How to Increase Your Credit Limit

Are Revolving Accounts More Powerful Than Installment Accounts?

04/25/2023

How to Build Credit Without a Credit Card

05/12/2023 If you have credit cards with low credit limits, you may be interested in increasing your credit limit.

If you have credit cards with low credit limits, you may be interested in increasing your credit limit.

In this article, we’ll talk about why your credit limit is important, reasons to increase your credit limit, when and how to request a credit line increase, and more.

Keep reading for everything you need to know about how to raise your credit card limits.

How Does Your Credit Limit Affect Your Credit Score?

The most obvious reason why you should care about your credit limit is that it controls the amount you can spend on that particular credit card. But beyond that, your credit limit also indirectly affects your credit scores.

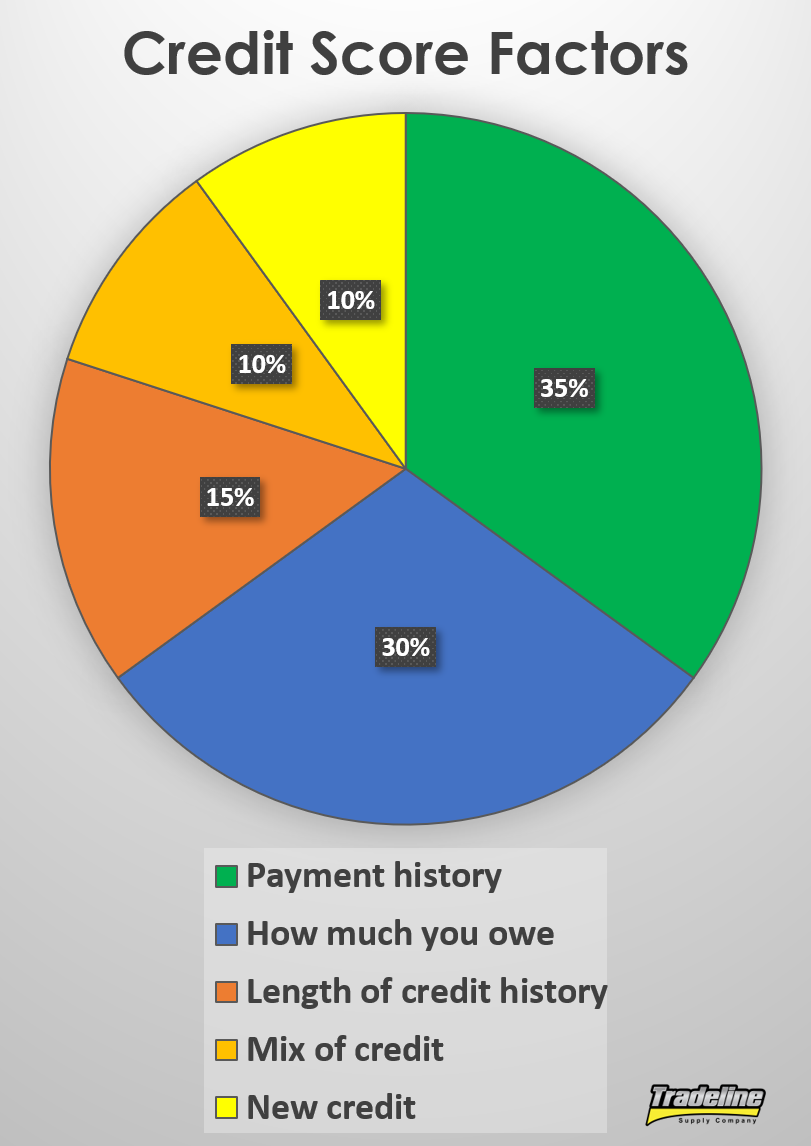

Although credit limit itself is not a factor in credit scores, it plays a role in your credit utilization ratio, which is an important part of your score. In fact, the credit utilization category makes up about 30% of a FICO score.

