Is There Such a Thing as Too Much Credit?

How to Overcome Financial Trauma

10/18/2023

How to Avoid Credit Card Debt

10/27/2023Is There Such a Thing as Too Much Credit?

Those in the know about credit will remember that credit utilization is one of the biggest factors that influence your credit score.

Those in the know about credit will remember that credit utilization is one of the biggest factors that influence your credit score.

To be specific, credit utilization makes up about 30% of your FICO score and about 20% of your VantageScore, with available credit comprising an additional 3% of your VantageScore.

Knowing this, we can conclude that the more available credit you have to your name, all other factors being equal, the better your credit score will be.

Why? Because the more available credit you have, the lower your credit utilization will be, which is ideal for your scores.

However, this naturally leads to the question, “Can you have too much credit?”

It makes sense to wonder if there is a limit to which it is beneficial to have available credit. Is it possible that lenders could frown upon having too much available credit? Do they worry that if you were to use all of that available credit, you could end up deep in debt and unable to pay back your loans?

In addition, there are a couple of other perspectives to consider regarding the question of how much credit is too much. For example, you might also wonder how much debt is too much with respect to your available credit (i.e. if your credit utilization rate is too high) and if having too many credit cards can hurt your credit score.

So, let’s try to answer the question of whether having too much credit could hurt your score by addressing three different angles of the issue: having too much available credit, having too much debt, and having too many credit accounts. We’ll also look at the amount of credit the average consumer has so you can see where you stand in relation to the national average.

How Much Credit Does the Average Person Have?

To provide some context before defining what may constitute “too much credit,” first, let’s find out how much credit the average consumer tends to have.

What Is the Average Amount of Available Credit?

According to a recent report by Experian on U.S. consumer credit card debt, in the second quarter of 2019, the average credit limit of consumers who have credit cards was $22,751.

The same report found that the average American has around four credit cards, so this $22,751 credit limit is likely spread across four cards for the average consumer.

Credit limits show trends based on age and location. Baby boomers, or those who are currently between the ages of 55 to 73, have the highest average total credit limit compared to other generations, at $39,919. In contrast, millennials have an average total credit limit of $20,647, while Generation Z (the youngest generation) has an average total credit limit of $8,062.

Experian found that the average total credit limit is $22,751 and the average amount of credit card debt per consumer is $6,194.

The states with the highest amount of available credit include New Jersey ($37,845), Connecticut ($36,272), and Massachusetts ($34,685). The lowest average total credit limits per consumer are found in Mississippi ($21,676), Arkansas ($24,570), and West Virginia ($24,684).

What Is the Average Credit Limit of a Credit Card?

The above figure for average total credit limit refers to the total credit limit for all credit cards owned by a consumer added together, not the average credit limit of each individual credit card. So if the average consumer has four credit cards, the average credit limit per card would come out to $5,687.75 ($22,751 / 4 = $5,687.75).

How Much Credit Card Debt Does the Average American Have?

According to Experian, in the second quarter of 2019, the average amount of credit card debt per consumer was $6,194.

Just like available credit, the amount of consumer credit card debt varies across regions. Alaska has the highest average credit card debt per consumer at $8,026, followed by New Jersey at $7,084 and Connecticut at $7,082. Iowa, Wisconsin, and Mississippi had the lowest average amount of credit card debt at $4,744, $4,908, and $5,134, respectively.

Can You Have Too Much Available Credit?

There is no simple answer to this question, as credit is complex and everyone’s situation is different. However, we can discuss how available credit affects your credit score and how you can start to figure out what amount of available credit might be too much for you.

Can Too Much Credit Hurt Your Score?

With respect to available credit, having a lot of credit will not hurt your credit score. As we described above, having a high credit limit is great for your credit utilization ratio, which means it can be very beneficial to your score.

However, this does not mean that having an abundance of available credit does not have any downsides. For some people, it may be possible to have too much available credit for other reasons that do not have to do with their credit score.

