Are Inquiries Really Killing Your Credit? What You Need to Know

Credit-Builder Loans: Can They Help You?

09/08/2023

Secured vs. Unsecured Debt: What Are the Pros and Cons?

09/14/2023People often point the finger at credit inquiries as the cause of their bad credit, but is this blame justified? Is it really true that inquiries can kill your credit score? Keep reading to find out the difference between hard inquiries and soft inquiries and learn the truth about how inquiries can affect your credit score.

Credit Inquiries Definition

A credit inquiry, also commonly referred to as a credit check or a credit pull, is a request by a business to check your credit report.

There are two different types of credit inquiries: a hard inquiry (also known as a “hard pull”) and a soft inquiry (also known as a “soft pull”).

The type of inquiry depends on the reason for the credit pull and the business conducting it.

Credit Countdown Video: What Are the Types of Credit Inquiries & Why Do They Matter?

Watch this Credit Countdown video with John Ulzheimer for a brief introduction to the types of credit inquiries, then keep reading below for an in-depth analysis of the topic of inquiries.

What Is a Hard Inquiry?

A hard inquiry is when a creditor who is considering issuing you credit pulls your credit report from one of the credit bureaus.

A hard inquiry occurs when a business that is considering issuing you credit gets your credit report from one of the bureaus.

Hard inquiries typically occur when you are applying for loans, including mortgages or auto loans, as well as credit cards.

How Many Points Does a Hard Inquiry Affect a Credit Score?

Since a hard credit inquiry on your credit report means you are actively seeking to get new credit, this is seen as risky behavior by lenders. According to FICO, people with six or more inquiries on their credit files are eight times more likely to declare bankruptcy than people who do not have any inquiries on their credit reports.

For this reason, each inquiry may lower your credit score by up to five points.

The specific number of points an inquiry costs you depends on other factors in your individual credit profile, such as the length of time that has passed since your last inquiry. If you do not have any other inquiries on your credit report, a hard pull likely won’t affect your score very much.

Depending on what else is in your credit profile, it may not even lower your score at all.

In addition, it’s important to keep in mind that hard credit inquiries are treated differently depending on which credit scoring model is being used, particularly when it comes to how they deal with rate shopping.

Shopping Around for Credit

For mortgages, auto loans, and student loans, inquiries of the same type are grouped together within a certain time period.

When consumers are looking to get certain types of loans, such as mortgages, student loans, and car loans, they often apply for loans from multiple lenders so they can compare interest rates and get the best deal.

The credit scoring models have incorporated various ways to account for this since it wouldn’t make sense to punish consumers for being savvy shoppers.

With older FICO scores, consumers have a 14-day window in which they can apply for multiple loans of the same type (e.g. auto loans) and have all the inquiries grouped together to count as only one inquiry.

With newer FICO scores, the time window has been extended to 45 days. However, inquiry grouping only counts for student loans, auto loans, and mortgages. With credit cards, each inquiry is counted separately regardless of when you applied for the cards.

FICO also includes a 30-day “buffer” for hard inquiries, meaning that when your score is calculated, it does not factor in any inquiries that were made within the last 30 days.

VantageScore works a bit differently: it groups together any inquiries that occur within a 14-day time period for all account types, even credit cards.

When Do Hard Inquiries Fall Off a Credit Report?

Hard inquiries are automatically removed from your credit report two years after the date of the inquiry.

How Long Do Hard Inquiries Affect a Credit Score?

While it takes two years for hard credit inquiries to fall off your credit report, they only impact your credit score for the first year.

What Is a Soft Inquiry (Also Known as a Soft Credit Check)?

A landlord may do a soft credit check when evaluating your rental application.

A soft inquiry, also known as a soft pull or soft credit check, can happen for a variety of different reasons.

Unlike hard inquiries, which are conducted by businesses that are considering offering you new credit for the first time, soft pulls are used by entities that are interested in your credit report for other purposes.

