Master Credit-Building in Less Than 7 Minutes

How to Search for Unclaimed Property

07/21/2023

Should You Open a Credit Card?

07/31/2023 A credit score is a three-digit number that can greatly impact your life.

A credit score is a three-digit number that can greatly impact your life.

The seemingly small number reflects a measure of your creditworthiness, which can have an outsized effect on your finances. A good credit score can unlock a lower interest rate on long-term loans, which could save you thousands. But a bad credit score could bar you from accessing affordable loans for major purchases such as a home or car.

Clearly, your credit score is important. We’ll talk about just how essential below. But how can you build credit? We’ll also cover the best strategies to give your credit score the boost it needs.

What Is Credit-Building?

Credit-building employs strategies to improve your credit score. Wherever your credit score currently stands, credit-building can help you take it to the next level.

The goal of credit-building is to create a history of responsible credit usage. That means opening credit accounts and making on-time payments to keep these accounts in good standing.

To start, building credit can be as simple as that—making on-time payments to your accounts. The only downside is that it can take time to create a solid payment history for your credit report. In fact, it takes around two years for a credit account to be ‘seasoned.’ Seasoned accounts have enough age to show potential lenders that you can responsibly manage your credit. With multiple seasoned accounts on your report, your credit score should increase.

Although it takes time to build good credit, the steady approach of making on-time payments to your accounts will pay off.

Credit-Building vs. Credit Repair

Credit-building and credit repair both have the same goal of increasing your credit score. But each path has a different strategy for success.

Here’s a closer look at each option.

Credit Repair

Credit repair should be the first step if you have a bad credit score.

Generally, credit repair involves addressing any existing negative activity on your credit report. Negative activity could stem from errors on your credit report or a case of identity theft. The process starts by pulling a free copy of your credit report and looking for any bad marks.

For example, you might see inaccurate information about a bill sent to collections on your credit report. In that case, you can dispute the record to have it updated or removed from your credit report.

A bad credit score could make a credit repair agency a tempting option. Typically, the operation works by going through your credit report for you to root out any errors.

Although you can pay for this service, it is possible to tackle credit repair on your own. It will take some time and energy. But you can track down your credit report and take steps to correct any errors you find.

You can learn more about your credit repair options in Tradeline Supply Company, LLC’s article and infographic, Credit Repair vs. Tradelines.

Credit-Building

While the focus of credit repair is to remove negative information, on the other hand, credit-building is focused on adding positive information to your credit report. Whether you don’t have a credit history of any kind or if you have a bad credit score, credit-building is the right move.

Essentially, building credit is accomplished by obtaining a line of credit to pay back on time. As you create a history of responsible credit management with consistent on-time payments, you will build your credit history.

No Credit vs. Bad Credit: Which is Worse?

When it comes to credit scores, there are good scores and bad scores.

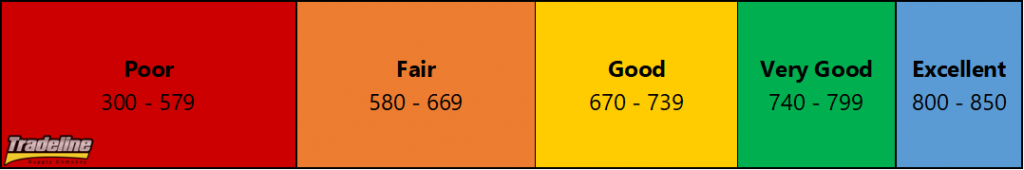

Here’s the breakdown of credit scores on a scale of poor to excellent:

- Poor: 300 to 579.

- Fair: 580 to 669.

- Good: 670 to 739.

- Very good: 740 to 799.

- Excellent: 800 to 850.

Most commonly used credit scores range from 300 to 850.

If you have a credit score, you’ll be able to find out where you fall on the scale. But what if you don’t have any credit at all? Is it better to have a bad credit score? Or are you better off with no credit score at all?

In general, it is easier to achieve a good credit score if you are starting from scratch. That’s because you will not have negative marks on your nonexistent credit report to address. With that, you can jump straight into building credit.

If you have a bad credit score, though, you’ll need to start credit repair before credit-building. If you have a bad credit score due to multiple errors on your report, then working on credit repair should give your credit score a big boost. In that case, the process of credit repair might be faster than credit-building. But if you have legitimate financial mistakes on your credit report that have led to a poor credit score, then it will likely take more time to improve your credit score.

It will take some work to improve your bad or nonexistent credit score in either situation. The details of your credit report will determine whether it is preferable to have a bad credit score or no credit at all.

A Fast Tour Through the Stages of Building Credit

The good news is that you can build credit from wherever you are starting. Here’s a fast tour of the stages of credit-building.

Check Your Credit Report

If you have a credit history of any kind, the first step should be to check your credit report.

When you have your free copy, check it over for errors and mistakes. A few things to watch for include incorrect balances and incorrect payment dates. You may or may not find any mistakes. But if you do, dispute the error with the credit bureaus or the company sending the information to the credit bureaus.