For example, if you are planning to apply for a loan in the future, such as a mortgage or business credit, it is likely that the lender will look at the amount of available credit that you have when considering your application because it is possible that you could use that available credit in the future.

They will also know your income, and they may weigh your total available credit against your income. This can help the lender understand whether you would be able to repay all of your debt if you were ever to utilize the entire amount of the credit that is at your disposal.

If you’re planning to apply for a loan and you’re concerned you might have too much available credit, talk to your loan officer.

If your amount of available credit is high compared to your income, the lender may not feel confident that you could pay them back if you end up maxing out all of your other accounts.

How Much Available Credit Is Too Much?

Since we know that having a lot of available credit does not negatively affect your credit score, then how can you know how much available credit is too much?

The short answer is that “too much” available credit is however much you will not be able to manage successfully.

If you are the kind of person who pays off your credit cards in full each month, then you can probably handle high credit limits without a problem.

On the other hand, if you tend to overspend and you think that having a high amount of credit available to you might lead you to get deep into debt, then it might be best to maintain a lower credit limit in order to remove the temptation.

In addition, if you are concerned about too much available credit potentially affecting your chances of getting approved for a loan, it is best to discuss your concerns with your loan officer. They should be able to give you an idea of what you need to do to boost your chances of getting approved.

How Much Available Credit Do You Need?

In answering the question of how much available credit you may need, you can calculate this number based on how much you typically spend on your credit cards each month and what you’d like your maximum credit utilization percentage to be.

As a hypothetical example, let’s say that you spend an average of about $1,000 on your credit cards each month, and you want to keep your overall credit utilization ratio under 10%.

When we can take the formula for credit utilization (utilization = debt / available credit) and rearrange it to determine available credit, we get: available credit = debt / utilization.

Now, we can plug in your ideal numbers to come up with the amount of available credit that you need. In this example, we’ll plug in 10% (or 0.10 in decimal form) for utilization and $1,000 for debt: available credit = $1,000 / 0.10 = $10,000.

Therefore, based on your spending in this example, you would need at least $10,000 in available credit in order to keep your credit utilization below 10%.

Now you can go ahead and try this calculation using real numbers from your own life!

Alternatively, if you know you want your credit utilization to stay around 20%, you can use this simple formula: just take the amount you spend each month and multiply by five to get the amount of available credit you should have.

For example, if you spend $1,000 per month, multiplying by five gives you $5,000, which tells you that you should have at least $5,000 of available credit in order to achieve your goal of maintaining 20% or lower credit utilization.

Can You Have Too Many Credit Cards or Installment Loans?

The credit mix factor of your credit score rewards having a diverse mix of several different types of credit accounts. In fact, as we know from How to Get an 850 Credit Score, consumers with high FICO scores have an average of seven credit card accounts, which includes both open and closed accounts.

As long as your credit utilization is in a good range, then having a lot of credit cards likely won’t hurt your credit score.

However, there is a limit to how many accounts you should have in your credit profile.

Does Having Too Many Credit Cards Hurt Your Score?

It is true that having too many credit cards can begin to hurt your credit score, according to an article by credit expert John Ulzheimer. Fortunately, however, this is an issue that most people probably will not have to worry about.

Unless you are “credit card churning” to take advantage of credit card signup bonuses, you likely aren’t opening new credit cards left and right. A 2019 report by Experian found that the average American has around four credit cards, and as we mentioned, FICO high scorers tend to have about seven credit cards in their credit file.

You Can Have a Lot of Credit Cards and Still Have Good Credit

While it’s best not to go wild opening a ton of accounts, it is still possible to have good credit even if you have a wallet full of credit cards.

Remember, credit mix only makes up about 10% of your credit score, and your total number of accounts is only one part of the credit mix category, which means it has a weight of even less than 10%. Therefore, even if you do have too many credit cards, that factor alone cannot give you bad credit.

In fact, the Guinness World Record holder for having the most credit cards has almost 1,500 of them! He claims to have “nearly perfect” credit, which he maintains by only using one card and paying it off every month.

