Are Revolving Accounts More Powerful Than Installment Accounts?

At What Age Can You Start Building Credit?

04/12/2023

How to Increase Your Credit Limit

05/04/2023

Revolving accounts and installment accounts are both important account types when building credit, but they are not equally powerful when it comes to your credit score. Which type of account has a greater impact on your credit score? Keep reading to find out.

Revolving Debt vs. Installment Debt: Definitions

Revolving Credit Account Definition

A revolving credit account is an account that allows you to “revolve” a balance, which means you do not have to pay the full outstanding balance on the account every month.

Revolving accounts typically have a credit limit up to which you can charge. You can choose how much to borrow from the account; you do not have to use the full credit limit. Once you make payments against the balance, that amount of credit is then available for you to use again.

Revolving accounts include lines of credit and credit cards.

Installment Credit Definition

Installment credit, in contrast, is credit where the full loan amount is disbursed at one time. You then make regular payments of a fixed amount toward the debt over a certain period of time.

Installment debt includes mortgages, auto loans, student loans, personal loans, credit-builder loans, and any other type of loan that has a regular payment schedule of fixed payments.

How Installment and Revolving Debts Affect Your Credit Score

Revolving Accounts and Your Credit Score

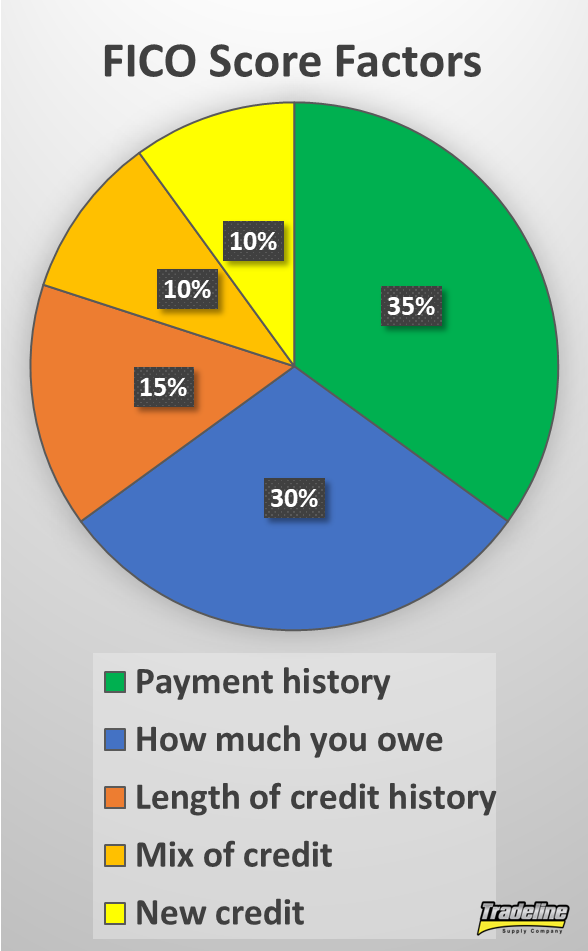

Five main factors are considered by FICO scores.

As you know from our article on credit scores, there are five main factors that influence your FICO score:

- Payment history, 35%

- Utilization/how much you owe, 30%

- Length of credit history (age), 15%

- Credit mix, 10%

- New credit/inquiries, 10%

Revolving accounts can have a significant effect on each of these five factors.

Payment History

As far as payment history, it’s important to pay your bills on time every single month just like any other account. However, with revolving accounts, you do not have to pay off the full balance every month.

Instead, there is likely a minimum payment amount that you will be required to make. If you make a payment that is less than the minimum payment, your account will still be considered delinquent.

Credit Utilization

A lot of the power of revolving accounts comes from their influence on your credit utilization ratios. This is because the credit utilization factor of your credit score places much more importance on the utilization of your revolving accounts.

Having high revolving utilization means that you are using a large portion of your available credit, which indicates to lenders that you might be at an increased risk of default. That’s why high credit utilization is bad news for your credit score.

If you run up a balance on a credit card and then only pay the minimum payment each month, you will be increasing your credit utilization. Since debt metrics such as utilization make up 30% of your FICO score, carrying a balance on your revolving accounts can seriously reduce your score.

Length of Credit History (Credit Age)

Credit age is also important since it goes hand-in-hand with payment history. The longer you keep your revolving accounts open, the better. Even after they are closed, they can still continue to age and impact your average age of accounts until they fall off of your credit report altogether.

Consumers with excellent FICO scores have an average of seven credit cards, including closed accounts.

Mix of Credit

Having a few different revolving accounts is also beneficial to your credit mix. Consumers with FICO scores of 785 and up have an average of seven credit cards in their credit files, including both open and closed accounts.

In fact, if you don’t have enough revolving accounts, you can get penalized for a “lack of revolving accounts,” because without them there is not enough information to judge your creditworthiness, according to Discover.

