FICO Resilience Index: Should You Be Worried? [Infographic]

How to Reach Your Savings Goals

08/25/2023

How Do Tradelines Work?

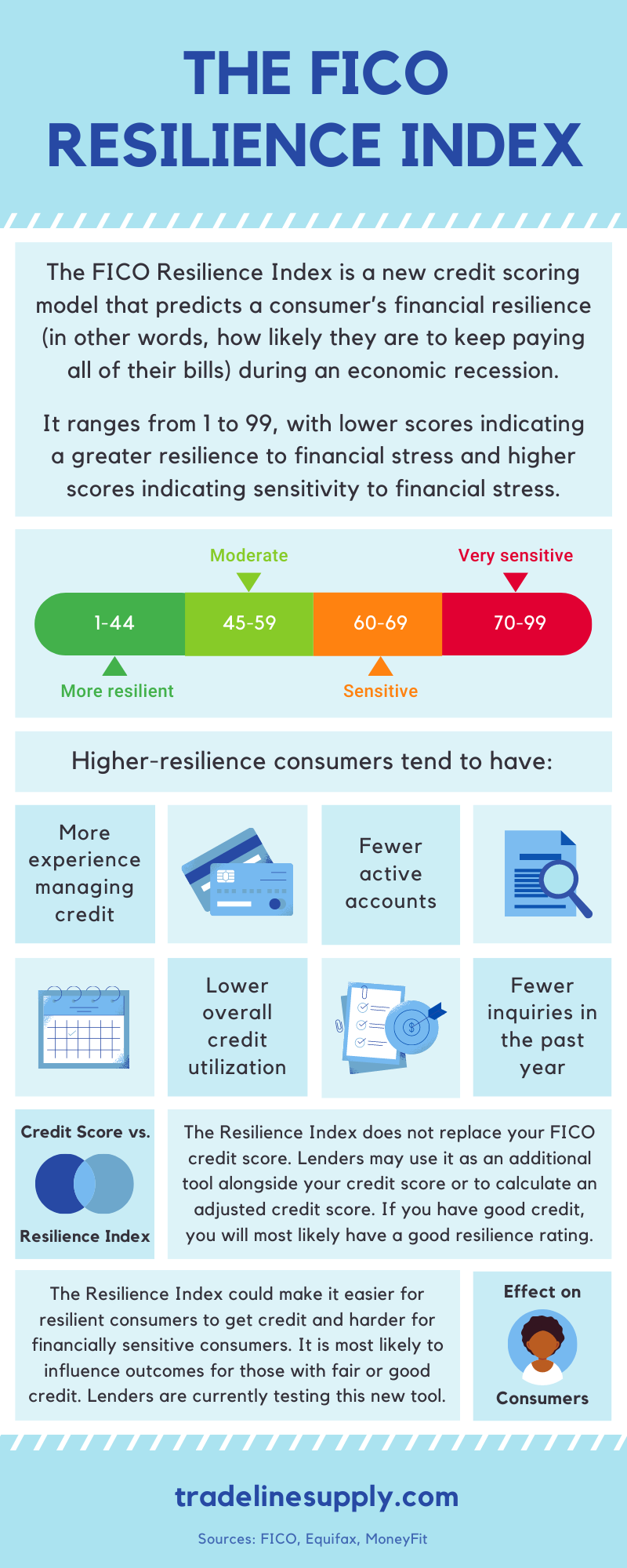

09/07/2023FICO, the maker of the FICO credit scores that are commonly used in lending decisions, has created a new type of credit scoring tool to help lenders better evaluate credit risk in today’s shaky economy: the FICO Resilience Index.

Many consumers are understandably concerned to learn that there is yet another type of credit score to keep track of. In this article, we have covered everything you need to know about this new credit scoring model so that you can come to an understanding of how much you should be worried about the FICO Resilience Index.

Check out our infographic below for a quick overview, then keep reading for additional information.

What Is the FICO Resilience Index?

The FICO Resilience Index is a new type of credit scoring model that is intended to predict a consumer’s financial resilience during an economic recession. In other words, it is supposed to indicate how well or poorly a consumer will be able to keep meeting all of their financial obligations when the economy is in bad shape.

