated information (generally more than 7-10 years old for negative information) cannot be reported.

- Consumers must provide consent for employers to check their credit reports.

- Consumers must have the option to request to be excluded from lists for unsolicited credit and insurance offers.

- Consumers who appear on a list of prospects requested by a lender must be extended a firm offer of credit.

As a result of the passing of the FCRA, credit bureaus stopped recording events such as marriages and arrests and started focusing more on verifiable credit history information. They also started reporting positive information in addition to negative information.

In 1996, the FCRA was amended to extend additional protections to consumers, including the following:

- Consumers have the right to take legal action against anyone who obtains their credit report without a permissible purpose.

- Credit bureaus can be held liable for knowingly reporting misinformation.

- Credit bureaus must investigate disputes within a certain period of time, usually 30 days.

- Banks can share credit information with affiliates, but consumers must be given the opportunity to prohibit this sharing of their information.

The transition to computerized databases allowed some credit bureaus to expand and dominate the industry.

The advent of computer-powered databases allowed some credit reporting agencies to become more efficient and do more business, while smaller agencies that could not afford to make the change got out of the industry.

This consolidation eventually led to the domination of the market by the three major bureaus we know today.

Experian

While Experian did not officially come about until 1996, according to creditrepair.com, the story of Experian can be traced back almost 200 years.

The Manchester Guardian Society was formed in England in 1826 to share information on customers who didn’t pay their debts. This organization eventually became a part of Experian, as did a group of merchants that later formed in Dallas for a similar purpose.

These groups were both acquired by TRW, an engineering and electronics conglomerate that also launched their consumer credit reporting branch as Experian.

Experian was acquired by the British retail company Great Universal Stores Limited (GUS) and became part of their consumer credit reporting arm. In 2006, it demerged from GUS and began trading on the London Stock Exchange.

Although Experian as we know it today did not come along until after the FCRA was passed, the bureau has certainly not been free of controversy in its history.

In 1991, a TRW investigator incorrectly reported that 1,400 people in Vermont had not paid their property taxes, which ruined the credit of those consumers. Several similar cases were discovered throughout New England.

Experian became infamous for their atrocious customer service and was hit with several lawsuits.

Later, Experian settled with the Federal Trade Commission (FTC) for operating a credit reporting scam in which consumers were led to believe they were signing up for a “free credit report” and were not told that they would automatically be enrolled in Experian’s $80 credit monitoring program.

The offending for-profit website, FreeCreditReport.com, is still in operation. As a reminder, the only site authorized to provide free credit reports as required by federal law is annualcreditreport.com.

Experian settled with the FTC again in 2005 for violating their previous settlement.

In 2015, Experian announced a data breach that existed for over two years and affected as many as 15 million consumers.

The bureau was then fined $3 million in 2017 for deceiving customers about their credit scores, along with TransUnion and Equifax.

TransUnion

TransUnion originally began as the holding company for a rail transportation equipment company in 1968. One year later, they entered the credit reporting industry by acquiring regional credit bureaus. The bureau has expanded steadily since then, although it is the smallest of the three major credit bureaus.

TransUnion has also been guilty of taking advantage of consumers.

Two consumers have sued TransUnion for refusing to remove inaccurate information on their credit reports.

They have also been accused of scamming consumers by not notifying them that they would be charged $18 a month for having a TransUnion account.

In June 2017, the largest FCRA verdict to date forced TransUnion to pay $60 million in damages to consumers who were erroneously included on a government list of terrorists and security threats.

Later in 2017, one of TransUnion’s websites was hijacked and made to redirect consumers to websites that attempted to download malware onto visitors’ computers.

Equifax was started as Retail Credit Company by a grocery store owner. Photo by Charles Bernhoeft, public domain.

Equifax

Equifax was started in 1898 by a grocery store owner who created a list of creditworthy customers and sold the list to other businesses. This business grew and became known as the Retail Credit Company.

The company expanded quickly throughout North America, amassing credit files on millions of Americans by the 1960s.

The Retail Credit Company developed a reputation for collecting extensive personal information on consumers and selling it to just about anyone who wanted it.

Critics accused them of reporting “facts, statistics, inaccuracies and rumors’…about virtually every phase of a person’s life; his marital troubles, jobs, school history, childhood, sex life, and political activities.”

Buyers of these reports would use them to judge the morality of individuals and avoid lending to those who they perceived as morally corrupt.

Consumers were not allowed to see their information, and many had no idea that the company had files on them in the first place.

