What Is the Difference Between Individual and Overall Credit Utilization Ratios?

How to Prepare Financially When Switching Jobs

06/21/2023

Collection Accounts on Your Credit Report: The Ultimate Guide

06/25/2023You may already be aware that your credit utilization is a major component of your credit score, but did you know that this category encompasses more than one type of utilization ratio?

In this article, we will talk about the difference between your overall credit utilization ratio and individual utilization ratios and why it matters to your credit.

What Is Credit Utilization?

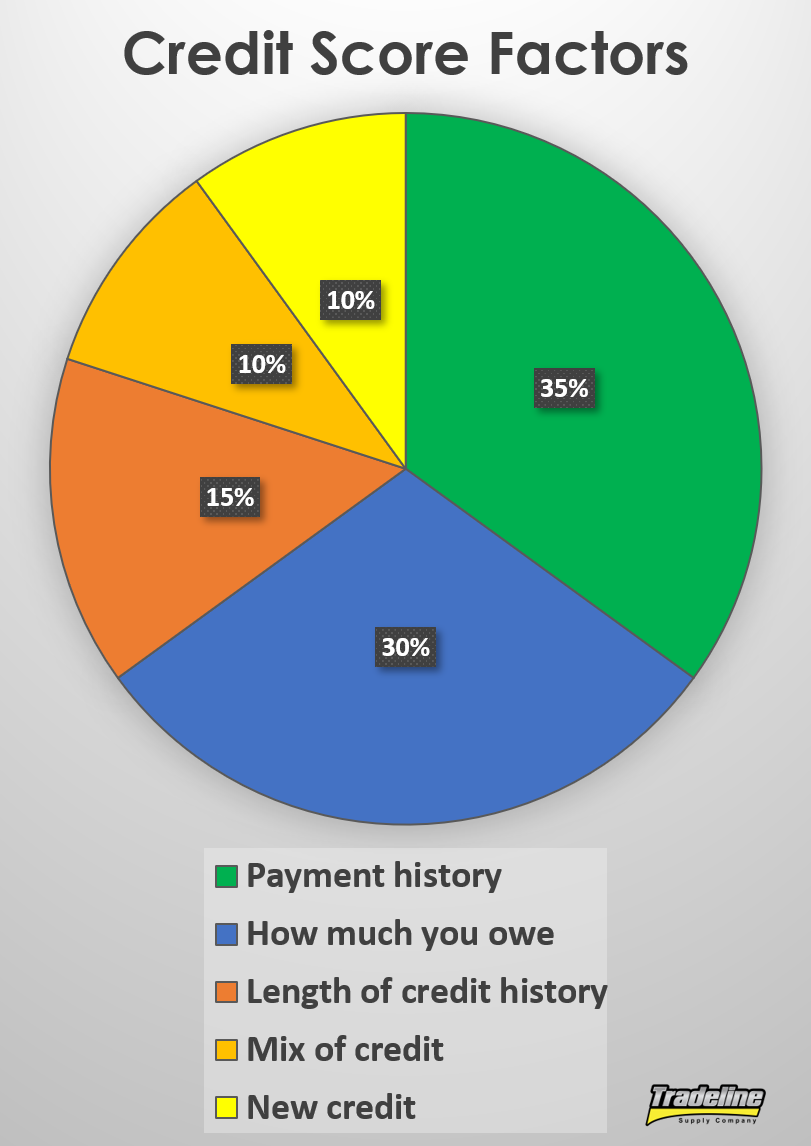

Credit utilization makes up 30% of a FICO score.

Your credit utilization is simply the amount of debt you owe compared to the amount of available credit you have. In other words, it is the amount of your available credit that you are actually using.

In terms of your credit score, credit utilization makes up 30% of your score, which means it is second in importance only to your payment history.

The reason why credit utilization is such an important part of your credit score is that the ratio of debt someone has is highly indicative of whether they will default on a debt in the future. The more debt you owe, the harder it becomes to pay off all that debt on time every month, which makes you a riskier investment for lenders.