The Resilience Index ranges from 1 to 99, with lower scores signifying that a consumer is well-positioned to be able to weather an economic downturn and higher scores signifying that a consumer appears to be more vulnerable to falling behind on bills during a poor economy.

FICO states that “Consumers with scores in the 1 to 44 range are viewed as the most prepared and able to weather an economic shift.” An index rating of 45-59 is categorized as moderately resilient. A rating of 60-69 is considered to be sensitive to economic turbulence while the 70-99 range is considered to be very sensitive.

What Is the Purpose of the Resilience Index?

More Sophisticated Tools Are Needed for Better Risk Analysis During Economic Instability

During an economic recession, lenders try to avoid financial losses by restricting credit availability to prevent consumer defaults.

When the economy is struggling, so are lenders and borrowers alike. Consumers with debts to pay may struggle to meet all of their financial obligations, which means creditors are faced with more severe losses than usual.

As a result, lenders try to hedge their bets and protect against further losses by tightening requirements to qualify for new credit and even slashing the credit limits of current customers’ accounts. This hurts both consumers and lenders since consumers lose access to credit and lenders earn less revenue.

This “over-tightening of credit,” FICO says, could slow down the economy’s recovery.

The FICO Resilience Index was created to help alleviate this problem by giving lenders a more complete picture of each consumer’s level of risk.

FICO credit scores already provide a general measure of consumer credit risk, but the Resilience Index is meant to be applicable to the more specific situation of an economic recession or depression.

Consumers Are Not All Equally Sensitive to Financial Stress, Even Those With Similar Credit Scores

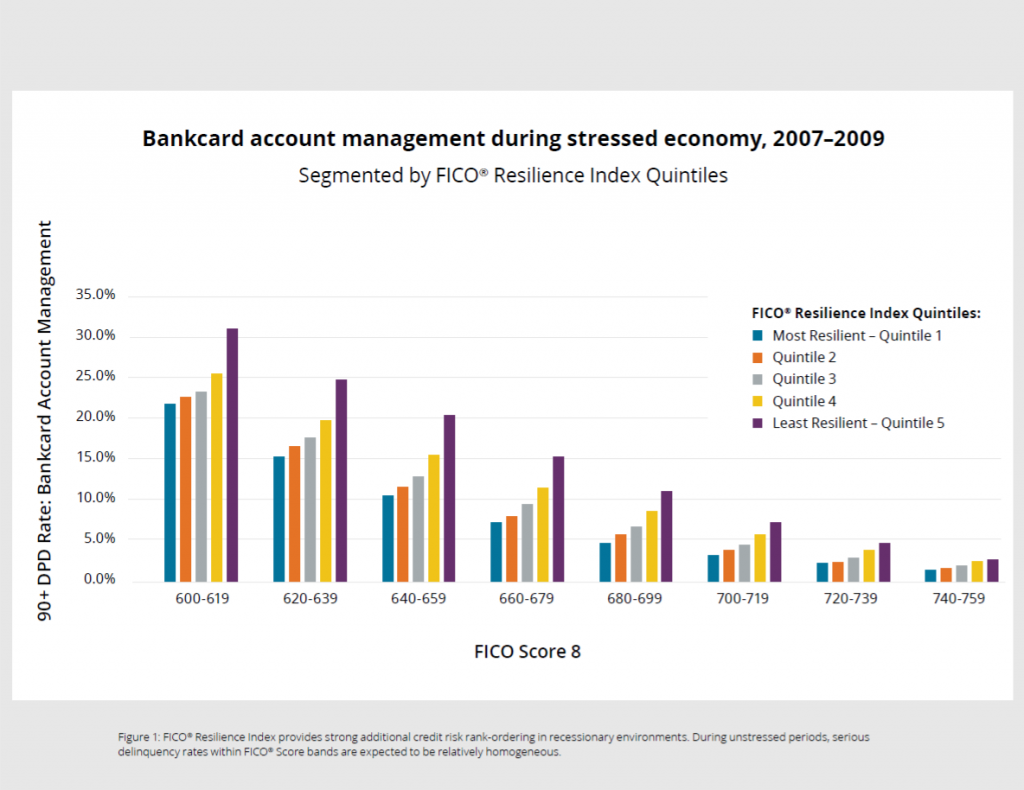

According to Equifax, even consumers with the same or similar credit scores have different levels of “sensitivity to financial stress,” which means there are consumers within these narrow credit score groups that present more of a risk than others during financially stressful times.