If the error is removed, your credit score could see a boost. If you don’t find any errors, this step will still help you understand where you are starting from in terms of your credit history.

Bringing in a consistent income is an important consideration when you are applying for credit.

If you don’t have a credit history yet, you should not have a credit report, but it’s a good idea to check anyway. If you discover that you do have a credit report despite never having credit, this is an indication that someone has fraudulently opened credit accounts in your name, and you will need to address the theft of your identity and the fraudulent accounts.

Maintain a Steady Income

An income is not a part of your credit score. But your income will play a big role in your ability to borrow money and repay your debts in full and on time. Without the option to borrow money, it can be almost impossible to build credit.

Borrow Funds

With a steady income, you may be able to take out a line of credit of some kind. Taking out a loan, line of credit, or credit card is a critical part of building credit. Otherwise, lenders won’t be able to discern how you manage your payments.

Two popular credit-building choices for those with no prior credit history include a secured credit card or a credit-builder loan.

Use Credit Responsibly

No matter how you choose to borrow the funds, the most important thing is to manage your credit obligations responsibly. In order to build your credit, you need to be able to demonstrate to lenders that you have a consistent pattern of responsibly using credit.

As you build a history of responsible credit usage, you will inch closer to your goal of having a good credit score.

Why Credit Scores Matter: Good Credit And Bad Credit Money Differences

It will take time and effort to build a good credit score. Is it worth the effort?

For most people, the answer is a resounding yes! A good credit score can have a big impact on your overall financial picture. If you have a bad credit score or lack a credit score, you could be missing out on big savings opportunities, or you could be missing out on opportunities to borrow money in the first place.

Most consumers need to take out a mortgage to be able to buy a house, which is much easier to do if you have a good credit score.

Big Purchases

With a better credit score, you are poised to take advantage of loans for big-ticket items with reasonable interest rates.

Let’s say that you want to take out a loan to achieve your dream of homeownership, as the majority of home buyers do not have the cash to pay for such a large expense outright. Your credit score will impact whether or not you are approved for the loan and decide what interest rate is attached if you do get approved.

In this scenario, a good credit score could make the difference between becoming a homeowner or not. In addition, a good credit score could save you thousands of dollars in interest over the life of the loan.

Insurance Savings

Those with higher credit scores benefit from lower insurance premiums.

A good credit score could impact your insurance premiums in some states. This is because insurance credit scores have been shown to correlate with a consumer’s likelihood of filing an insurance claim.

In fact, a recent WalletHub survey found that people with no credit pay 67% more for car insurance than people with excellent credit.

Imagine how quickly those costs add up when you have to pay a higher premium every month!

Credit Card Perks

When used responsibly, a credit card can be an extremely valuable financial tool. But if you have a bad credit score, you could be stuck with a credit card for bad credit that offers no perks and a sky-high APR.

In contrast, a good credit score can open the door to many credit card options that come with helpful perks. For example, you might find a cashback opportunity or built-in savings when you use the card, as well as other benefits.

Video: How Your Credit Score Affects the Terms of Your Loan or Card

What Lenders Want to See in Your Credit History

As you build your credit history, you might wonder what lenders are looking for in a creditworthy customer. Although there is no hard and fast rule, since each lender has their own underwriting process, the breakdown of a credit score gives us insight into the most important characteristics that lenders generally want to see when evaluating your credit profile.

Credit card perks such as cash back are typically reserved for consumers who have high credit scores.

Payment History

Payment history accounts for 35% of your credit score. In other words, on-time payments represent a critical component of your credit score. Lenders want to feel confident that you make it a priority to repay your debts so that they will not incur a financial loss by extending credit to you.

Even one missed payment can make a serious dent in your credit score, so do not take this category lightly. Making your payments on time 100% of the time is the most important thing you can do to earn a good credit score.

Credit Utilization

Your credit utilization rate represents 30% of your credit score. Your credit utilization rate, also referred to as your utilization ratio, revolving utilization, or your debt-to-credit ratio, measures how much debt you owe on your revolving accounts compared to the amount of revolving credit you have available.

A lower overall utilization rate will result in a better credit score, meaning that lenders will be looking to see how you manage your balances relative to your credit limits. Using too much of your available credit shows that you are a greater credit risk and lenders will be less likely to be willing to work with you.

Furthermore, having too many accounts with balances can also hurt your credit score.

Length of Credit History

Lenders want to know that you are someone they can count on to repay their funds consistently over time. To that end, they’ll be looking to see how long you’ve been able to manage your credit accounts responsibly.

Your actual age is not considered in this, but older consumers do tend to have longer credit histories simply because they have had more time in their adult life to accumulate credit accounts and make on-time payments. In order to improve this factor, all consumers can do is open accounts early on and wait for their accounts to age while diligently making payments and managing their balances.

This factor accounts for 15% of your credit score, but in reality, it is far more important than it seems on the surface because more credit age also means more on-time payments in your payment history, which adds another 35% of your score.