Components of Credit Utilization

According to FICO, there are several components that fall within the category of credit utilization, such as:

- The total amount you owe on all accounts (your overall utilization ratio)

- The amount you owe on different types of accounts

- The utilization ratios of each of your revolving credit accounts (individual utilization ratios)

- The number of your accounts that have balances or the ratio of accounts with balances to accounts with no balance

- The amount of debt you still owe on your installment loans (e.g. mortgages, auto loans, student loans), although this is known to be less important than the utilization of your revolving accounts

What Is the Difference Between Individual and Overall Utilization?

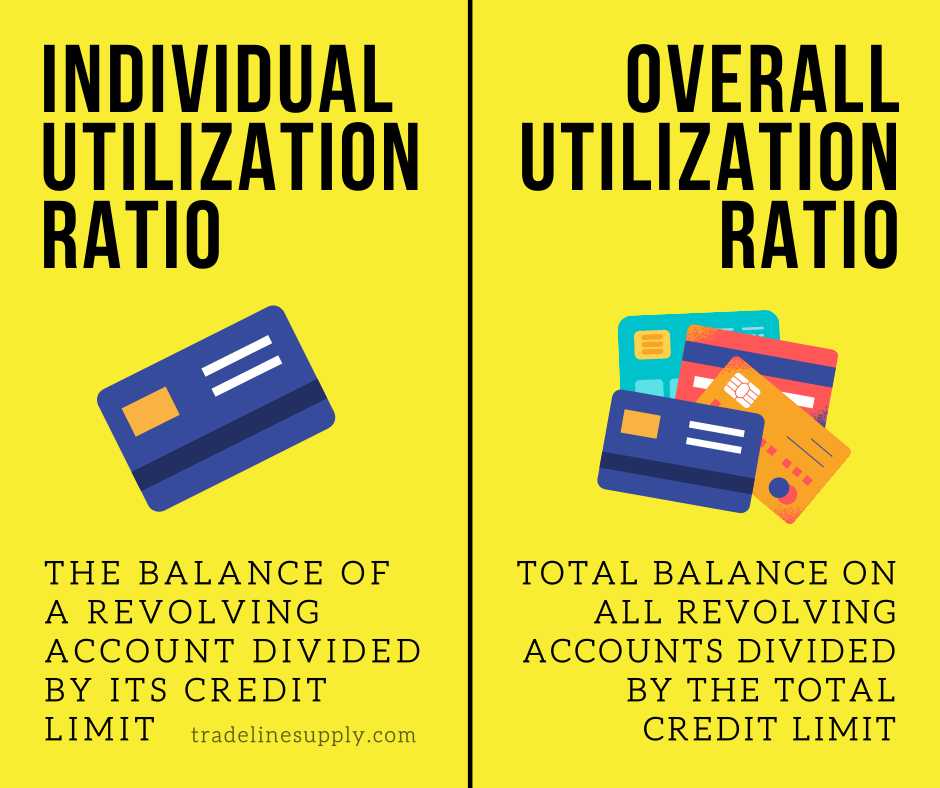

Your overall utilization ratio is the amount of revolving debt you have divided by your total available revolving credit.

For example, if you have one credit card with a $450 balance and a $500 limit and a second credit card with a $550 balance and a $3,500 limit, your overall utilization ratio would be 25% ($1,000 owed divided by $4,000 available credit).

However, the individual utilization ratios of your respective credit cards are 90% ($450 balance / $500 credit limit) and 16% ($550 balance / $3,500 credit limit).

Since credit scores consider individual utilization ratios, not just overall utilization, having any single revolving account at 90% utilization is going to weigh negatively on the credit utilization portion of your score.

An individual utilization ratio refers to the utilization of a single revolving account, whereas the overall utilization ratio includes the balances and credit limits of all of your revolving accounts.

Video: Did You Know There Are 2 Types of Credit Utilization Ratios?

Overall Utilization May Not Be as Important as You Think

Typically, when people think of the effect that credit utilization has on credit scores, they often assume that overall utilization is the only important variable.