For example, all consumers with a 650 credit score represent a similar risk level during typical economic conditions. However, during times of financial hardship, some of these consumers will be more susceptible to falling behind on bills than others, despite having the same credit score. The Resilience Index is meant to capture this variation in risk level that is not apparent from a consumer’s credit score.

This chart, found in Equifax’s FICO Resilience Index product sheet, shows that when you divide consumers into groups of narrow credit score ranges and then apply the Resilience Index to these groups, the consumers that are determined to be the least resilient in each credit score group are the most likely to be 90 or more days past due (DPD) on their accounts.

This additional insight into consumer risk levels helps lenders make more favorable business decisions during periods of financial instability. For example, it could enable creditors to continue marketing and lending to consumers who are relatively resilient to financial stress. At the same time, they can try to minimize losses from consumers who are less financially resilient by lowering credit limits and tightening eligibility requirements for opening new accounts.

The ability to better evaluate credit risk is especially important at this particular time in history since we are in the midst of a severe economic recession brought on by the coronavirus pandemic.

Equifax states that “A lender with FICO Resilience Index in their analytic arsenal might have continued to offer periodic credit line increases to consumers in the lower quintiles while maintaining or proactively reducing credit limits for those in the top quintile, avoiding losses and reducing volatility.”

Here’s what FICO says about it on the company’s blog:

“The FICO Resilience Index can be helpful in navigating through changing economic cycles. The desired outcome is for lenders, borrowers, and investors to benefit from a system that is even more precise in assessing risk, and less prone to broad credit restrictions and undifferentiated risk pricing, which can tighten the flow of credit during an economic downturn.”

How Do You Get a Good Resilience Rating?

According to FICO, the credit profiles of higher-resilience consumers, compared to those of lower-resilience consumers, should have the following characteristics:

Consumers who have fewer hard inquiries on their credit reports will get a more favorable Resilience Index rating.

- A greater amount of experience managing credit

- Lower total balances on your revolving accounts

- Fewer active accounts in your credit profile

- Fewer hard inquiries on your credit report within the past year

For the most part, it appears that a favorable Resilience Index score should be attainable to those who practice the same generally good credit habits that you are likely already familiar with.

One point to note, however, is that consumers with higher financial resilience ratings are supposed to have fewer active accounts. In a way, this makes a lot of sense, because not having as many accounts open means there is a lower amount of available credit for you to spend and then potentially default on during times of financial stress.

However, if you know how a typical FICO credit score works, then this may seem strange. We will talk more about the similarities and differences between the Resilience Index and regular credit scores in the next section.

MoneyFit reports that the Resilience Index score works in the same way as traditional credit scores in that it is entirely based on the contents of consumers’ credit reports and does not include other non-credit information such as a consumer’s income, employment status, and marital status. In other words, whether you have a job and how much money you or your household earns should not have a direct impact on your Resilience Index rating.

How Is the FICO Resilience Index Different From the FICO Credit Score?

Although the two scoring systems are related and share some similarities, the FICO Resilience Index is not the same as the traditional FICO credit scores.

First, the scale is different. While standard FICO credit scores generally range from 300 to 850, the new Resilience Index has a scoring range of 1 to 99.

In addition, the scale of the Resilience Index has been flipped in the opposite direction: low scores are best when it comes to the Resilience index, whereas higher numbers are best with most, if not all, other existing types of credit scores.

With traditional FICO scores, having many accounts is generally beneficial, in contrast to the Resilience Index, which favors consumers who have fewer active accounts.

As far as the criteria for getting a good rating, both types of scores have similar requirements with one notable exception:

-

- The FICO Resilience Index and regular credit score models both value having a more extensive credit history.

- Both score types underscore the importance of having a low overall utilization ratio on your revolving accounts.

- Both types recommend keeping your number of inquiries within the past year to a minimum.

