What Are Credit Scores?

A Guide to Credit Card Fees and How to Avoid Them

09/21/2023

Derogatory Credit Marks—Grow From Bad to Great Credit

09/29/2023 When it comes to credit scores, there’s a lot of confusion and misinformation out there.

When it comes to credit scores, there’s a lot of confusion and misinformation out there.

Credit scores impact our lives in more ways than you might think, yet, unfortunately, they are complicated and can be difficult to make sense of.

In this article, we’ll clear up what credit scores are, why they matter, how to build credit, and how to improve your credit score.

What Is a Credit Score?

A credit score is a 3-digit number that is meant to represent your credit risk, i.e. how likely you are to default on a loan.

This credit rating is calculated based on the information in your credit report, which lists all of your current and recent credit accounts.

To use an analogy, your credit report is like your school transcript: it is a list of your current and recent credit accounts and how well you did in paying them off on time. Your credit score rating is like your overall GPA: it sums up all of that credit history information into a single number.

While there are many different versions of credit scores, most lenders use a FICO credit score. Another type of credit score, called the VantageScore, was developed by the three major credit bureaus: Equifax, Experian, and TransUnion. While VantageScore is a relatively newer score, it is starting to be used and accepted by lending institutions more frequently.

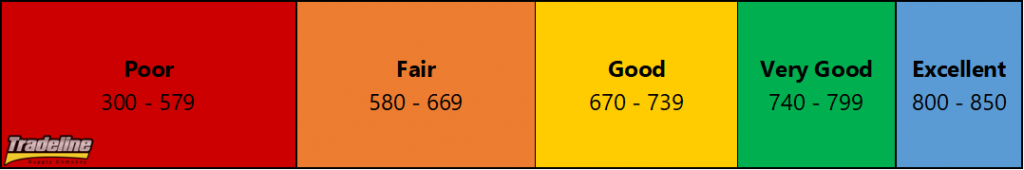

Both the VantageScore and the FICO credit scores range from a low of 300 to the highest score of 850. Lower numbers represent a higher likelihood of defaulting on a loan, which is considered bad credit, while higher numbers represent a lower likelihood of defaulting on a loan, which is considered good credit.

Why Is Your Credit Score Important?

If you ever want to buy something using credit instead of cash—a house or a car, for example—you’ll likely want to achieve a high credit score. Your credit score is what lenders use to decide whether or not they should loan you money and what the terms of that loan should be.

If you don’t have a credit score or credit history at all, lenders don’t have a way of judging your creditworthiness. Therefore, they may see you as too much of a risk and decline your request for credit.

If you do have a credit score, lenders will see it as a representation of how risky it is to lend money to you. A great credit score means you are a low-risk borrower, which means lenders can offer you low interest rates and other perks, such as credit card rewards.

On the other hand, a low credit score represents a high risk to lenders, since it shows that you may be more likely to default on a loan. To compensate for the higher risk of default, lenders charge higher interest rates and fees to those with poor credit scores—if they are willing to extend credit at all.

Phone carriers and utility providers may require a security deposit based on the results of your credit check.

Your credit score doesn’t just affect your access to credit and the costs associated with using credit. Credit scores have increasingly been used for a variety of non-credit applications.

- Your credit score may affect what you pay for insurance, so you’ll want to have a good credit score if you want to get the best insurance rates.

- Landlords often check the credit scores of applicants to see how reliable they are in paying their bills.

- Utility providers and even cell phone carriers may check your credit score to determine whether to charge you a security deposit upfront.

As you can see, credit scores affect a lot more than just your ability to get credit, and it is more important than ever to prioritize building your credit score.

What Factors Determine Credit Scores?

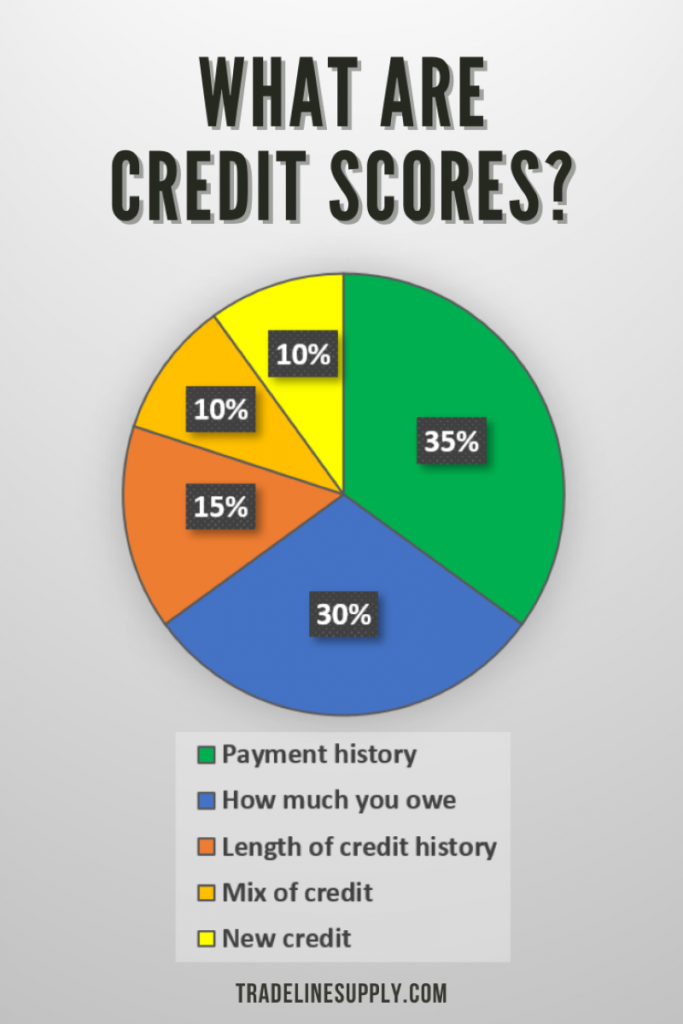

Although the specific algorithms behind credit scores are closely guarded trade secrets, the general categories that affect credit scores are widely known. In general, here’s what makes up a credit score:

- Payment history: 35%. This is the most important piece of your credit score, so even one late or missed payment can do a lot of damage.