When the company started planning to computerize their records, which would make consumer information more widely available, the U.S. Congress intervened, holding hearings that led to the Fair Credit Reporting Act being passed.

Equifax had to stop scamming consumers by lying about their identity and their motives when collecting information, among many other changes.

The Retail Credit Company changed its name to Equifax in 1975, which many speculate was a move to improve their damaged reputation after the congressional hearings.

Unfortunately for consumers, Equifax’s issues didn’t end with the Fair Credit Reporting Act. In recent years they have betrayed consumers’ trust even more egregiously.

Equifax ruined their reputation again in 2017, when their systems were breached by hackers twice, impacting hundreds of millions of consumers in the United States, Canada, and Britain.

The scam left the names, social security numbers, birth dates, addresses, driver’s license numbers, and credit card numbers of consumers exposed for months, from May 2017 until July 2017.

Not only that, but Equifax did not disclose the breach until September of that year, giving top executives plenty of time to sell their shares of the company before going public with the announcement.

They continued to bungle their response to the breach by setting up websites that were supposed to allow consumers to determine whether they were affected by the Equifax breach but instead returned random results.

In addition, Equifax was allowed to charge fees for credit freezes in many states, which gave them the opportunity to actually make money off of this breach.

Nearly two years later, Equifax has still not been penalized or held accountable for this epic failure in any way. In fact, they just went back to selling credit monitoring, and they are now making more money than ever.

For a fascinating in-depth investigation of the 2017 Equifax breach, listen to the podcast “Breach.”

There is virtually no end to the list of disastrous errors committed by Equifax, but here are some more of the highlights:

- The bureau repeatedly tweeted a link to a fake Equifax phishing website, directing consumers to enroll in fraud prevention services at the imposter site.

- Equifax left the private data of approximately 14,000 Argentinian consumers and staff members open to anyone who entered “admin” as the username and password for one of its online portals.

- The company removed its mobile apps from app stores in 2017 because they had security flaws that left them vulnerable to cyber attacks.

- A website operated by Equifax exposed the salary histories of tens of thousands of people to anyone that had someone’s Social Security number and date of birth, both of which were in the hands of criminals after the security breach.

Equifax left their systems vulnerable to a series of cyber attacks that affected hundreds of millions of people.

- In October 2017, Equifax’s website was hacked and made to serve malware disguised as a software update, leaving visitors to the site at risk of having their computers infected by the malware.

- The company has been sued hundreds of times and fined millions of dollars by the Federal Trade Commission for violating the FCRA.

Sadly, it seems Equifax has not changed for the better since their early days of selling people’s private information to anyone and everyone, since they have allowed criminals to easily access consumer data on a massive scale.

Innovis: The Fourth Credit Bureau

Many people are completely unaware that there is actually a fourth major credit bureau called Innovis. It was founded as Associated Credit Bureaus in 1970 and changed its name to Innovis in 1997. The company is now owned by CBC companies, which purchased Innovis in 1999.

In contrast to the other consumer reporting agencies (CRAs), credit reporting is not the primary function of Innovis. In fact, Innovis does not even offer credit scores.

Innovis instead serves businesses by providing “consumer data solutions” such as identity verification, fraud prevention, receivables management, and credit information. According to finance writer Sarah Cain, Innovis’ credit reports are used primarily to compile lists of pre-approved consumers to sell to lenders for marketing pre-screened offers.

Innovis also states on their website that as a CRA, they “enable” personal solutions such as credit reports, credit disputes, fraud alerts, active duty alerts for consumers in the military, credit blocks, security freezes, and opt-outs.

What Is In Your Innovis Credit Report?

Your Innovis report, like your other credit reports, contains your personal information as well as your credit history. However, they do not receive credit information from all of the same lenders that report to the other three major credit bureaus. If you pull your Innovis credit report, you may notice that some of your credit accounts are missing, particularly revolving accounts.

Your credit report will also show inquiries if any businesses have pulled your file from Innovis.

While you can’t get your Innovis credit report from annualcreditreport.com, you can order a copy directly from the company for free once a year.

Who Uses Innovis Credit Reports?

While there are some anecdotal reports of credit card companies pulling consumers’ Innovis credit reports for lending decisions, it seems that their reports are used mostly for pre-screened marketing offers. Innovis’ services are also used by companies such as cell phone service providers.

Is CBCInnovis the Same Company?