This could include potential employers, landlords pulling your credit as part of a background check, utility providers, or insurance providers, for example.

When you check your own credit report, this is also considered a soft inquiry.

Soft credit checks may also be used by businesses you already have accounts with, such as your credit card issuers, who routinely check your profile to make sure you are still a creditworthy consumer.

How Do Credit Inquiries Affect Your Credit Score?

Soft Inquiries

Soft inquiries do not affect your credit score. This is because soft pulls are typically not used when you are actively seeking new credit, so they do not necessarily indicate risky financial behavior. Therefore, they are not factored into your credit scores, which are designed to estimate risk.

Since checking your own credit report is classified as a soft credit check, you do not need to worry that checking your own credit report will affect your score. It is a common credit myth that checking your credit will make your score go down. You can actually check your own credit report as many times as you like without it affecting your score.

In fact, you can even conduct a free soft inquiry on your own credit report using free educational websites like creditkarma.com.

Hard Inquiries

When it comes to hard pulls, although people tend to fixate on the impact of these hard credit inquiries, the truth is that they are a relatively minor player in your credit score.

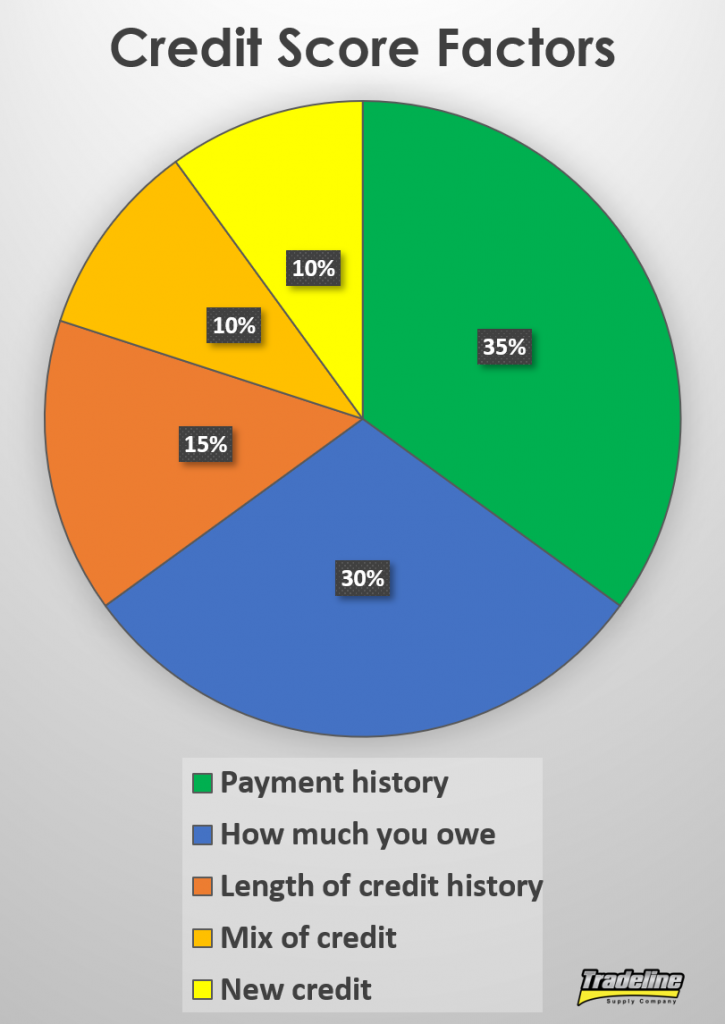

The “New Credit” Category Includes More Than Just Inquiries

Of the factors that go into your credit score, the category that includes inquiries, “new credit,” is the smallest one, making up about 10% of your score.

Within that small category of new credit, according to FICO, there are several different data points that are taken into consideration. These data points include:

- The number of new accounts

- The proportion of new accounts vs. seasoned accounts for each type of account

- The number of recent credit inquiries

- The amount of time that has passed since recent account opening(s) for each type of account

- The amount of time that has passed since your recent credit inquiries

As you can see, there are several variables in this category that can affect your credit score beyond just the number of inquiries on your credit report.