Credit Mix

Your mix of credit is determined by the types of accounts you have open. In general, lenders want to see examples of both revolving lines of credit (e.g. credit cards) and installment loans (student loans, auto loans, personal loans, mortgages, etc.) on your credit report.

This factor accounts for 10% of your credit score.

Learn more about account types and account diversity in our credit mix infographic.

New Credit

Last but not least, credit inquiries account for the final 10% of your credit profile. Hard inquiries appear on your credit report when lenders check your credit when you are looking to open a new credit account with them.

Creditors don’t want to see very many of these hard credit inquiries acquired within the past year. Having too many credit inquiries could be a red flag because it shows that you are seeking a lot of new credit and may not be in the best financial position to pay your bills.

Keep in mind that soft inquiries, which occur when you check your own credit report and other situations when your credit is pulled for something other than a lending decision, are not seen by lenders and are not considered in credit scores.

7 Epic Credit-Building Master Moves

Now it’s time to tackle your credit-building goals. Here are seven strategies to help you take your credit to the next level in no time.

Become an Authorized User

A trusted friend or family member may be able to add you to their credit account as an authorized user. As a credit card authorized user, your credit report will reflect the credit limit and reliable payment history of the account.

Open a Joint Line of Credit

Opening a joint line of credit can be a helpful step in your credit-building journey. If you have someone to manage your finances with, a joint line of credit can provide an opportunity for you to build credit along with the joint account holder.

However, there are some downsides to joint lines of credit. They are not available with all lenders, and if you do choose to open a joint account with someone, you may not be able to remove the joint account holder if the relationship sours.

Consider a Secured Credit Card

A secured credit card requires an upfront cash deposit to mitigate financial risk to the lender in case you do not pay your bill. In most cases, the deposit is equal to your credit limit. So, if you deposit $1500, your spending limit will likely be $1500.

Since secured credit cards typically have low credit limits, you will want to keep your balances low so that your credit report does not show a high utilization rate.

If you are just getting started with credit, a secured credit card can be a good way to get the ball rolling.

Set Up Automatic Bill Payments

Setting up automated bill payments on your credit cards can help you avoid getting negative marks on your credit report.

If you open any lines of credit, it is critical that you make on-time payments in order to build up a positive credit history. A good way to ensure that you always make on-time payments is to set up automatic bill payments. With an automatic payment system in place, you won’t have to worry about missing a payment and hurting your credit score.

But even with automatic payments, it is a good idea to check out your bills each month to keep an eye on your spending as well as any potentially fraudulent charges.

Increase Your Credit Limit

If you already have existing credit cards, then consider asking your credit card provider for an increased credit limit. You will effectively lower your credit utilization rate with an increased credit limit. With a lower credit utilization rate, you might see an increase in your credit score.

Pay Off Existing Debt

On the flip side, you can also lower your credit utilization rate by paying off any existing debt you currently have. Although paying off debt is never easy, it could provide the credit score increase you’ve been looking for.

Want tips on paying off debt? See our article on the debt snowball method vs. the debt avalanche method.

Get Credit For Your Bills

Did you know that you can get credit for some of the bills you already pay? There are alternative credit data services out there designed to add your utility, rent, and subscription payments to your credit report.

For example, Experian Boost, eCredable Lift, and RentReporters can help you get credit for the bills you already pay on time. If you pay your bills on time, having that information on your credit report could boost your credit score.

Fighting Credit Misinformation

According to Possible, 4 in 7 Americans are financially illiterate, so it should come as no surprise that many Americans are mystified by their credit score. Not only that, but many believe in detrimental credit myths, leading to poor credit choices due to misinformation.

If you are working with someone to build their credit, you may have to work through some deeply embedded credit score myths. For example, you might hear that checking your credit score lowers your credit score. But that is completely inaccurate. Other common myths include the belief that carrying a balance will boost your credit score or the idea that your credit score doesn’t matter to your personal finances.

As you dive into the process of building credit, utilize reliable resources to learn more about good credit practices and take action to help you reach the credit score of your dreams.

The Bottom Line: Credit-Building Is Achievable

A good credit score can open a world of financial possibilities such as low-interest loans on major purchases, valuable credit card perks, lower insurance premiums, lower security deposits, and more. Although the process of building good credit will take time, it is an achievable goal no matter where you are starting from.

Want to learn more about your credit? Take advantage of the free resources offered by Tradeline Supply Company, LLC.

4 Comments

Do you have any credit lines for South Africa. Eg Barclays Bank for under 100 USD

We sell exclusively U.S. tradelines.

I would like to get a credit score of 740 or better and now I have no credit, how much would it cost to get me to that point.

Thanks for your question. We do not guarantee credit score results. Be sure to see our guarantees and FAQs for more on this and we also offer content that can help guide you in selecting tradelines. You can also call us at 619-255-9588 if you have further tradeline questions. Hope this helps!

https://tradelinesupply.com/what-is-the-average-boost-in-score-from-tradelines/

https://tradelinesupply.com/guarantees/