Confusingly, there is another company owned by the same parent company as Innovis called CBCInnovis. Although CBCInnovis and Innovis share similar names, they are different companies with different functions.

Unlike Innovis and the other credit bureaus, CBCInnovis does not maintain a repository of consumer credit data. Rather, it serves as a third-party company that pulls consumers’ credit reports from Experian, Equifax, and TransUnion and compiles the information into one “tri-merge” credit report. These tri-merge reports are sold to lenders such as banks and mortgage companies.

Inequality in Credit Reporting

Unfortunately, historical discrimination is still baked into the credit system.

You might think that inequality in the credit system is a thing of the past, left behind along with the shady information-gathering tactics of the earliest credit bureaus.

Although discrimination based on age, gender, ethnicity, nationality, or marital status is officially prohibited by the Equal Credit Opportunity Act, unfortunately, the way our credit system works still results in de facto inequality.

A study by the Federal Reserve Board revealed that on average, Black Americans and Hispanic Americans have lower credit scores than non-Hispanic White Americans, even after controlling for personal demographic characteristics, location, and income.

Why is this the case, despite race not being a factor that is considered in credit scores?

Past and present discrimination against some demographics in the United States affects consumers in ways that have dramatic effects on their credit scores.

When you think about the financial impacts of implicit bias, segregation, redlining, and mass incarceration, it becomes very clear why communities of color have not had access to the same opportunities to build wealth that many White Americans take for granted.

As a result, with less income, capital, and collateral, people of color often face greater challenges in obtaining affordable sources of credit and building a credit history.

Thus, the credit system further burdens those who are less privileged and provides very few opportunities for disadvantaged consumers to improve their situation.

You can read more about this important issue in our article, “What Happened to Equal Credit Opportunity for All?”

Conclusion on the History of Credit Reporting

The credit reporting agencies have a surprisingly long and controversial history. From the 1800s to today, the consumer credit reporting industry has been plagued with bias, inaccuracies, and serious security issues.

While technological advancements have allowed the credit bureaus to expand and improve, and government regulation has been enacted to protect the rights of consumers, the system is still far from perfect.

Ultimately, the credit bureaus were built to serve lenders, not consumers, and that remains their primary purpose. We are reminded of this every time consumers are harmed by the incompetent or even outright malicious actions of the credit bureaus.

Have you been affected by a credit reporting scam or a security breach? Let us know in the comments, and please share this article if you liked it!

5 Comments

Awesome Read Wow Did not know The Entire history of the Agencies but Its Clear to see they were NOT created for Consumers. Its Mind Boggling to think they were that blatant and still are. Glad to know The Watchers Are watching and providing a Light on the Industry. I was jusy on a Pdcast talking about the History behind the Credit Industry , very Timely Article More people need to Read.

Wow this infuriates me. This brought to light many things. Being a minority myself I have struggled with bad credit for years, I was never taught financial literacy I also see now why my parents never taught me anything about the credit bureaus the FCRA is relatively new. Within the last 3 months I have been on a mission to improve my credit standing and they don’t make it easy by any means they make it as difficult as possible with many hoops to jump through. I myself was also a victim of the Equifax breach and the best thing they have to offer for allowing my information to be stolen is free credit monitoring for a year in hopes I will decide to keep it and pay for it. I’ve said for years those people were crooks and it shows more and more. In my opinion they have too much power over the consumer. They have the ability to either change my life for the better or keep me in poverty. Credit makes the world go around you can’t buy a house without it Hell you can’t even hardly rent a house anymore without a credit check. The best thing I have to fight back are these dispute letters that take 30 days for a response it can take months to years to get all this in accurate information removed and in the mean time you suffer because of it. They are too big to fail and they know this. The majority of people who make the laws and ect are in bed with these people. They hold stock in these companies or friendly with the CEO&CFO. Lawmakers don’t care as long as they aren’t the one on the receiving end. These CRA can keep you indebted basically working like a slave.

2017 equifax scam.

I did not request or authorize any bureau or agency to management my creditworthiness, social security number or any other personal information. As such I did not request or authorize any company or bureau to assign, monotor, or manage any sort of monitoring me. If my ‘credit score’ changes albeing unauthorized, why am I not to allowed to know why it increased or decreased? This is B. S. and needs to change!!!!!!!!!!!!!! What can we do?

I’m here to make the same observation as Mr. Goodyr… WTF? Who authorized these credit agencies to have my personal information? I never told my bank to give these companies information about my bank accounts, mortgage, credit cards… By what right do they have access to my personal financial information?