How to Use a Budget to Improve Your Credit Score

The Surprising History of the Credit Bureaus

04/22/2022

Personal Finance Principles of Continuous Development

06/09/2022A budget is a helpful tool that can help you manage your finances effectively. On the surface, a budget just tracks your income and expenses. But on a deeper level, a budget can help you transform your financial trajectory.

Improving your credit is just one of many ways that budgeting can boost your personal finances. In this guide, you’ll learn how to use a budget to improve your credit score. Plus, take a look at the most popular budgeting options.

Key takeaways:

- A budget can help you improve your credit score

- A better credit score is just one reason to create a budget

- The right budgeting method varies based on your preferences

How a Budget Can Impact Your Credit Score

Before we dive into how you can use a budget to improve your credit score, let’s consider the many impacts a budget can have on your credit score.

An Effective Budget Allows You to Pay Bills on Time

When it comes to your credit score, on-time payments to credit accounts are the most important factor. In fact, your payment history accounts for 35% of your FICO credit score.

A history of on-time payments will give your credit score a boost. But a spotty payment history can lower your credit score. Plus, inconsistent payment history can make lenders perceive you as more of a risk. The increased perceived risk is compensated for with increased interest rates and fees, which can take a toll on your finances.

Not only can late payments have a negative impact on your credit score, but they can also lead to fees and penalties that add to your financial distress.

An effective budget can help you stick to on-time payments by making sure you have the funds you need by the bill’s due date.

Lower Your Reliance on Credit to Get By

The second most important factor in your credit score is your credit utilization ratio. It accounts for 30% of your FICO credit score.

Essentially, your credit utilization ratio is a measure of how much you rely on debt. You can calculate your own credit utilization ratio by adding up your credit card balances and dividing the number by the sum of your available credit.

For example, let’s say that you have a credit limit of $1,000. If you currently have a balance of $500, then your credit utilization ratio is 50%. According to some experts, it’s a good idea to keep your credit utilization ratio below 30%. A higher credit utilization ratio will likely have a negative impact on your credit score.

It’s easy for your credit utilization ratio to balloon when you aren’t on a budget. When you are on a budget, you can make sure there is money set aside to cover your bills. With that, you won’t have to resort to putting expenses on a credit card.

Prioritize Debt Repayment With Your Budget

If you have debt on the books, it can be challenging to improve your credit score. Extensive debt not only increases your credit utilization, but too much debt can also make it difficult to keep up with your minimum monthly payments.

If you want to erase debt from your life, a budget can help you do that. With a budget, you can choose to slash other expenses and allocate those savings towards a debt repayment plan.

Two of the most popular debt repayment strategies to include in your budget include the debt snowball or the debt avalanche.

In the debt snowball approach, you’ll start by paying off your smallest debt. Once that debt is eliminated, you’ll start making extra payments to the next smallest debt by including the minimum payment from the debt you eliminated. As you pay off more debts, the snowball will grow to help you tackle larger debts.

The debt avalanche method is similar. But instead of focusing on the smallest debt, you’ll start by paying off the debt with the highest interest rate first.

Sticking to a budget can make either of these debt repayment strategies more manageable.

Prioritize Credit Improvement Tools

As you map out a budget, you’ll have the chance to prioritize what matters to you.

If you decide that improving your credit score is important, then you can choose to make room for credit improvement tools.

Enlisting the help of a credit repair service is one thing you may include in your budget. Credit repair services can help you remove any inaccurate information from your credit report. If the inaccurate information is negative, then removing it can have a positive impact on your budget.

But removing negative information will only get you so far. If you want to add positive information to your credit report, then purchasing a tradeline is one thing to add to your budget.

5 Reasons to Start a Budget

If you are on the fence about implementing a budget in your personal finances, there are plenty of reasons to consider. Here are a few reasons why starting a budget is a good idea.

Improve Your Credit Score

As we outlined above, a budget is a tool that can help you improve your credit score.

With a clear budget, you can stick to managing your debt responsibly. Responsible debt management includes making on-time payments, minimizing your reliance on credit, and choosing to pay for credit improvement tools.

It’s important to note that if you already have a strong track record of managing your debts responsibly, then creating a budget likely won’t have too big of an impact on your credit score in the short term. But the long-term impacts of a budget can help you keep your credit score on track.

Build an Emergency Fund

An emergency fund constitutes a stash of savings set aside for financial emergencies. Instead of turning to credit, you can dip into this cash reserve when the need arises.

If you have an emergency fund in place, you can protect your finances from the unexpected. For example, if you were hit with an unexpected car repair bill, an emergency fund could help you cover the bill.

Most experts recommend building up an emergency fund that would cover between three to six months of expenses. Importantly, an emergency fund is based on the amount you spend each month. Not the amount you earn each month.

For example, let’s say that you spend $2,500 per month. You might decide to build an emergency fund of $7,500 to $15,000. But an emergency fund doesn’t need to be that large to be useful. Since many Americans can’t cover a $400 expense, building an emergency of even $500 is a good place to start.

When you build a budget, you can choose to set aside a certain amount of money each month. It will likely take some time to build up a big emergency fund. But it’s worth the effort.

Reach Financial Goals

If you are like most of us, you likely have some lofty financial goals.

For example, you likely want to retire at some point. Most will need to save for decades to achieve this goal. But it can be challenging to actually reach this goal without setting aside funds each and every month.