By this assumption, it would be fine to have individual accounts that are maxed out as long as the overall utilization is still low.

The individual utilization ratios on each of your accounts may be more important than the overall utilization ratio.

However, we have often seen cases where this is not true.

For example, sometimes a consumer who has maxed-out credit cards may assume that if they reduce their overall utilization ratio, their credit will improve, but once they accomplish this goal, they don’t see the results they were hoping for.

This implies that the individual accounts with high utilization ratios are still weighing heavily on the consumer’s credit score, despite the fact that the consumer has improved their overall credit utilization ratio. In other words, the decrease in this person’s overall utilization ratio did not have a significant impact on their credit.

Cases like this seem to indicate that overall utilization may not play as big of a role as traditional wisdom has led us to believe and that the individual utilization ratios may actually be more important to one’s credit.

This is one of the reasons why we typically suggest that consumers focus on the age of their accounts rather than their credit limits. Although people tend to focus on getting high credit limits, the age and payment history of their accounts is actually more powerful in most cases, especially considering that lowering one’s overall utilization ratio may not help very much.

Video: Which Is More Important: Individual or Overall Utilization?

Tradelines and Credit Utilization

Although age should usually be the top priority, it’s still important to consider the credit utilization factor of any revolving tradelines in your credit file.

Our tradelines are guaranteed to have utilization ratios that are at or below 15%, which means at least 85% of that tradeline’s credit limit is available credit. In fact, most of our tradelines typically maintain utilization ratios that are much lower than 15%.

Before buying tradelines, see where you stand currently by using our tradeline calculator, which automatically calculates your credit utilization ratios for you. You can also use the calculator to see how your overall utilization ratio could be affected by changing some of the variables.

What Is the Ideal Utilization Ratio?

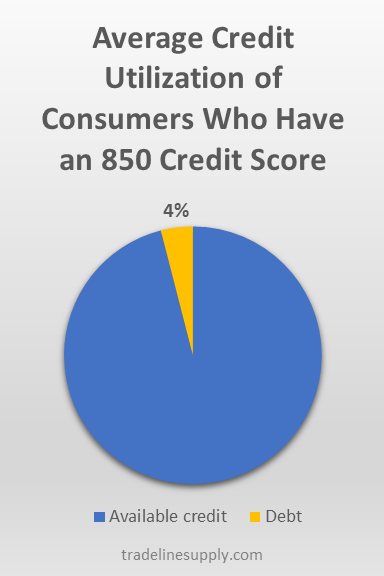

The average credit utilization ratio of consumers who have an 850 FICO score is about 4%.

As a general rule of thumb, simply aim to keep your utilization as low as possible. However, you might be surprised to learn that having a zero balance on all revolving accounts is actually not the best scenario for your score.

According to creditcards.com, “…the ideal scenario tends to be having all but one card show a zero balance (zero percent utilization) and having one card with utilization in the 1-3 percent range.”

Why? As it turns out, consumers with a 0% utilization ratio actually have a slightly higher risk of defaulting than those with low (but more than 0) utilization. A 0% utilization indicates that a consumer may not use credit regularly, which leads to the consumer having a higher risk of default in the future.

However, your utilization doesn’t necessarily have to fall in line with the above scenario in order to have a perfect credit score. In “How to Get an 850 Credit Score,” we found that consumers with FICO credit scores of 850 have an average utilization rate of 4.1%.

For those of us who use credit regularly, however, maintaining a minuscule balance may not always be practical. So what is a realistic threshold to shoot for?

While you may hear the figure 30% cited frequently, knowledgeable credit experts say this is a myth and that you should aim for 20%-25% instead.

Tips to Avoid Excessive Revolving Debt Utilization

-

Spread out your charges between different cards

Since we have seen that it’s important to keep individual utilization ratios low, one strategy to accomplish this is to make your purchases on a few different credit cards instead of charging everything to one card. Spreading out your charges helps to prevent an excessively high balance from accumulating on any one individual card.