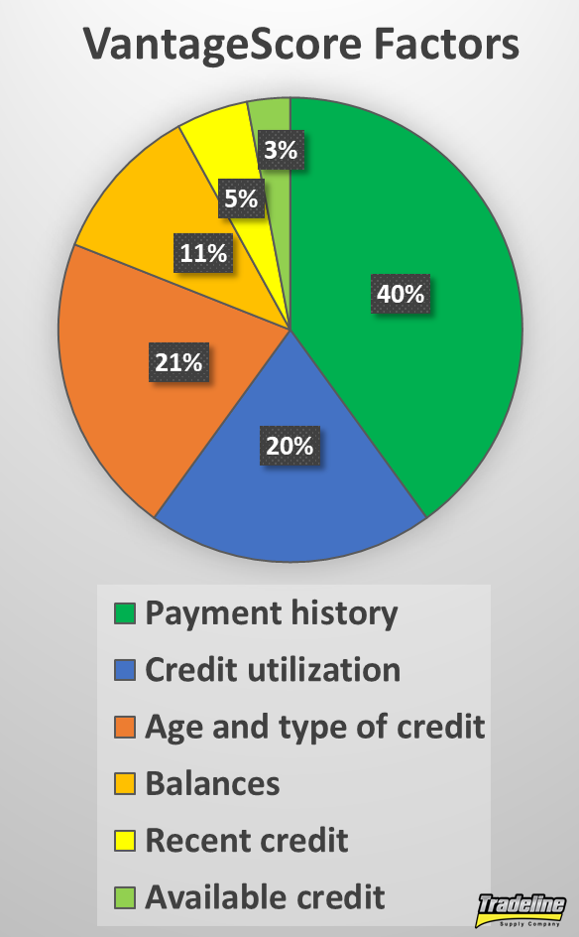

How Does VantageScore Consider Credit Inquiries?

With VantageScore, the “recent credit” category only accounts for about 5% of your credit score, which is an even smaller proportion than FICO’s 10%. Assuming there are multiple variables within this category besides the number of recent inquiries, we can conclude that inquiries likely make up a very small percentage of your VantageScore.

VantageScore has confirmed this to be true on their website, which reads:

“In the VantageScore credit scoring system, credit inquiries are considered to be less influential than other credit behaviors, such as payment history. And despite the fact that inquiries can remain in your credit report as long as two years, a credit score that’s lowered by a hard inquiry generally will increase back to its pre-inquiry level in just a few months – provided no new negative information is added to your credit files.”

The Impact on Your Credit Score Impact Depends on the Timing and Number of Inquiries

Recent credit makes up 5% of a VantageScore.

Since inquiries are just one variable within one small piece of the credit score pie, they do not weigh heavily on one’s credit score. Therefore, as we mentioned above, each hard inquiry should only cost you a maximum of five points, and if they are done within a short period of time they often are only counted as one inquiry.

Inquiries typically only cause problems for your credit if you show a pattern of new hard inquiries continuously over a long span of time, which makes you seem more risky to potential lenders.

This makes sense because if you have your credit pulled multiple times over an extended period of time, this could indicate that you are applying for credit and being denied or opening a lot of new accounts and going into debt.

As mentioned above, this is not the case as long as the inquiries are done in a short period of time. That is assumed to be the rate-shopping period.

Inquiries Matter Most in Borderline Cases

In the case of someone having continuous hard pulls over an extended period of time, a few points lost per inquiry can add up if there are a lot of them. If you have 10 inquiries on your credit report over an extended period of time and the average decrease in score per inquiry is 3 points, that’s a total loss of 30 points! If you are near the lower edge of the “good credit” range, this 30-point dip could take you into a lower credit score level.

This would be an example of a more extreme situation, but if this person were in the “bad credit” category after the hit from these inquiries, the inquiries may have helped to tip the scale on the credit score category, but they are not the original cause of being on the cusp of bad credit to begin with.

