What Is Bad Credit and How Can It Affect You?

Secured vs. Unsecured Debt: What Are the Pros and Cons?

09/14/2023

A Guide to Credit Card Fees and How to Avoid Them

09/21/2023

Bad credit is something we all fear, but what is actually considered poor credit and how could it affect you? In addition to explaining what bad credit is and why you need to avoid it, we’ll also provide some strategies in this article to help you fix bad credit.

What Is a Bad Credit Score?

The definition of “bad credit” varies depending on which credit scoring system you are talking about. Since FICO 8 is the scoring model most widely used by lenders, we will focus on FICO when discussing the question of what is considered bad credit.

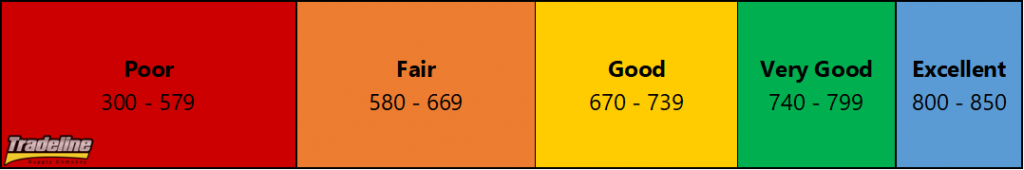

The FICO 8 credit scoring system assigns consumers a number to represent their creditworthiness, with the lowest credit score possible being 300 and the high end of the scale being 850.

A high credit score shows lenders that they can be fairly confident that a consumer will repay debts because they have demonstrated responsible behavior when it comes to credit in the past.

A low credit score, on the other hand, means that someone represents a higher risk to lenders because they are thought to have a higher probability of defaulting on a loan.

According to Credit Karma, a FICO score between 300 to 579 is considered a poor credit score, while a fair credit score is between 580 and 669. In contrast, an excellent credit score is between 800 and 850.

Credit scores between 300 and 579 are considered poor credit.

Video—Bad Credit Score: Do You Know Where the Line Is?

Credit expert John Ulzheimer explains what is considered a bad credit score vs. a good credit score in this Credit Countdown video from our YouTube channel.

What Gives You Bad Credit?

As we mentioned, having a bad credit score means lenders perceive you as a high-risk borrower. Therefore, what causes bad credit generally is poor management of credit and risky behaviors that indicate that you may have a higher probability of default.

In order to better understand how consumers can end up with bad credit, let’s review what factors are considered by credit scores generally and how certain actions or issues could affect those categories.

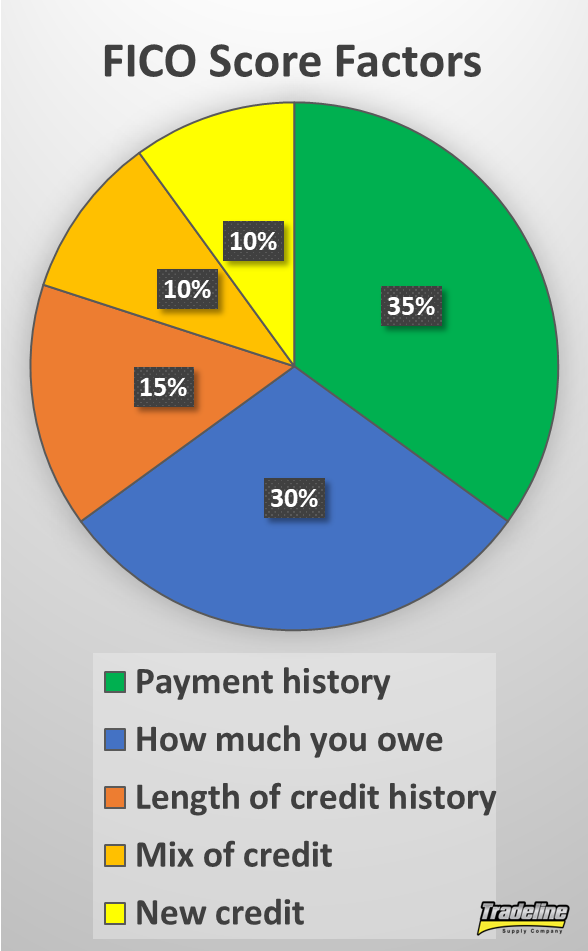

With FICO credit scores, there are five main categories that influence your score:

-

Payment history, 35%

This category looks at how often you make your debt payments on time compared to how often you are late in paying your bills. The more payments you miss, and the longer they go without being paid, the lower your credit score will be.