However, also keep in mind that credit scores may penalize you for having too many accounts with balances. Ideally, try to maintain low individual utilization rates while not having a balance on every single account.

-

Pay off your balances more frequently

If you do spend a lot on one card, it helps to pay off your balance more than once a month. If your card reports to the credit bureaus before you have paid off your balance, it will show a higher utilization than if you had paid some or all of the balance down already.

If you spend a lot on one of your cards, consider spreading out your charges between different cards or paying down the balance more often.

You can either time your payment to post just before the reporting date of your card or you can make payments several times per month. Some people even prefer to pay off each charge immediately so their card never shows a significant balance.

-

Set up balance alerts to monitor your spending

To prevent mindless spending from getting out of control, try setting up balance alerts on your credit card. Your bank will automatically notify you when the balance exceeds an amount of your choosing, so you can back off of spending on that card or pay down your balance.

-

Don’t close old accounts

Even if you don’t use some of your old credit cards anymore, it’s often a good idea to keep the accounts open so they can continue to play a positive role in your overall utilization ratio and the number of accounts that have low utilization vs. high utilization.

-

Ask for credit limit increases

Try calling up your credit card issuer and asking for a higher credit limit. If you get approved, as most people who ask do, this can improve your credit utilization.

Another way to decrease your utilization ratios is to call your credit card issuers and ask them to increase your credit limit. By increasing your amount of available credit, you decrease your utilization ratio, both on individual cards and overall.

Keep in mind that your bank may do a hard pull on your credit to decide whether or not to grant your request, which could ding your score a few points temporarily. However, the small negative impact of the credit inquiry could be offset by the benefit of the credit line increase.

Also, this might not be an ideal strategy if you think you will be tempted to spend the new credit available to you, which could leave you even worse off than you started.

If you want to learn more about how you can successfully ask for credit line increases, check out our article, “How to Increase Your Credit Limit.”

-

Open a new credit card

Like asking for a higher credit limit, opening a new credit card can also lower your credit utilization, provided you leave most of the credit available.

Again, this will add an inquiry to your credit report, as well as decrease your average age of accounts, so this could have a negative impact on your score temporarily, which may be outweighed by the decrease in your credit utilization.

-

Transfer your credit card balances to other cards

A balance transfer is when you use available credit from one credit card account to pay off the balance on another credit card, thus “transferring” your debt balance from one card to another.

There are two ways to do this: you can transfer a balance to another credit card you already have, as long as it has enough available credit, or you can transfer a balance by applying for a new credit card and letting the card issuer know in your application which accounts you want to transfer balances from and how much you want to transfer.

The latter option is best for your credit utilization since opening a new credit card means you are adding available credit to your credit profile. In addition, it gives you the opportunity to apply for specific balance transfer credit cards, which usually come with low promotional interest rates on the balances you transfer.

However, using an existing account to do a balance transfer can still be beneficial if done properly, because it can help your individual utilization ratios. Just make sure the account you are transferring the balance to has a higher credit limit than the account that is currently carrying the balance in order to keep the individual utilization ratios as low as possible on each account.

-

Pay down small balances to zero

Having too many accounts with balances can bring down your score since credit scores consider the number of accounts in your credit file that are carrying a balance. If you have any accounts with low balances, paying those down to zero will decrease the individual utilization ratios on those accounts, reduce your overall utilization ratio, and reduce the number of accounts with balances, thus improving your credit profile in multiple ways.

4 Comments

I’ve got hospital and credit cards in my derogatory I had a stroke 3yrs back and acquired the hospital bills and my cards thanks to my family unfortunately and illness I couldn’t get them paid I use to have 800 credit scores luckily I’m 625 and 578,I’m trying.

So sorry to hear that, Dwon! Hopefully, you will continue to see improvements with time!

Ellen,

You are my hero! Thank you for sharing your gift of teaching finance so that anyone can easily understand!

❤️ Stephanie

Thank you so much for your kind words, Stephanie! I’m glad my articles have been helpful!