New Credit/Inquiries

Having too many inquiries for revolving accounts or too many new revolving accounts can hurt your credit score. Typically, each application for a revolving account is counted as a separate inquiry.

Installment Loans and Your Credit Score

Installment accounts can also affect some of the credit score factors, but in different ways and to different degrees than revolving accounts do.

Payment History

When it comes to your credit score, installment loans primarily impact your payment history. Since installment loans are typically paid back over the course of a few years or more, this provides plenty of opportunities to establish a history of on-time payments.

Credit Age, Credit Mix, and New Credit

Since installment loans typically don’t count toward your utilization ratio, you can have a high amount of mortgage debt and still have good credit.

Having at least one installment account is also beneficial to your credit mix, and installment debt can also impact your new credit and length of credit history categories.

Credit Utilization

What installment loans do not affect, however, is your credit utilization ratio, which primarily considers revolving accounts. That’s why you can owe $500,000 on a mortgage and still have a good credit score.

This is also why paying down installment debt does not help your credit score nearly as much as paying down revolving debt.

This is the key to understanding why revolving accounts are so much more powerful than installment accounts when it comes to your credit score. Debt metrics make up 30% of a credit score, and that 30% is primarily influenced by revolving accounts, not installment accounts.

Inquiries

In addition, with a FICO score, multiple credit inquiries for certain types of installment accounts (mortgages, student loans, and auto loans) will count as just one inquiry as long as they occur within a certain time frame. As an example, applying for five credit cards will be shown as five inquiries on your credit report, whereas applying for five mortgage loans within a two-week period will only count as one inquiry.

Why Are Revolving and Installment Accounts Treated Differently By Credit Scores?

Now that you know why revolving accounts have a more powerful role in your credit score than installment accounts, you might be wondering why these two types of accounts are considered differently by credit scoring algorithms in the first place.

According to credit expert John Ulzheimer in The Simple Dollar, it’s because revolving debt is a better predictor of higher credit risk. Since credit scores are essentially an indicator of someone’s credit risk, more revolving debt means a lower credit score.

Since revolving accounts like credit cards are usually unsecured, they are a better indicator of how well you can manage credit.

Why is it that revolving debt better predicts credit risk than installment debt?

The first reason is that installment loans are often secured by an asset such as your house or car, whereas revolving accounts are often unsecured.

As a result, you are going to be less likely to default on an installment loan, because you don’t want to lose the asset securing the loan (e.g. have your car repossessed or your home foreclosed on).

Since revolving accounts such as credit cards are typically unsecured, you are more likely to default because there is nothing the lender can take from you if you stop paying.

In addition, while installment debts have a schedule of fixed payments that must be paid every month, revolving debts allow you to choose how much you pay back each month (beyond the required minimum payment). Since you can decide whether to pay off your balance in full or carry a balance, revolving accounts are a better reflection of whether you choose to manage credit responsibly.

How to Use Revolving Accounts to Help Your Credit

Since revolving accounts are the dominant force influencing one’s credit, it is wise to use them to your advantage rather than letting them cause you to have bad credit.

Aim to accumulate at least a few revolving accounts over time.

Here’s what you need to do to ensure your revolving accounts work for you instead of against you:

- Make at least the minimum payment on time, every time.

- Don’t apply for too many revolving accounts and spread out your applications over time.

- Aim to eventually have a few different revolving accounts in your credit file.

- Keep the utilization ratios down by paying off the balance in full and/or making payments more than once per month. Use our revolving credit calculator to track your utilization ratios.

- Avoid closing credit cards so that they can continue to help your credit utilization.

Video: Are Revolving Accounts More Important to Your Credit Score?

Watch this video with credit expert John Ulzheimer to learn more about the impact of revolving credit vs. installment credit. Then, head over to our YouTube channel to watch more credit videos, and be sure to subscribe!

Revolving Accounts vs. Installment Accounts: Summary

- Revolving accounts are given more weight in credit scoring algorithms because they are a better indicator of your credit risk.

- Revolving accounts play the primary role in determining your credit utilization, while installment loans have a much smaller impact. High utilization on your revolving accounts, therefore, can damage your score.

- With a FICO score, inquiries for installment loans are grouped together within a certain time frame, while inquiries for revolving accounts are generally all counted as separate inquiries. Therefore, inquiries for revolving accounts can sometimes hurt the “new credit” portion of your credit score more than inquiries for installment accounts.

- Use revolving accounts to help your credit by keeping the utilization low and keeping the accounts in good standing.

Credit Expert: Are Revolving Accounts Better For Your Credit Scores Than Installment Loans?

As you know, John Ulzheimer, who is one of the top experts in the field of credit, has contributed several articles to our Knowledge Center. We asked him to share his opinion on the topic of the importance of revolving credit vs. installment credit. Overall, John’s position supports our conclusions in the above article.