-

Credit utilization (AKA how much you owe), 30%

FICO scores take into account five main factors: payment history, credit utilization, credit age, mix of credit, and new credit.

This refers to how much revolving debt (e.g. credit card debt) you have compared to the amount of available credit you have. In other words, do all of your credit cards have zero balances, or are they all maxed out, or somewhere in between? Having higher balances has a negative effect on your score since it means that you may be close to being overextended financially and you are therefore a higher credit risk.

-

Length of credit history, 15%

The length of your credit history (also known as your credit age) is correlated with a lower risk of defaulting on your debts. If you don’t have enough credit age, it can hurt your credit score.

-

Credit mix, 10%

An ideal mix of credit requires having a balance of both revolving and installment accounts. Examples of revolving accounts include credit cards and lines of credit. Installment accounts include auto loans, student loans, home loans, and other loans that you pay in “installments.”

Having too few accounts of either type, or too few accounts in general, can contribute to a low credit score, although at only 10% of your credit score, it is not likely to be a primary driver of bad credit.

-

New credit: 10%

The new credit factor of your score considers hard inquiries on your credit report as well as the number of new accounts in your credit file. Having too many inquiries and/or newly opened accounts on your credit report can have a negative effect on your credit score because it looks like you are trying to obtain a lot of credit and may not have the intention or the ability to pay it all off down the road.

However, this factor also represents only 10% of your credit score, so even if you have a lot of inquiries or new accounts, it is almost certainly not the only reason why you have bad credit.

VantageScore credit scores are slightly different in terms of the percentage breakdown, but overall, the factors and their relative weights are similar to those of FICO scores.

Specific Causes of Bad Credit

Now that we have a general idea of what is good and bad to shoot for in each category, we can go into what causes bad credit specifically.

Here are some more examples:

-

Late or missed payments

The more payments you miss, the lower your score will fall. Even one missed payment can have a huge negative impact on your credit, but you’re more likely to end up with bad credit if you have multiple 30-day lates or 60-day lates (minor derogatory items) on your record, and/or a 90-day late, which is a major derogatory item.

-

Defaulting on a loan

When you do not make the required payments on your loan for an extended period of time, eventually, the loan will be considered to be in default, which means you did not fulfill the legal obligations associated with your debt. Having a default on your credit report is highly damaging to your score and can scare lenders away from doing business with you.

The specific amount of time that passes without a payment before a loan is considered to be in default depends on the type of loan, but it is generally at least 90 to 120 days.

-

Charge-offs

At a certain point after your debt has gone into default, the lender will eventually have to “charge off” the account. This means they have given up hope that they will recover any of the money and will write off the debt as a business loss.

Federal regulations require that lenders must charge off debts after a certain length of time. According to credit.com, credit card debt must be charged off when it becomes 180 days past due and installment loans may be charged off after 120 days without a payment.

However, you are still legally responsible to pay off the debt even if it is considered “charged off,” so you would now have a serious derogatory mark on your credit in addition to still owing the money.

-

Collection accounts

Delinquent accounts that are sold to third-party debt buyers are called collection accounts. In “Collection Accounts on Your Credit Report: The Ultimate Guide,” we explain how accounts in collection can affect your credit.

To summarize, even having just one collection on your credit history may lead to bad credit, particularly if they are open collections that have not been paid. Some credit scoring models don’t count collections that have been paid off, including FICO 9, VantageScore 3.0, and VantageScore 4.0.