A budget can help you make sure that you regularly save for your big financial goals. Whether you want to take an exotic vacation or build a retirement nest egg, a budget can help you stick to a savings plan.

Break the Paycheck-to-paycheck Cycle

Living paycheck to paycheck is stressful. If any unexpected expense pops up before your next payday, you may have to turn to a high-interest loan to make ends meet.

Unfortunately, 64% of Americans live paycheck to paycheck. But building a budget can help you escape this stressful reality.

Although it is challenging, look for ways to trim your spending. Even a little bit can add up quickly. If you don’t see room to cut, consider looking for ways to boost your income. Picking up extra hours at work or starting a side hustle could be the solution to building a safety net in your finances and breaking the paycheck-to-paycheck cycle.

Create Financial Freedom

When you hear the word budget, you likely don’t think of financial freedom. Instead, you might think of a restrictive spending plan that sucks the fun out of life.

It doesn’t have to be that way! Although some budgeters choose a strict plan, others leave room for flex spending in their budget.

But most importantly, you can choose to prioritize your financial future within your budget.

For example, setting aside money each month towards an emergency fund gives you options if you lose your job or encounter an unexpected expense. Saving for retirement each month sets you up for a bright financial future in which retiring from the workplace is a viable option.

Instead of thinking of a budget as an unwelcome chore that stops you from spending, consider budgeting as a tool that is making your financial future a brighter place. Personally, I’ve found that setting up and sticking to my budget is empowering because it helps me stay on track toward my big dreams.

Take a minute to ask yourself what your big dreams are. Do you want to retire early? Buy a home? Live without the stress of making it until payday? Want to travel to every continent? Whatever your dreams are, look for ways that a budget can help you achieve these goals.

Pick a Budgeting Method That Works for You

Budgeting is not a one-size-fits-all venture. Although there is no single method that is better than the others, it’s important to choose a budget that works for your lifestyle.

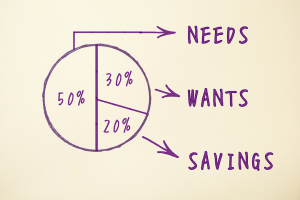

50/30/20 Budget

If you want to keep things simple, the 50/30/20 budgeting method is a great option.

In this method, you’ll break down your budget into three categories. You can spend 50% on necessary expenses, 30% on discretionary expenses, and 20% on savings and debt repayment.

Necessary expenses include things like housing, food, and transportation costs. Discretionary expenses might include a fun vacation or a fancy dinner out.

This simple method is a great starting point for new budgeters. And if you need to adjust the percentages to be realistic for your own life, that’s okay. For example, you might need to allocate more towards debt repayment if you have a lot of debt.

Here’s what a hypothetical 50/30/20 budget might look like:

- You have a monthly income of $4000

- $2,000 is available for necessary expenses

- $1,200 is available for wants

- $800 is available for debt repayment and savings

Pay-yourself-first Budget

The pay yourself first budget is designed to prioritize your saving and debt repayment goals. Essentially, you’ll determine how much you want to save or use to repay debt every time you get paid.

After you’ve tucked funds into savings or made a debt payment, you’ll have the freedom to use the rest of the funds in any way. You’ll still need to prioritize your basic needs over wants. But the pay yourself first budget can allow you to spend your discretionary income more freely because you know that your long-term goals have already been taken into account.

Zero-based Budget

If you have a set monthly income, the zero-based budgeting method is a popular option.

Essentially, you start with your set monthly income. From there, you subtract your monthly expenses and savings.

For example, let’s say that you have a $3,000 monthly budget. You spend $1,000 on housing, $500 on food, $400 on debt repayments, $100 on medical expenses, $250 on insurance, $250 on utilities, and save $500.

This budgeting method can help you account for every single penny. But it’s not the best option if you don’t have an emergency fund or don’t have the time to meticulously track every expense.

Envelope System

The envelope system is essentially a spin on the zero-based budgeting system. Like the zero-based budget, you’ll plan out your spending by expense category each month. But unlike the zero-based budget method, the envelope method requires an all-cash approach.

So, you’ll label envelopes for each of your spending categories. At the beginning of each month or pay period, you’ll put the appropriate cash value into the envelope. When an envelope runs out of cash, you can’t spend in that category until the next month.

In some cases, the physical cash helps you stick to the budget. After all, seeing an empty envelope can make the reality of running out of money more tangible than swiping your card. But if you aren’t interested in carrying large amounts of cash, then the envelope system isn’t the right fit for you.

The “No Budget” Method

For some, the budgeting options above may feel a bit too restrictive.

If that’s the case, then try the “no budget” method. Instead of sticking to the hard and fast rules created by any budget, you can try this freeform approach.

Essentially, this involves tracking your spending to make sure you are on track. You can easily do this by signing up for a budgeting app that tracks your every purchase. With that, you can check in at any time to make sure that you have enough funds in your account to cover your bills.

No matter which budgeting method you choose, it can take some time to see the fruits of your labor. Instead of giving up after just one month, try to stick it out for at least three to four months. At that point, you should have a good idea of whether or not a budgeting method is a right fit for your finances.

The Bottom Line

A budget can help you move your finances in the direction of your long-term goals. Plus, an effective budget is a useful tool that can help you work towards a better credit score.

Which budgeting method will you pick to help you reach your credit goals?