- The Resilience Index score rewards consumers who have fewer active accounts, while traditional credit scores generally reward consumers who have several different types of accounts open, including multiple active credit cards.

Unfortunately, when it comes to the number of active accounts you have in your credit file, the Resilience Index and typical credit scores have conflicting criteria. It seems that trying to get a better Resilience Index rating by closing some accounts would hurt your credit score. On the other hand, if you have many active accounts open, this may help your credit score but hurt your Resilience Index.

It’s also important to remember that the Resilience Index considers the very same information as your FICO credit scores: the information contained within your credit file. The difference between the two is how FICO analyzes the information in your credit file, the weights they assign to the various factors of your credit, and the formulas they use to calculate the credit score or resilience rating.

Does the FICO Resilience Index Replace Your Credit Score?

The Resilience Index is not a replacement for standard credit scoring models. It is designed to accompany and complement the classic FICO credit scores as an extra tool that can help lenders make better decisions in recessionary times.

Equifax states that the Resilience Index score can be used alongside a FICO score or it can be used to calculate an adjusted FICO score based on the lender’s data.

How Will the Resilience Index Affect Consumers?

The question on everyone’s mind is how the Resilience Index system will affect consumers and whether consumers should care about their resilience rating.

For consumers on either extreme of the credit score scale, the new index tool is not likely to have an effect on their chances of getting credit. If you have bad credit, it is unlikely that most lenders will want to lend to you regardless of what the Resilience Index says. Similarly, if you have very good or exceptional credit, it will probably still be easy to qualify for credit even if you don’t have an ideal Resilience Index rating.

According to MoneyFit, the Resilience Index is most likely to affect outcomes for consumers who have fair or good credit ratings, which amounts to about 40% of consumers.

More Credit Available to Financially Resilient Consumers

If the Resilience Index becomes widely used, consumers who are rated as “resilient” will likely have an easier time getting approved for credit than those who are rated as “sensitive” to financial stress.

As we discussed above, during an economic downturn, lenders try to reduce their exposure to risk by decreasing the amount of credit available to consumers, which hurts both the lenders and the consumers.

By using the Resilience Index, lenders could get a better understanding of each consumer’s actual level of risk, which, in times of financial stress, may be different than the traditional FICO credit score alone would suggest.

If lenders can identify the consumers who are the most likely to stay on top of all their bill payments even during a recession, this would allow the banks to continue offering credit or even extend additional credit to these consumers.

Let’s suppose, as a hypothetical example, that you have a FICO score of 650, which would be considered a “fair” credit score. Normally, you would likely be able to obtain credit from many lenders (although you would probably not get the best interest rates).

During an economic downturn, when lenders are tightening their belts and raising their underwriting standards, you might not be above the cutoff anymore, so you could have difficulty getting approved for a loan or a credit card.

If, however, the lender had access to your Resilience Index rating and you were among the consumers in your credit score group who had a low index number, indicating that you are relatively resilient, that might help your chances of getting credit despite your fair credit score.

FICO claims that if the Resilience Index had been available for lenders to use between 2010 and 2015, almost 600,000 additional mortgages could have been approved for consumers with FICO credit scores between 680 and 699 during that time.

Additionally, having a low Resilience Index rating could allow you to qualify for better deals and lower interest rates since lenders can trust you to keep making your payments on time.

Less Credit Available to Consumers Who Are Less Financially Resilient

FICO estimates that hundreds of thousands of additional mortgage loans could have been granted to creditworthy consumers if the Resilience Index had been available to lenders starting in 2010.

On the other hand, the Resilience Index could make it more challenging for consumers deemed less resilient to get access to affordable credit.

For this example, let’s say you have a 700 credit score. Most of the time, you should have no problem getting approved for a loan or a credit card, thanks to your high credit score.

However, if a lender sees that you have a high Resilience Index rating, indicating that you are sensitive to financial stress, they may decide to decline your application, even though you might have qualified had they based their decision solely on your credit score. Alternatively, they may still approve your application but offer you a higher interest rate.

Of course, this is good for lenders who want to avoid extending credit to consumers who are more likely to potentially default on their debt. Unfortunately for consumers, though, it means that folks who are already struggling to get by in hard times may face even more difficulty when trying to access credit that would help them make ends meet.

