Ellen Johnson

03/12/2025

Published by Ellen Johnson at 03/12/2025

Balance transfers are a somewhat controversial topic in the world of credit repair and debt payoff. They can be a wonderful tool for helping consumers get out of credit card debt without being crushed by sky-high interest rates. On the other hand, if you’re not careful, they can also enable you to get yourself even deeper into debt than you were before.

03/03/2025

Published by Ellen Johnson at 03/03/2025

Categories

The “opt-out” myth is one of many myths that lead consumers astray when it comes to credit. What is the opt-out myth and why does it not work?

02/26/2025

Published by Ellen Johnson at 02/26/2025

Categories

We’ve written before about the problem of credit invisibility, which is when a consumer does not have a credit score. Millions of consumers are credit invisible in the United States.

01/12/2025

Published by Ellen Johnson at 01/12/2025

Categories

Credit cards are often vilified for their high interest rates, which can be very costly to consumers who carry a balance from month to month rather than paying off the full balance that was accrued.

12/22/2024

Published by Ellen Johnson at 12/22/2024

Categories

When you are paying for purchases, is it better to use a debit card or a credit card? The answer depends on which features and advantages are important to you.

11/21/2024

Published by Ellen Johnson at 11/21/2024

Categories

Myths about credit are extremely common, even among people who purport to repair credit. In this post, we’re going to focus on the top three credit myths that just won’t seem to go away, according to credit expert John Ulzheimer.

10/27/2024

Published by Ellen Johnson at 10/27/2024

Categories

It’s never a good feeling when you notice that your credit score has dropped. Let’s explore some of the possible reasons that could cause your credit score to decline.

07/17/2024

Published by Ellen Johnson at 07/17/2024

Could inquiry "bumpage" and "choppage" improve your credit? Find out from an expert who has spent three decades in the industry, John Ulzheimer.

06/27/2024

Published by Ellen Johnson at 06/27/2024

Categories

The “date of last activity,” also known as the DLA, is often discussed within the field of credit repair in a way that is inaccurate or misleading. Because of this, many consumers do not understand the DLA as it relates to their credit reports and credit scores.

06/06/2024

Published by Ellen Johnson at 06/06/2024

While credit mix only makes up 10% of your FICO score, it’s still important to consider when building credit. Check out our infographic about mix of credit and types of credit.

05/30/2024

Published by Ellen Johnson at 05/30/2024

Categories

Derogatory items can stay on your credit report and damage your credit scores for years. We’ll help you understand minor and major derogatories, how derogatory items affect your credit score, and what you can do about them.

04/07/2024

Published by Ellen Johnson at 04/07/2024

Categories

If you monitor your credit using a free website, chances are, you’ve seen your VantageScore. However, you may not have realized that this credit score is not the same as your FICO score.

03/24/2024

Published by Ellen Johnson at 03/24/2024

Nearly one in five American adults do not have a credit score. Find out what it means to be "credit invisible" and how consumers can become credit visible.

03/19/2024

Published by Ellen Johnson at 03/19/2024

Categories

The debt snowball and the debt avalanche are the two most popular methods for paying off debt. We explain how they work, the pros and cons of each approach, and how to decide which debt payoff strategy is right for you.

03/11/2024

Published by Ellen Johnson at 03/11/2024

Categories

Credit cards are not only a useful payment method for making purchases but also an essential component of a solid credit-building strategy. When you have the knowledge to use credit cards to your advantage rather than to your detriment, they can be an extremely powerful financial tool to have in your arsenal.

03/04/2024

Published by Ellen Johnson at 03/04/2024

Categories

The vast majority of lenders use your FICO credit score to evaluate your credit risk as a consumer when they are deciding whether or not to extend credit to you. And yet, historically, it has been costly for consumers to access their own FICO scores.

02/04/2024

Published by Ellen Johnson at 02/04/2024

Everyone wants to get a higher credit score, but not all of the “hacks” or tips being promoted actually help you get more credit score points. Credit expert John Ulzheimer answers some common questions about ways to get more credit score points.

01/21/2024

Published by Ellen Johnson at 01/21/2024

Categories

Being an authorized user on someone else’s credit card can often be a valuable strategy for consumers who are looking to build credit. However, it is not true that everyone will benefit from authorized user accounts in every situation.

01/15/2024

Published by Ellen Johnson at 01/15/2024

Credit sweeps are a heavily advertised and promoted service among credit repair companies. John Ulzheimer explains why you need to watch out for credit sweep scams in an episode of Credit Countdown.

12/07/2023

Published by Ellen Johnson at 12/07/2023

Credit repair can take months to see results, but we have effective credit hacks that you can use to get a better credit score fast. Check out our list of the best credit hacks that will help you improve your credit.

11/19/2023

Published by Ellen Johnson at 11/19/2023

Categories

If you’re wondering how to update your credit report information fast so that you can improve your credit rating quickly, you may be interested in getting a rapid rescore. Find the answers to all your questions about rapid rescores in this article.

11/10/2023

Published by Ellen Johnson at 11/10/2023

Do you have derogatory items dragging down your credit score? Here's how to get derogatory entries removed from your credit report.

10/30/2023

Published by Ellen Johnson at 10/30/2023

Certain negative items could potentially stay on your credit report permanently. Here are the three exceptions to the 7-10 year limit on negative information imposed by the FCRA.

10/19/2023

Published by Ellen Johnson at 10/19/2023

Categories

Is it possible to have too much credit? We answer the question of whether having too much credit could hurt your credit score by breaking it down into three parts: having too much available credit, having too much debt, and having too many credit accounts.

10/05/2023

Published by Ellen Johnson at 10/05/2023

Categories

Credit reports are an integral part of our financial system, yet many of us are seriously misinformed about how credit reports work. We'll help you understand what your credit report is and why it’s important.

09/25/2023

Published by Ellen Johnson at 09/25/2023

Categories

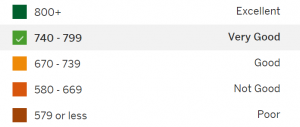

Credit scores impact our lives in more ways than you might think, yet, unfortunately, they are complex and can be difficult to understand. In this article, we’ll clear up what credit scores are, why they matter, how to build credit, and how to improve your credit score.

09/16/2023

Published by Ellen Johnson at 09/16/2023

Categories

Bad credit is something we all fear, but what is actually considered poor credit and how could it affect you? In addition to explaining what bad credit is and why you need to avoid it, we'll also provide some strategies in this article to help you fix bad credit.

09/14/2023

Published by Ellen Johnson at 09/14/2023

Categories

Secured credit and unsecured credit are types of credit that are very different in terms of risk to consumers and lenders.

09/10/2023

Published by Ellen Johnson at 09/10/2023

Categories

Inquiries are often blamed for people's bad credit, but we're not so sure that's the case. Read this article to learn what hard inquiries and soft inquiries are and the truth about how inquiries affect your credit score.

09/08/2023

Published by Ellen Johnson at 09/08/2023

If you have bad credit or no credit at all, you’ll likely have a hard time getting a loan. Fortunately, there are some ways to start building credit even when you haven’t used credit before.