-

Judgments

When a creditor or debt collector has to sue you to recover unpaid debt, the court may grant them a judgment against you, which gives the plaintiff greater authority to collect money from you. For example, they could garnish your wages, taking a chunk out of every paycheck you receive until the debt is repaid.

Judgments, like collections and charge-offs, are major derogatory items that can easily cause you to have bad credit.

-

Settlements

A settlement on your credit record indicates that you and your lender came to an agreement that you would settle the debt for less than the amount you originally owed. This will get the lender to stop trying to collect from you, but it is still very bad for your credit since it shows that you failed to fully pay off your debt.

High credit card utilization can lead to bad credit. Photo by Natloans

-

Bankruptcy

Bankruptcy is the worst item to have on your credit report and it is extremely damaging to your credit. This is because declaring bankruptcy essentially releases you from the legal obligation to repay some (Chapter 13 bankruptcy) or all (Chapter 7 bankruptcy) of your debts.

Naturally, a bankruptcy can tank your credit score and make it difficult to get credit in the future.

-

Foreclosures or repossessions

When you take an installment loan that is secured by an asset, such as your house or car, the lender can take possession of the asset if you default on the loan. They can then sell the home or the vehicle to try to recover some of their losses from your unpaid debt.

These are also major derogatory items, so they can often be driving forces behind bad credit.

-

Maxed out or high-utilization credit cards

Credit utilization is second only to payment history when it comes to your credit score. At 35% of your score, it is still an important determining factor. Therefore, having revolving accounts that are maxed out or close to their credit limits can result in bad credit.

See our article on credit utilization ratios or our list of credit hacks that actually work for some valuable tips on how to keep your credit utilization low.

-

Too many inquiries at one time

While it’s highly unlikely that having a few inquiries would cause bad credit, the impact can be more significant if there are a lot of inquiries around the same time.

Since this is in the new credit category, which is only 10% of your credit score, it is likely not going to be the main contributing factor to bad credit, but it can help push you over the edge if you are already on the lower end of the “fair” credit range, which is 580 – 669.

You can find more information on how inquiries affect your credit in our article, “Are Inquiries Really Killing Your Credit?”

-

Too much new credit

As with inquiries, this falls into the new credit category of your score, which is not hugely significant overall. However, having too much new credit can hurt your score and could potentially tip you over the edge into bad credit territory.

-

Unpaid medical bills

Sometimes people have bad credit because of things they can’t control, like having a medical emergency that leads to huge hospital bills that they can’t afford to pay. In fact, the majority of consumer debt in collections is medical debt, according to Magnify Money.

The Good News About Bad Credit

Fortunately, these negative items don’t give you bad credit permanently, even bankruptcy. All derogatory items on your credit report have less of an impact on your credit as they get older.

Most negative items will be removed from your credit report altogether seven years from the original date of delinquency. The exception is Chapter 7 bankruptcy, which can be reported as part of your credit history for up to 10 years.

As you may have noticed, most of the items we listed above relate to the payment history portion of your credit score, which underscores how important it is to pay all of your bills on time, every time.

This also means that you can speed along your recovery from bad credit simply by making all of your debt payments on time in the future.

We will discuss more on how to repair and rebuild bad credit below.

Bad Credit Loans

Payday loans can come with interest rates of up to 400%. Photo by Aliman Senai.

If you have bad credit, you’re likely going to have a hard time getting loans with favorable terms or possibly even getting approved for a loan in the first place. Since a bad credit score represents a high risk for the lender, loans for people with poor credit typically have higher interest rates and may require collateral or a down payment—if the lender is willing to approve the loan at all.

Personal Loans for Bad Credit

Personal loans for bad credit may be few and far between. Usually, at least a fair credit score is needed to be considered for a loan.

Bad credit loan lenders may charge very high interest rates since they are taking on a lot of risk by lending money to someone with poor credit. These higher interest rates may translate into thousands of dollars of additional interest payments over the term of a loan.

Very bad credit loans such as payday loans often have astronomical interest rates of up to 400%, which makes it nearly impossible for many consumers to get out of debt.