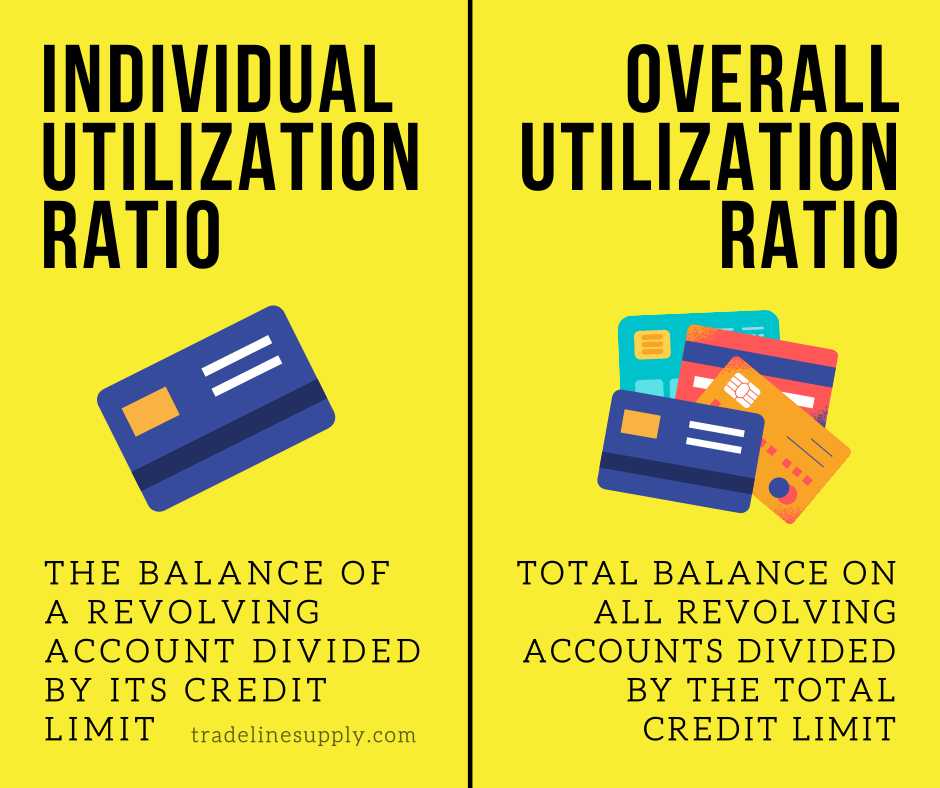

Your credit utilization ratio is the amount of debt you owe divided by your credit limit, typically expressed as a percentage. For example, if your credit card has a $10,000 credit limit and you owe $2,000 on it, your utilization on that card is 20% ($2,000 / $10,000 x 100% = 20%).

Your Credit Limit Affects Both Your Individual and Overall Utilization Ratios

The above example is an individual utilization ratio since it is the utilization ratio of a single card. Your overall utilization ratio uses a similar formula, but it includes all of your revolving account balances added together divided by your total credit limit, which is what you get when you add up the credit limits of all of your revolving accounts. Both your individual and overall utilization ratios are accounted for in your credit score.

Why is credit utilization such an important part of one’s credit score? High utilization means high risk for lenders. If you are using too much of your available credit, this indicates that you may be overextended and you might have trouble paying off your debts. Therefore, having a high utilization ratio lowers your credit score because it means you are more likely to default.

On the other hand, low credit utilization means you are not using very much of your available credit, which indicates to lenders that you are at a low risk of defaulting. Therefore, keeping your utilization ratios low is a good thing for your credit score.

Credit utilization (how much you owe) makes up 30% of your FICO score.

Why Increase Your Credit Limit?

To bring this all back to your credit limit, remember that your credit limit affects your utilization ratio. The higher your credit limit is, the more potential it has to help your credit score.

Example Scenario

Consider an example in which someone owes $500 on a $1,000 limit credit card.

Their utilization ratio is currently at 50%, which is high enough to potentially have a negative impact on their score.

But if they were to increase their credit limit to $2,000, their utilization ratio would go down to 25% ($500 / $2,000 x 100% = 25%), which would be better for their credit score.

Essentially, increasing your credit limit helps to lower your utilization ratio, which can benefit your credit health.

Plus, it gives you more spending power if you end up needing it to make a big purchase. If you use credit cards to make purchases for the rewards, then a higher credit limit could allow you to earn more rewards as well.

One important caveat: this strategy only works if you do not run up the balance on your credit cards. If increasing your credit limit means you will just continue to spend all the way up to your credit limit and get into more debt, then it’s probably not a good idea as it could lead to having bad credit in the future.

If you are concerned about this being a possibility in your case, check out our article, “Is There Such a Thing as Too Much Credit?”

How to Increase Your Credit Limit

There are a few different strategies that you can try if you have decided that you want to raise your credit limit.

-

Wait for the credit card issuer to automatically increase your credit limit.

Lenders will often automatically bump up your credit limit after you have had the credit card for a certain amount of time, provided that you have used it responsibly and paid your bill on time every month. However, you usually have to wait at least six months after opening a card before you can be considered for a credit limit increase.

-

Request a credit limit increase.

If you have not received an automatic credit limit increase, you can request one. You can do this over the phone or on the credit card issuer’s website.

Generally, if you apply for a credit line increase using your bank’s online portal, this will result in a hard credit pull. However, if you call your bank and talk to a representative, you may be able to get approved for an increase with only a soft inquiry, depending on the situation.

When you request a credit line increase, you should be ready to provide your total annual household income, your employment status, and the amount of your monthly rent or mortgage payment. Credit card issuers typically state that you can include income from someone else if that person’s income is regularly used to pay your expenses.

Your credit card issuer may ask you to explain why you need or deserve a credit line increase, so be prepared to state the reason for your request. They may also inquire about how much you tend to spend on your credit cards each month.

If you can’t get a credit line increase on an existing card, one alternative is to open a new credit card.

-

Transfer some available credit limit from a different card.

Another option is to transfer some or all of your credit limit from another credit card to the card you want to extend. However, with this method, the two cards need to be from the same bank, and not all banks allow customers to do this.

If your bank does allow credit limit transfers, you could open a new credit card with them, take advantage of any signup bonuses offered, and then transfer most of the credit limit to your older card.