Can Consumers Check Their Own Resilience Index Ratings?

At this time, it seems that the only way for consumers to access their Resilience Index scores is to pay FICO for them.

One option is to purchase a one-time credit report from myFICO, which costs $20 for a one-bureau report or $60 for a three-bureau report, which includes Experian, Equifax, and TransUnion.

Alternatively, you can subscribe to “Advanced” or “Premier” membership on myFICO, which costs $30 per month and $40 per month, respectively. If you already subscribe to this service, you should be able to see your Resilience Index score on your member dashboard online.

Are Lenders Using the New Product Yet?

Any consumer who may need access to credit in the near future will likely want to know how many lenders are using or planning to use the FICO Resilience Index in their underwriting decisions.

The short answer is that lenders are currently testing the new scoring tool to decide whether and how to use it, so we do not know yet how commonplace it will become during this recession.

When a new credit scoring model comes out, such as FICO 9 or FICO 10, it is not always well-received by the financial industry.

It is expensive and time-consuming for lenders to update their systems, so they tend to be slow to adopt new technology.

It is expensive and cumbersome for lenders to update their systems to accommodate a new credit scoring model, particularly if major changes have been made from the old score to the new score.

Creditors in the mortgage industry, among others, have amassed vast amounts of valuable consumer data over the decades, but this data is all based on older versions of FICO scores, such as FICO 2 or FICO 4. This information is not necessarily going to be compatible with a much newer system that has different processes and algorithms. Therefore, the information becomes less valuable once the old system is replaced.

For this reason, virtually all lenders are using old FICO score versions that have been around for decades. FICO 8 is the most recent model that is popular among lenders, and it has been around since 2009. FICO 9 is widely considered to be a flop since it was never adopted by a significant number of lenders. FICO 10 is brand new, so it is not in widespread use yet either.

The FICO Resilience Index, however, is meant to be a simple add-on to lenders’ existing underwriting systems that is easy to implement, so it may take off faster than some other credit scoring products that would require a more extensive overhaul.

Usually, such new products come with a cost, which is another barrier to widespread implementation. In this case, Sally Taylor, the Scores Vice President at FICO, stated in July of 2020 that the Resilience Index is in an initial pilot period during which it is being offered to lenders for free alongside the FICO scores they purchase from Equifax or Experian.

However, there still may be a cost to lenders, because, during the initial pilot phase, lenders will need to “conduct their own validation testing,” Taylor said.

To summarize, some lenders may already be experimenting with the new FICO resilience scoring tool, but it is still in a testing phase, so it is not likely to immediately have a significant effect on borrowers. If you are curious as to whether your lenders are utilizing the FICO Resilience Index, consider reaching out to your banks’ customer service departments.

Problems With the FICO Resilience Index

The Resilience Index does not take into account your profession, income, or savings, so even if you have a stable, high-paying job, that doesn’t necessarily mean you will get a good resilience rating from FICO.

While the Resilience Index seems poised to become a useful tool for many lenders, it is certainly not perfect. Let’s discuss some of the issues that the new system has.

The Index May Not Encompass All Aspects of Financial Resilience

As we stated previously, the FICO Resilience Index, just like your credit scores, is based solely on the contents of your credit report. This means it does not take into account a consumer’s income, job security, savings, or other financial assets, which would seem to be important factors in determining how well someone can weather a recession.

For this reason, some may argue that this rating system is not a true measure of financial resilience. Consumers who have stable employment, high incomes, a lot of money in savings, or other valuable assets may be highly prepared to deal with economic stress, but they still may not get a good resilience rating because none of these things would be included in their score.

The Rating System Is Not Consistent With Other Credit Scores

It is not clear why FICO chose to structure the new scoring system in the way that they did, but the fact that it works very differently from traditional credit scores seems likely to confuse both consumers and lenders.

It would be simpler and more intuitive for everyone to understand the Resilience Index rating scale if lower numbers represented poor ratings and higher numbers represented better ratings, as with all other major types of credit scores, including FICO scores.