The Dangers of Having Too Many Credit Cards

If you’re not accustomed to juggling handfuls of credit cards, though, having an excess of cards might put you in danger of becoming overwhelmed and accidentally missing a payment.

If you apply for a lot of credit cards within a short time span, you could end up with too many hard inquiries on your credit report, which could hurt your credit score.

Although you can mitigate this potential problem by setting up automatic bill pay on all your accounts, as we described in our “Credit Hacks” article, in some cases, it might be a better idea to keep things simple so you can avoid ending up with a derogatory item on your credit report.

Another red flag that you may have opened too many credit cards is if the inquiries from your recent credit card applications are having a significant negative impact on your credit score.

Every time you apply for a credit card, the lender will most likely do a hard pull on your credit, and each hard inquiry has the potential to reduce your score by a few points. While credit inquiries usually aren’t a big deal in the grand scheme of things, if you apply for credit too many times within a short time span, the impact of those inquiries on your credit may become more severe.

Should You Close Some of Your Credit Card Accounts?

If all this information has you feeling like you might have too many credit card accounts, it’s important to note that closing some of your cards will not actually help you decrease your number of accounts. When credit scoring models look at your number of accounts, they count both open and closed accounts.

In addition, closing credit card accounts will hurt your credit utilization by removing the available credit associated with those accounts. Therefore, it’s better for your credit score to keep accounts open and in good standing by making a purchase every so often and always paying off the balances on time.

So if you have too many credit cards, the best course of action is to stop opening new accounts while at the same time keeping your current accounts open and simply letting them age. The more age your accounts accumulate, the more they can benefit your credit. You can read more about the importance of credit age in “Why Age Is the Most Valuable Factor of a Tradeline.”

If you want to read more on the topic of how many credit cards one should have, be sure to check out John Ulzheimer’s guest article, “What’s the ‘Right’ Number of Credit Cards?”

Here is an interesting video from Ask Sebby that helps sum up the answer to the question, “how many credit cards is too many?”

Can Having Too Many Installment Loans Hurt Your Credit Score?

So far, we have focused on credit card accounts in answering this question. The reason for this is that revolving accounts, including credit cards, are weighted more heavily in credit scoring algorithms than installment accounts. Having installment debt is not viewed as negatively as having revolving debt.

You can learn more about how revolving accounts and installment accounts can each affect your credit in our article, “Are Revolving Accounts More Powerful Than Installment Accounts?”

Between student loans, auto loans, mortgages, and personal loans, It’s fairly common for consumers to have several different types of installment accounts on their credit reports, which is not necessarily a bad thing.

However, it would make sense that having too many installment accounts on your credit report could have a negative effect on your credit score, especially if the loans still have high balances that you are currently paying off.

When it comes to installment accounts, follow the same general principle that applies to credit cards: you shouldn’t apply for an excessive amount of installment loans, but on the other hand, if you’re a fairly typical consumer, you probably don’t need to worry too much about how many installment accounts you have on your credit report.

How Much Credit Card Debt Is Too Much?

Where we run into real trouble is with having too much debt and too high of a credit utilization ratio. Although having a lot of available credit and a lot of credit accounts shouldn’t be disastrous for your credit score per se, that is dependent on you not maxing out those credit limits.

If you end up using all that available credit on your different credit accounts, that’s when your credit score will really suffer.

When it comes to how much debt is too much, there is no straightforward answer that can be applied to all consumers. It depends on your individual credit file and how well you can manage your credit.

The amount of debt that is too much is any amount that is more than you can successfully pay off. You don’t want to be in so much debt that you can’t keep up with your payments, as payment history is the number one most important factor in your credit score.

Although there is no one-size-fits-all answer, you can think of too much debt as any amount that you cannot afford to pay off.

How Much Credit Utilization Is Too Much?

On the other hand, since credit utilization is expressed as a percentage instead of a dollar amount, it is easier to generalize how much credit utilization is too much across consumers.

Unfortunately, however, there is still no magic number that determines the threshold between a good amount of credit utilization and too much credit utilization. After all, the credit scoring algorithms are proprietary and the scoring companies do not share the specifics of those algorithms.