-

Apply for a new credit card.

If transferring credit limit between cards is not an option, opening up a new credit card with any bank will still increase your overall credit limit and will therefore improve your overall utilization ratio, assuming you do not run up a balance on the card.

When to Request a Credit Line Increase

It’s best to wait until the right time to ask for a credit line increase. Just like when you apply for a new credit card or installment loan, you want your credit and your income to be in good shape when you make the request.

Here are some examples of potentially good times to request an increased credit limit:

- After you receive a raise at your job

- After you have been a responsible cardholder for at least 6 months

- If you have not requested a credit limit increase in the past 6 months

- When you do not have many hard inquiries on your credit report

- When you have a high credit score

A good time to request a credit line increase is after you get a pay raise at work.

On the other hand, in these situations, you might want to hold off on requesting a credit limit increase:

- If you lose your job or take a pay cut

- If you have recent late payments or other derogatory items on your credit report

- If your credit cards are maxed out or have high utilization

- If you have only been making the minimum payments on your card each month

- If your account is less than 6 months old

- If your credit limit has changed within the past 6 months

- If you have multiple inquiries on your credit report because you applied for other credit cards or loans recently

- When your credit score is low.

How Much Should You Request?

There is no hard-and-fast rule when it comes to how much of an increase to ask for, but here are a few ideas:

- If you want to avoid getting a hard inquiry on your credit report, you could try calling your bank and asking the representative if there is an amount that they could approve you for without doing a hard pull on your credit.

- If credit utilization is your primary concern, then use your average monthly spending and your ideal utilization ratio to calculate your desired credit limit. For example, if you normally spend $1500 on your card and you want to keep your utilization at or below 20%, then you would want to ask for a total credit limit of at least $7500 ($1500 / 0.20 = $7500).

- Another approach is to ask for more than you think you need. If the bank does not approve the full credit line increase that you asked for, they may counter with the maximum amount that they can offer you.

Will Requesting a Credit Limit Increase Affect Your Credit Score?

Depending on the lender and the amount that you request, the credit card issuer may conduct a soft or hard inquiry on your credit. The lender will want to see what your credit report looks like and whether you’ve been a responsible borrower in the past before taking the risk of granting you even more credit.

Check with your credit card issuer to see if requesting a credit limit increase will trigger a soft or hard inquiry.

As we discussed in “Are Inquiries Really Killing Your Credit?” a hard pull could reduce your credit score by a few points, but it’s not the end of the world. As long as you keep your inquiries to a minimum, it shouldn’t pose much of a problem.

It’s when you have several recent inquiries on your credit report that you start to look like you are desperate for credit and you may get denied by lenders.

However, as we discussed earlier, the more significant potential impact on your credit score is the decrease in your utilization ratio if you do get approved for a credit line increase. Since credit utilization makes up about 30% of your credit score, improving that factor could benefit your score and would likely outweigh the relatively small impact of a hard inquiry.

Video: What Is the Impact of Increasing Your Credit Card Limits?

Credit expert John Ulzheimer discusses the credit score implications of getting a higher credit limit in the video below. After you watch the video, subscribe to our YouTube channel and check out our other credit videos!

What Are the Downsides to Increasing Your Credit Limit?

Besides the impact on your credit score of potentially getting a hard inquiry, there are a few other drawbacks to consider when increasing your credit limit.

For example, some credit card issuers may charge sneaky fees to increase your credit limit. If you don’t want to pay a fee, make sure to check the terms of your credit card agreement or inquire with your lender before requesting a credit line increase.

In addition, having access to too much credit could encourage you to spend more, which could end up doing more harm than good to your credit score and to your overall financial health. It’s important to keep this in mind and try to be honest with yourself before making the decision to try to get a higher credit limit.

Have you tried requesting a credit limit increase before? Which of these methods do you plan to try next? Let us know in the comments below!

6 Comments

If I buy some trade line user authorization with say a 10,000 credit limit when I apply for a card will my limit start at 10,000

We do not guarantee that you will be able to secure any new funding or achieve any financial goal based on purchasing our tradelines. We also do not advertise our tradelines for the purpose of boosting credit scores and we do not guarantee any improvements to credit in any way. See Our Guarantees for more information on this.

If I apply for $40000 credit line would I get a $40000 credit card

We do not guarantee that you will be able to secure any new funding, credit cards, etc. or be able to achieve any financial goal based on purchasing our tradelines.

https://tradelinesupply.com/guarantees/

https://tradelinesupply.com/do-you-help-with-funding/

I want to increase my credit score and apply for a credit card

Good article! I completely agree with your thoughts. But it takes a bit of time to repair the credit. We can’t expect the credit score to jump up within a day or two. It generally takes 6 to 12 months at the very least. I have been paying bills on time, I pay my rent in advance and I had excellent credit which dropped after my SSN was stolen. I had 756 and now its 548. So, I asked the Lender to Remove it With a Goodwill Adjustment Letter. This process is simple and easy to write a letter to your creditor explaining why you paid late. Ask them to forgive the late payment and assure them it won’t happen again. After few months, I checked my credit app and my score is 776.

All we need to do is keep patience