In addition, it is unusual that the scale begins at 1 and ends at 99 rather than simply ranging from 0 to 100 as one might expect, and the categories that go along with this scale (resilient, moderate, sensitive, and very sensitive) are not evenly distributed in terms of the range of points within each category.

The Resilience Index rating system has a different format than other credit scoring models.

Because of these changes, there may be some issues with implementation as lenders and consumers have to put in more effort to become acquainted with the new system.

Consumers Cannot Freely Access Their Resilience Scores

Obviously, the Resilience Index is designed as a tool to help lenders, not consumers. The same is true of all credit scores.

However, unlike the Resilience Index, most consumers are easily able to check their VantageScore credit score for free on sites like Credit Karma and many can also check their FICO score for free through certain banks and credit card issuers.

This transparency is important so that consumers know where they stand and can work to address any issues in preparation for seeking credit. Charging a fee for these services is unnecessary and is not considered fair by consumers who want to be able to see the information that lenders are using to make decisions about their finances.

If the Resilience Index becomes a widely used system, it would be helpful to consumers to provide free access to their own resilience ratings.

The FICO Resilience Index May Not Apply to Consumers Whose Lenders Use Other Types of Credit Scores

Currently, consumers must pay FICO if they want to access their Resilience Index scores.

If you are working with a lender who uses VantageScore or another alternative to FICO credit scores, then they may not have access to the FICO Resilience Index. Therefore, you would not be able to benefit from this tool as the lender decides whether to offer you credit.

Conclusions on the New FICO Resilience Index Score

The FICO Resilience Index is a new credit scoring system that is designed to do what other credit scores do not: it takes into account the major external factor of the state of the economy, which can have huge effects on rates of consumer defaults.

For this reason, the Resilience Index better predicts consumer behavior in the specific situation of an economic downturn, which makes it a highly valuable tool for lenders, especially as we are now enduring a recession as a result of the COVID-19 pandemic.

It is a good idea for consumers to be aware of this system and the factors it considers (lengthier experience managing credit, a low overall utilization ratio, fewer active credit accounts, and fewer hard inquiries in the past 12 months) so that they can best prepare to apply for credit in the future, particularly for borrowers with fair or good credit scores, whose chances of approval or denial are most likely to be swayed by their Resilience Index rating.

Ultimately, however, your regular credit scores should still be your primary concern. The Resilience Index is an optional add-on to the traditional FICO scores, and it is still being tested out by lenders, whereas most lenders already rely on your FICO score as their primary underwriting tool.

In addition, if you have a good credit record, you are likely to have a good resilience rating as well, since the criteria for each scoring mostly system overlap, with the exception of the number of active accounts in your credit file.

Pay attention to the Resilience Index in mind as this recession progresses, especially if it starts to become popular with lenders, but remember to keep the focus on what is most important: building a solid credit history and achieving a high credit score.

FICO Resilience Index Score Updates

Now that the FICO Resilience Index has been out for a few years, we can take a look at the data to see what we’ve learned since its release in June 2020. Here are some noteworthy results of the practical application of the Resilience Index in recent years, according to FICO’s blog:

- There is now a second version of the Resilience Index which has improved its ability to predict consumer resilience or sensitivity in economic downturns.

- Within each FICO Score band, the credit card borrowers identified as the least resilient by the index as of October 2021 took on more new credit and carried much higher credit card balances than resilient borrowers.

- The Resilience Index was a strong predictor of the probability that a consumer would receive a form of loan accommodation (such as payment deferral or forbearance) following the CARES Act during the COVID-19 pandemic.

- Consumers identified as the least resilient before the pandemic have since turned out to represent a much higher proportion of seriously delinquent accounts and carry significantly higher credit card balances.

- Resilient borrowers at a given FICO Score may be more likely to go “mildly delinquent” (e.g. 30 or 60 days delinquent) in general, but are less likely to become seriously delinquent during a severe economic disruption than those who are less resilient.

- Retroactively looking at consumer credit behavior coming out of the Great Recession, consumers’ ability to recover from serious delinquencies was predicted by Resilience Index values.

- Some lenders, such as First National Bank, used the FICO Resilience Index as part of their decision-making process when offering credit line increases to credit card customers.

Let us know what you think about the FICO Resilience Index by leaving a comment below!