You can read his take on the issue below.

Disclaimer: The following article was contributed by credit expert John Ulzheimer. The views and opinions expressed in the following article are those of the author, John Ulzheimer, and do not necessarily reflect the official policy or position of Tradeline Supply Company, LLC.

When it comes to credit scoring there are a variety of items from your credit reports that are scorable, meaning they can possibly influence your credit scores. Two of those items are revolving accounts and installment loans. The question that comes up from time to time is which of these two common types of credit accounts is better for your credit scores?

What Are Revolving Accounts?

The most common example of a revolving account is a credit card.

“Revolving” describes one of the three types of accounts that can appear on your credit reports. With a revolving account, you are assigned a line of credit or credit limit. You can draw against that line, pay it back, and draw against it again. The most common example of a revolving account is a garden-variety credit card.

For example, if you have a credit card with a $10,000 credit limit you can charge up to $10,000, pay some or all of it back, and then use some or all of that $10,000 again. You can do this over and over until the card issuer closes the account or you choose to stop using that card.

When you consider the number of banks and credit unions in this country, there are thousands of financial institutions that issue credit card accounts. And, most of these credit card issuers will report your account activity to the credit reporting agencies; Equifax, Experian, and TransUnion.

What Are Installment Loans?

“Installment” describes another of the three types of accounts that can appear on your credit reports. With installment accounts or loans, you have borrowed some specific amount of money and have agreed to pay it back in fixed monthly payments over a fixed period of time. A common example of an installment account is an auto loan.

For example, if you borrow $30,000 to buy a car you now owe the lender $30,000. You’ll be required to make the same payment every month until the balance has reached zero. A common length of time to pay back an auto loan is four years, or 48 months.

As with credit card issuers, there are also thousands of financial institutions that will extend installment loans. In fact, most lenders offer both credit cards and installment loans. And again, most of these lenders will report your account activity to the credit reporting agencies.

How Do They Impact My Credit Scores?

Although you could have hundreds of thousands of dollars of debt with a mortgage loan, it probably wouldn’t affect your credit score as much as your revolving debt.

Both credit cards/revolving accounts and installment loans are considered by the credit scoring systems built by FICO and VantageScore. As such, both account types can influence your scores. But, they do not influence scores equally. Not even close.

In fact, revolving accounts have considerably more influence on your credit scores than installment loans. This can be counterintuitive given you can easily be in several hundred thousand more dollars of installment debt than credit card debt (think home loans versus credit cards).

While installment debt can impact your credit scores, it’s generally benign as long as you’re making your payments on time. I’ll give you a personal example that I’ve shared before. I paid off a $250,000 mortgage loan by selling my house and my scores went up on average by about four points.

Now the credit card debt…ouch! A modest amount of credit card debt can be very problematic for your credit scores, even if you’re making your payment on time.

Credit card debt is measured in a number of ways in credit scoring systems. The number of accounts with a balance, the ratio of balances to credit limits on all of your open credit cards, and the same ratio but on a card-by-card basis. All of these metrics are very influential to your credit scores.

If I could paint a picture of a terribly problematic scenario as it pertains to your revolving credit card debt, it would look like this…$10,000 of credit card debt spread equally across 10 different cards, each with a $1,000 credit limit. So basically you’d have 10 fully maxed-out credit cards on your credit reports. This is a score killer, even if you’re making your payments on time. So, don’t do this at home.

The Impact of Authorized User Credit Card Accounts

Having maxed-out credit cards on your credit report can be disastrous for your credit score.

The scenario I described above is a disaster, plain and simple. In addition to having so many accounts with balances, you have ten credit card accounts that are maxed out and, thus, are 100% utilized. The utilization ratios associated with your credit card debt are a very influential part of your credit scores.

Now, let’s say you opened a new credit card account with a $15,000 credit limit or had your name added to a credit card account as an authorized user with the same credit limit, but you maintained a zero balance on the card. If/when that account was added to your credit reports your overall credit card utilization ratio would go from 100% to 40%.

That is how volatile your credit scores can be just from how you’re managing your revolving credit card debt. Same number of cards with a balance. Same amount of aggregate debt. But when you add that new card, your utilization ratio drops. This is why you should never assume you’ve got perfect credit just because you make your payments on time.

John Ulzheimer is a nationally recognized expert on credit reporting, credit scoring, and identity theft. He is the President of The Ulzheimer Group and the author of four books about consumer credit. Formerly of FICO, Equifax, and Credit.com, John is the only recognized credit expert who actually comes from the credit industry. He has 27+ years of experience in the consumer credit industry, has served as a credit expert witness in more than 370 lawsuits, and has been qualified to testify in both Federal and State courts on the topic of consumer credit. John serves as a guest lecturer at The University of Georgia and Emory University’s School of Law.