What we can say for sure about credit utilization is that the lower it is, the better your scores. The exception is 0% utilization, which is actually worse than having 1% utilization because it indicates that you do not use credit and therefore may not be able to manage it well.

This means that the ideal situation for your credit utilization is being at a percentage that is in the single digits but greater than zero. Once you start to get beyond that range, your utilization can begin to have a negative impact on your credit.

The Ideal Utilization Ratio Depends on Your Credit Goals and Spending

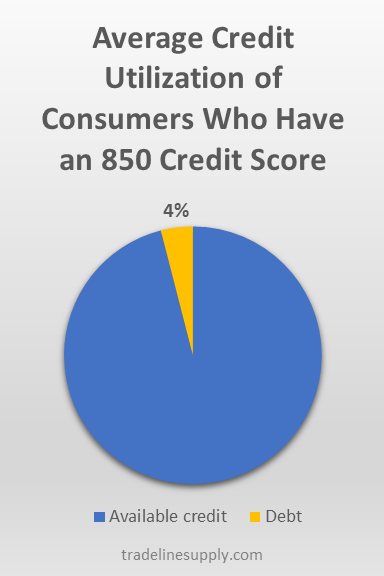

To get the highest credit score possible, you’ll want to shoot for around 4% utilization.

Credit utilization is a continuous scale between zero and 100 rather than a binary “good” or “bad” outcome (as opposed to, say, derogatory items, where you either have one on your credit report or you don’t). For this reason, instead of attempting to draw a line in the sand to mark how much credit utilization is too much, you have to think about what your goals are and why your credit utilization is important to you.

If you are not planning to apply for credit anytime soon, then your credit utilization and credit score may not matter very much. In that case, you may not care if your credit utilization goes all the way up to 100%, as long as you are making all of your payments on time.

On the other hand, if you are looking to maintain very good credit, you will need to be more careful.

In our article on overall credit utilization and individual utilization ratios, we talked about the myth of the 30% credit utilization ratio. Although you may have heard that keeping your credit utilization under 30% is the way to go, your credit can still suffer if your utilization is as high as 30%, so it would be better to strive for 20% or even lower if possible.

Therefore, if you want to have very good credit, you might consider anything above 20% to be too high. In other words, the amount of credit you still have available should be at least five times greater than the amount of revolving debt that you have.

If you want to get the best credit score possible, you will need to go even lower than 20% utilization. Recent data collected on high FICO scorers show that consumers with perfect 850 FICO scores have an average utilization rate of 4.1%.

To summarize, the utilization rate that is “too much” depends on your personal situation and what you are trying to achieve, although 20% is generally considered to be a safe credit utilization ratio for most purposes.

Credit Countdown Video: Is Having Too Much Credit Bad for Your Credit Score?

In the video below, John Ulzheimer explains whether having “too much” credit can affect your credit scores. Plus, he reveals how to find out exactly how much credit you need to have optimal credit scores.

Conclusions: How Much Credit Is Too Much?

As you know from reading all of our credit-related articles, credit is a complex topic, and the question of how much credit may be too much is no exception.

When it comes to available credit and your credit score, technically, there is no such thing as too much. However, when applying for a mortgage, excessive available credit could be a drawback, so check with your lender. In addition, you must be diligent about managing your spending, because once available credit becomes debt, that debt has the opposite effect on your credit.

Similarly, having many credit accounts in itself is not necessarily a red flag, as long as they are all managed properly, i.e. you make all of your payments on time. Generally, closing credit accounts won’t help you, so even if you have a lot of credit cards, it may still be a good idea to keep them open.

With credit utilization, we have a more concrete idea of how much utilization is too much. Many credit experts recommend staying below 20% in order to have good credit, while you will want to shoot for under 5% to get the perfect 850 credit score.

Ultimately, how much credit is too much is a question that you have to answer for yourself based on your personal goals and what works best for you. We hope that the information in this article helps to guide you in your journey!