Video: Do All Inquiries on Your Credit Reports Lower Your Scores?

Can You Still Get a Mortgage if You Have Inquiries on Your Credit Report?

Some people believe that you cannot get a mortgage if you have recent inquiries on your credit report. However, inquiries themselves are typically not an automatic disqualifier, although you may have to provide a few sentences to explain each inquiry.

If you have enough inquiries on your credit report to lower your credit score, though, this could affect the terms of your loan. Even a small difference in the interest rate of a home loan can cost you tens of thousands of dollars over the life of the loan.

If you want to get the best rate possible, it’s safest to try to avoid getting any new inquiries or opening new credit accounts around the time that you are planning to apply for a mortgage.

Can You Remove Inquiries From Your Credit Report?

People with a lot of inquiries on their credit reports often want to know how to remove inquiries from a credit report fast. However, as with any credit repair process, there is no silver bullet that will instantly boost your credit score. It takes time, work, and patience if you want to see your credit score go up.

It’s also important to note that there is no legitimate way to remove timely and accurate inquiries from your credit report. If you really did get a hard inquiry, it would be fraudulent to lie and claim that the inquiry is not correct and should be removed.

According to the Federal Trade Commission, “No one can legally remove accurate and timely negative information from a credit report.”

The same rules apply when you are working with a credit repair company. The FTC says, “The first rule of credit repair is that no credit repair company can remove accurate and timely negative information from someone’s credit report.”

If you have inaccurate inquiries shown on your credit report as a result of identity theft or a reporting error, however, you can and should look into how to delete hard inquiries so you can get the credit inquiries removed.

How to Remove Inquiries From a Credit Report

Hard inquiry removal may seem intimidating, but removing credit inquiries from your credit report is certainly possible and should not be an issue if they are inaccurate or fraudulent.

If you are interested in how to delete credit inquiries, the best way to go about it is to write a credit inquiry removal letter. Write a letter to the credit bureau(s) that explains the errors and provide whatever evidence you may have that you did not authorize the hard pull on your credit report. The FTC provides a sample credit inquiry letter that you can use as a template.

It’s also helpful to attach a copy of your credit report that you have annotated to indicate which inquiries are inaccurate.

Once the credit bureau receives your credit inquiries letter, they have 30 days to investigate the dispute and respond. If the creditor cannot prove that you authorized the hard pulls on your account, the bureau will delete the inquiries from your credit report, and the credit inquiry removal process will be complete.

You can find out more about how to delete inquiries from your credit report in “How to Fix the Most Common Credit Report Errors.”

Conclusion on Credit Inquiries

We often hear people blaming their bad credit on the fact that they have too many inquiries on their credit report. However, it is a myth that inquiries alone can cause bad credit.

In reality, the cause of bad credit is usually a combination of missed payments, defaults on loans, and/or high credit utilization. These factors are all much more significant than having too many inquiries.

We are aware that on many credit monitoring platforms, the system may mention that the person has too many inquiries. Perhaps this is one cause of the myth that inquiries are the cause of bad credit.

However, as we illustrated in this article, inquiries are only one data point among several other data points within the category known as “new credit,” which accounts for around 5%-10% of someone’s overall credit score.

This does not mean that inquiries alone count for 10% of your credit score. It means that inquiries are one of several data points that, combined, account for around 10% of a credit score. Therefore, it is fair to assume that the number of inquiries you have, in fact, accounts for less than 10% of a credit score.

It may be possible for inquiries to have a significant effect on one’s credit score in extreme cases, such as someone having multiple hard inquiries pulled continuously over the course of a year. However, in more typical scenarios, inquiries most likely are not the cause of someone having bad credit.

2 Comments

Should you buy Trade lines if you still have inquiries on your credit??

You can purchase tradelines if there are inquiries on your credit report. Inquiries can have a small negative effect on your credit, but they are given much less weight than tradelines.