Knowledge Center

07/31/2023

Published by Sarah Sharkey at 07/31/2023

Categories

Opening a credit card is a very serious financial decision. As with all financial decisions, it’s not a good idea to fly into this situation blindly. Instead, it’s helpful to weigh out the options to determine whether or not a credit card is truly the right fit for your wallet.

07/27/2023

Published by Sarah Sharkey at 07/27/2023

Categories

A credit score is a three-digit number that reflects your creditworthiness, which can greatly impact your life. In this article, learn the best strategies to build up your credit score.

07/21/2023

Published by Sarah Sharkey at 07/21/2023

Categories

Everyone loves a financial windfall. Unclaimed property in the form of a cash payment might give your financial situation a boost. Not everyone will uncover unclaimed property, but the potential to reclaim funds you are owed makes it worth taking a look around.

07/16/2023

Published by Sarah Sharkey at 07/16/2023

Categories

You’ve likely heard that having a good credit score is important. But why does this three-digit number matter so much? It can impact your finances in many ways.

07/14/2023

Published by Sarah Sharkey at 07/14/2023

Categories

It’s often a challenge to stay on top of household finances. Whether you are managing money by yourself or with a partner, life tends to get in the way of financial decision-making. If you have trouble setting aside time for financial planning, a money date might be the perfect solution.

07/02/2023

Published by Sam Hawrylack at 07/02/2023

Categories

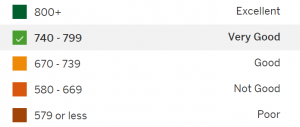

While most people know they have credit scores, they may not understand why these numbers matter or how they are determined. Learn how different credit score ranges can impact your life and tips to help you improve your credit score.

06/30/2023

Published by Moriah Chace at 06/30/2023

Categories

Economic inequality is the unequal distribution of wealth, income, and opportunity between different groups in society. It affects social structures deeply because it leaves some communities more vulnerable to poverty and harm than others.

06/25/2023

Published by Ellen Johnson at 06/25/2023

Categories

Collections can damage your credit score for a long time, so it's important to understand them. This helpful guide explains what collections are, how they affect your credit, how collection agencies try to re-age debt, how to get collections removed from your credit report, and more.

06/22/2023

Published by Ellen Johnson at 06/22/2023

Categories

What is the difference between your overall credit utilization ratio and individual credit utilization ratios and why does it matter to your credit?

06/21/2023

Published by Sarah Sharkey at 06/21/2023

Categories

It’s not uncommon to switch jobs, especially in the wake of the “Great Resignation.” For many, a lengthy job search can yield a worthwhile job opportunity. But finding a new job is just the beginning.

06/16/2023

Published by Ellen Johnson at 06/16/2023

Categories

26 million consumers in America have no credit record whatsoever. On top of that, there are an additional 19 million consumers who do have credit files, but they do not contain sufficient credit information to be scored by a widely available credit scoring model.

06/14/2023

Published by John Ulzheimer at 06/14/2023

How many times have you read a blog or heard some financial “guru” opining as to the mystical “right” number of credit cards to have in your wallet? Is the right number one, or two, or three? And what are the criteria for considering what is the right number versus the wrong number?

06/07/2023

Published by John Ulzheimer at 06/07/2023

Most of the time when I’m asked about credit scores the line of questioning is commonly about how to improve scores. It’s equally often, and equally enjoyable, when I receive questions from people about how many points certain things from your credit reports are worth to their credit scores.

05/31/2023

Published by Ellen Johnson at 05/31/2023

People who are serious about improving their credit often wonder what it takes to get the highest possible credit score. For the FICO 8 credit scoring model, the perfect credit score is 850.

05/25/2023

Published by Sarah Sharkey at 05/25/2023

Categories

Emotional spending is one personal finance issue that many struggle with. According to a NerdWallet survey, 49% of Americans said emotions have caused them to spend more than they can reasonably afford. With almost half of Americans struggling with emotional overspending, you aren’t alone if you are facing this issue.

05/12/2023

Published by Sarah Sharkey at 05/12/2023

Categories

If you are unlucky enough to experience credit card fraud, following some best practices can help you get the situation under control as soon as possible. Let’s explore what you should do if you experience credit card fraud.

05/12/2023

Published by Sarah Sharkey at 05/12/2023

Categories

A good credit score is a key to accessing financing options on major purchases. Building credit can be easier said than done. One popular way of building credit is to use a credit card. But that’s not the only option.

05/04/2023

Published by Ellen Johnson at 05/04/2023

Categories

If you have credit cards with low limits, you may want to increase your credit limit. In this article, we cover everything you need to know about how to get a higher credit limit.

04/25/2023

Published by Ellen Johnson at 04/25/2023

Revolving accounts and installment accounts are both important for building credit, but they do not have an equal influence on your credit score. Which type of account is more powerful for your score?

04/12/2023

Published by Ellen Johnson at 04/12/2023

Categories

There’s never a bad time to start building good credit, but there is definitely a good time to start: as early as possible. So when can you start building credit?

04/05/2023

Published by Ellen Johnson at 04/05/2023

Categories

Establishing tradelines is an essential part of credit. Because credit is a necessary part of modern life for most people, you need to know why tradelines matter, the best ways to establish tradelines, tradeline factors to consider, and how to tell which tradelines to avoid and which are a good fit for you.

03/27/2023

Published by Tradeline Supply Company, LLC at 03/27/2023

Categories

The tradeline industry is full of rumors, myths, and inaccuracies. Since we aim to educate consumers on how tradelines work, we want to dispel these common myths about tradelines.

03/24/2023

Published by Sarah Sharkey at 03/24/2023

Thousands of workers were laid off by their employers in 2022. As the trend of layoffs trickles through the economy, it’s important to take steps to safeguard your finances against a potential layoff.

03/15/2023

Published by Ellen Johnson at 03/15/2023

Categories

How important are closed accounts when it comes to your credit score? Perhaps more than you think. Let’s shed some light on the question of how closed accounts can affect your credit.

03/10/2023

Published by Sarah Sharkey at 03/10/2023

Like having the right credit score, choosing the appropriate insurance policies has a big impact on your financial health. Without the right insurance policies, it is easy to get caught in a financial pinch.

03/03/2023

Published by Sarah Sharkey at 03/03/2023

Categories

We all know that saving money is important. But stashing those savings into an emergency fund can be a game changer for your financial future.

03/01/2023

Published by Tradeline Supply Company, LLC at 03/01/2023

Categories

Buying tradelines doesn’t have to be complicated. Just follow these five steps to make buying tradelines easy!

02/27/2023

Published by Ellen Johnson at 02/27/2023

Business credit is similar to personal credit, but it uses a different reporting system. If you are interested in building business credit, our article breaks down business credit vs. personal credit, what business tradelines are, and how to build business credit.

02/20/2023

Published by Ellen Johnson at 02/20/2023

Building credit using traditional methods can take years. In this article and infographic, we’re talking about the fastest ways to build credit.

02/16/2023

Published by Ellen Johnson at 02/16/2023

Go behind the scenes of the dispute process used in credit repair and learn the importance of the Metro 2 and e-OSCAR systems in credit disputes.