- Utilization (how much you owe): 30%. Your utilization ratio is the ratio of the amount of debt on all your revolving accounts (e.g. credit cards) to your total available revolving credit, expressed as a percentage. Credit scores may account for both your overall utilization ratio and the utilization ratio of each individual tradeline. The lower your utilization, the better your credit score.

- Length of credit history: 15%. This category considers factors like your average age of accounts, the age of the oldest account in your credit file, and the ratio of “seasoned” to non-seasoned tradelines. A seasoned tradeline is defined as one that is at least two years old, which is an important milestone in your length of credit history. Having a long credit history is important because it shows you have been using and managing credit well for a long time.

These five main factors affect your credit score.

- Credit mix: 10%. Creditors want to see that you can responsibly use different types of credit, so they look for a variety of accounts in your credit report, including both revolving credit accounts and installment loans.

- New credit: 10%. This credit score category takes into account any new inquiries and new accounts that you have added in the past 6 to 12 months. Creditors consider seeking new credit a risky behavior, so inquiries can hurt your score. Opening a new account can also have a temporary negative effect on your score since it has no age or payment history.

What Is a Good Credit Score?

Scores between 670 and above are considered good credit scores. Very good credit scores lie between 740 and 799 while excellent credit scores include scores of 800 and above.

Which credit score is the best? Only about 1% of Americans have the coveted 850, a perfect credit score.

Credit scores range between 300 and 850, with 850 being the best credit score possible.

How to Get a Good Credit Score

The most important factor of a good credit score is a history of on-time payments.

Here are some things that can help you get a good credit score:

- A history of on-time payments

- Low utilization ratios

- Accounts that are at least 2 years old

- A mix of different revolving and installment accounts

- Minimal credit inquiries

- Monitoring your credit report for errors

Learn more about how to increase your credit score with do-it-yourself credit repair strategies and our guide to how to get an 850 credit score.

What Is a Bad Credit Score?

According to Investopedia, credit scores of 579 or below are considered bad credit scores, with 61% of borrowers in this credit score range being predicted to become delinquent on future loans.

Credit scores in the range between 580 and 669 are considered fair because only 28% of these borrowers are predicted to become delinquent on future loans. Unfortunately, even those with fair credit scores often have difficulty getting credit and higher interest rates than those with good or excellent credit scores.

Bad credit scores can have serious consequences that can impact much more than just your finances. For more on bad credit, how it can affect you, and how to fix it, check out our article on bad credit.

Here are some things that can lead to a bad credit score:

Having too much debt can affect your credit utilization ratio and bring down your credit score.

- Late or missed payments

- High credit card balances and high credit utilization

- Low account age

- Not enough accounts in your credit mix

- Too many inquiries

- Collections

- Judgments

- Foreclosure

- Bankruptcy

- Identity theft

How to Build Credit

To build credit, you’ll need to open your own credit accounts and keep them in good standing by always making payments on time. This is the foundation of a good credit score.

However, as we mentioned, it can be difficult for many people to start building credit since lenders typically want to see a good credit score and an established credit history before extending credit.

![]()

The fastest way to build credit, especially for those who have a limited credit history, is to become associated with the credit of someone else. Examples of this strategy include getting a cosigner or guarantor, opening a joint account with someone, or being added as an authorized user to an existing credit card account in good standing.

Once you have started to establish a credit history through one of these methods, you can continue to build up your credit by opening up more tradelines.

Remember, tradelines are the foundation of building credit because all credit starts with tradelines.

Learn More About Building Credit

On tradelinesupply.com, we offer many free articles and guides to help you build your credit. We suggest reading these next:

- Tradelines: What You Should Know About Building Credit

- How to Build Credit Fast [Infographic]

- Master Credit-Building in Less Than 7 Minutes

- At What Age Can You Start Building Credit?

- How to Establish Credit While Young

- Credit Card Credit Building—2023 Best Cards for Credit Building

How to Improve Your Credit Score

If you need to fix your credit score, there are some strategies you can use to repair your credit score yourself, such as disputing errors on your credit report and paying down high credit card balances. However, if you have a lot of inaccurate negative information on your credit report, working with a trusted credit repair company could be a worthwhile option.

Since payment history makes up the majority of your credit score, the most important thing is to get all of your accounts current and make all payments on time in the future, and your credit score should gradually recover.

When it comes to boosting your credit score, lasting results will require patience, good financial practices, and knowledge of how the credit system works. At TradelineSupply.com, you can use the free educational resources in our Knowledge Center to learn more about credit scores and building credit.

Let us know what steps you’re taking to improve your credit score in the comments below. We wish you well on your credit journey!

3 Comments

Thanks for the read. Good Larsopn

If my oldest credit is 1991 and current credit to 2015 , which one should be purchase to help my score?

We do not advertise our products for the purpose of boosting credit scores and we do not guarantee any improvements to credit. You can use our Tradeline Buyer’s Guide and Tradeline Calculator to decide what is best for you!