Bad Credit Car Loans

Bad credit auto loans, also known as subprime auto loans, are often considered “second-chance” loans because they are typically the next option for those who have been rejected for traditional auto loans. Although there is not necessarily an official dividing line between which credit scores are considered prime and subprime when it comes to auto loans, credit scores below 620 tend to be considered subprime.

Bad credit car loans can have triple or more the interest rate as prime auto loans. Photo by QuoteInspector.com.

Car loans for bad credit, similar to personal loans for bad credit, are associated with much higher costs than prime auto loans. Since lenders of second-chance auto loans are taking on additional risk, these loans often have significantly higher interest rates and more fees than auto loans for consumers with good credit. Additionally, car loans for bad credit may come with penalties for paying off the loan early.

According to Investopedia, “While there is no official subprime auto loan rate, it is generally at least triple the prime loan rate, and can even be five times higher.”

Credit Cards for Bad Credit

If you have bad credit, your options for getting a credit card will be limited, and you will most likely not be able to get the perks associated with premium credit cards, such as low interest rates, high credit limits, and rewards. Credit cards for poor credit may also come with annual or even monthly fees.

Subprime credit cards often require you to make a deposit with the lender as collateral. These cards are known as secured credit cards since they are secured by your deposit, which the lender can keep if you fail to make payments on the card. Sometimes, the lender may be willing to switch you to an unsecured card after you have shown a history of consistent on-time payments.

As we’ve seen with loans for bad credit, credit cards for bad credit, whether they are secured and unsecured, may have high interest rates, sometimes as high as 30% or more.

How to Fix Bad Credit

Having a bad credit score is expensive. It makes getting any kind of credit more difficult and more costly because bad credit lenders tack on high interest rates and fees to compensate for the higher financial risk of poor credit loans.

Having bad credit doesn’t just dramatically increase the cost of credit. It can also affect other aspects of your life, such as your insurance premiums, your ability to find housing, and even your job, since many employers now check prospective employees’ credit reports. Therefore, most people with bad credit want to fix it as soon as possible.

Here are some strategies that you can try if you need to fix bad credit.

Credit Repair

If you have bad credit as a result of identity theft or extensive errors on your credit report, you’ll likely need to undergo credit repair in order to clean up your credit file.

Some people opt to try their hand at DIY credit repair, while others may prefer to hire a trusted credit repair company to get help with the dispute process and potentially faster results.

Either way, it’s important to be aware of best practices when disputing credit report errors. It’s best to submit your dispute by sending a letter along with documentation to verify your identity and support your claim. Trying to dispute errors online or over the phone may not yield the best results.

In addition to disputing inaccurate information with the credit bureaus, it’s also important to contact the company that is furnishing the data so that the error doesn’t get reported again in the future.

Rebuilding Credit

Improving bad credit takes time and patience. While credit repair companies may claim to have tactics that can boost your credit fast, the reality is that these tactics are usually limited to removing inaccurate information from your credit report. If you remove everything from your credit report, what are you left with?

The best way to fix bad credit, beyond correcting inaccuracies, is to rebuild it with more positive credit history over time. In other words, you need to add more positive accounts to your credit profile and keep them in good standing while they age. At certain age levels, these accounts should begin to boost your credit profile with that positive payment history.

Rebuilding credit with positive credit history helps to fix bad credit.

One option that can help people re-establish credit is opening a credit-builder loan, which works in the reverse order of a traditional loan. Instead of receiving the loan amount upfront and then making payments to the bank to pay off your debt, with a credit-builder loan, you make all the payments first and then receive the funds after you have finished paying off the loan.

Since these loans are much less risky for lenders, they can be offered to those struggling with bad credit or lack of credit history.

Generally, though, building credit by opening new accounts can take at least two years to see much of a positive effect. The best way we have seen to bypass this two-year waiting period is by piggybacking on the good credit of others.

Have you been affected by bad credit? What did you do about it? Tell us your story in the comments.