How to Protect Your Credit Score From a Layoff

How Do Closed Accounts Affect Your Credit?

03/15/2023

Watch Out for These Tradeline Myths

03/27/2023 Fears of a recession in the economy have been floating around for months. According to the National Bureau of Economic Research, we aren’t in a recession. However, thousands of workers were laid off by their employers in 2022. As the trend of layoffs trickles through the economy, it’s important to take steps to safeguard your finances against a potential layoff.

Fears of a recession in the economy have been floating around for months. According to the National Bureau of Economic Research, we aren’t in a recession. However, thousands of workers were laid off by their employers in 2022. As the trend of layoffs trickles through the economy, it’s important to take steps to safeguard your finances against a potential layoff.

If you are concerned about the potential impact of a layoff on your finances, you are in the right place. We will explore how to protect your credit score from the fallout of a layoff.

How a Layoff Can Impact Your Credit Score

When you are laid off from your job, that won’t directly impact your credit score. After all, your employment status isn’t a factor your credit score considers. But the sudden loss of income could cause your finances to get messy, which could lead your credit score to take a hit.

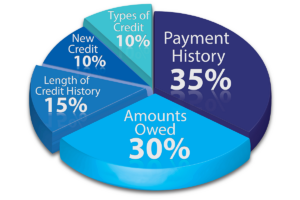

There are five factors that make up your credit score. These include:

- Payment history. Payment history accounts for 35% of your credit score, which makes it the most important factor. If you no longer have an income, you might end up missing a payment. Missed payments can have a severe negative impact on your credit score.

- Debt: How much you owe accounts for 30% of your credit score. One factor in the debt category is your revolving credit utilization ratio. A lower revolving credit utilization ratio is better for your credit score. When your income drops, you might rely more heavily on your credit cards. As your credit utilization ratio rises, you might see your credit score fall.

- Length of credit history: The length of your credit history accounts for 15% of your credit score. The older your accounts, the better off your credit score will be. A layoff shouldn’t impact the age of your accounts. If possible, refrain from closing your older credit accounts.

- Credit mix: A mix of revolving and installment credit accounts for 10% of your credit score. Unless you take out new loans or lines of credit, a layoff shouldn’t impact this part of your credit score.

- New credit: New credit accounts for 10% of your credit score. If you apply for new credit cards or take out new loans after a layoff, this could negatively impact your credit score.

A job loss won’t directly cause negative impacts on your credit score. But losing your job is often a big shakeup for your personal finances. If the changes push you to miss payments or take on more debt, you could see your credit score fall after a job loss.

5 Ways to Protect Your Credit Score From a Layoff

No one wants to experience a layoff. But you can diminish the financial aftershocks of a layoff by choosing to create a safety net before getting a pink slip. Even if you are not concerned about potential layoffs at your company, it’s still a good idea to prepare yourself for an unexpected loss of income.

Look for Ways to Cut Your Spending

If you are concerned about the fallout of a layoff, it’s a good time to consider spending cuts. When you shrink your expenses, you’ll need less to get by if a layoff suddenly cuts off your income.

Here are some ways to slash your spending:

- Comb through your expenses: Start by taking a look at your bank or credit card statements. When you go through your spending on a line-by-line basis, you might be surprised to find plenty of room for cuts. For example, you might cull unnecessary subscriptions or cut back on eating meals outside of the home.

Try a no-spend challenge: Within a no-spend challenge, you eliminate all discretionary spending for a set period of time. For example, you might choose to eliminate spending on extras for an entire month. You can make a no-spend challenge as long as you’d like.

Try a no-spend challenge: Within a no-spend challenge, you eliminate all discretionary spending for a set period of time. For example, you might choose to eliminate spending on extras for an entire month. You can make a no-spend challenge as long as you’d like.- Track down savings: When you need to make a purchase, there is no reason to overspend. Consider looking for sales and clipping coupons to limit your spending.

- Skip eating out: It’s very easy to overspend on eating out. If you are spending more than you want to on restaurant food, then consider upgrading your cooking skills.

- Negotiate your bills: Many bill providers are willing to negotiate your price point. For example, you might be able to save on your internet costs if you give your provider a call and ask for a more basic plan.

As you cut back on your expenses, you’ll make it easier to survive financially after a layoff. Plus, all of these cuts can help you make progress toward other financial goals while your income is stable.

Beef Up Your Emergency Fund

An emergency fund is a key piece of any stable personal finance plan. It acts as a safety net for your finances. If something goes wrong, like if you get laid off from your job, you’ll have some funds on hand to cover expenses while you find a new source of income.

In terms of your credit score, an emergency fund can help you continue to make on-time payments to your debt obligations after a job loss. Plus, you can use these funds to cover your living expenses instead of taking out debt to get through this difficult time.

In general, personal finances experts recommend having between three to six months’ worth of living expenses in your emergency fund. For example, if you spend $2,000 per month, you’d ideally save between $6,000 to $12,000 in your emergency fund. However, you might decide to save more if you see a layoff coming your way.

Of course, saving up this chunk of change isn’t easy. If you aren’t able to build up this size of an emergency fund, start by tucking away what you can. Even having a few hundred dollars on hand can make a difference after a layoff.

Image via www.SeniorLiving.Org

Need some tips on building an emergency fund? Check out How to Build an Emergency Fund.

Pay Down High-interest Debt

Debts that have a high interest rate attached are a drain on your finances. Each month, you are stuck with a monthly payment that can suck the life out of your budget and make it difficult to stay afloat after a layoff.

If possible, work on paying down your high-interest debt. For example, if you have a credit card balance with a sky-high interest rate, paying off that balance might be the right move to protect your credit score. Reducing what you owe now can help keep your payments lower after a potential layoff.

Not sure how to tackle your debts? If you are worried about the interest rates, then the avalanche method might be the right fit. Within this debt repayment strategy, you’ll pay off the debt with the highest interest payment first. After you’ve eliminated the debt with the most interest, you’ll tackle the debt with the next highest interest payment. Eliminating your high-interest debt first is the most mathematically efficient path to becoming debt-free.

Learn more in Snowball vs. Avalanche: What Is the Best Way to Pay Off Debt?

Before paying off your debts, consider building a small emergency fund. For example, you might save up a few hundred dollars before throwing the rest of your income toward debt repayment.

Build Extra Streams of Income

As an employee, the paycheck you receive from your employer is likely your main source of income. For many Americans, their paycheck is their only form of income. If you lose that main source of income, it can be challenging to protect your credit score after a layoff. Luckily, there are countless ways to build extra income streams.

With extra income streams, you can use the funds to tackle your financial goals. For example, you might use the funds to build up your emergency fund or pay down high-interest debt. Either action can help you protect your credit score after a job loss.

But if you lose your job, these new income streams offer a way to keep paying all of your bills on time. With the ability to keep up with your expenses, you can protect your credit score in the event of a layoff.

Here are some extra income streams to consider:

- Deliver food: You can earn money by delivering groceries or takeout. A few services you might be able to work for include Instacart, DoorDash, and Shipt.

- Rideshare: As a rideshare driver, you pick up passengers and transport them around town.

- Find a part-time job: Many physical retailers have part-time job opportunities, which could serve as an extra income stream.

- Offer services in your town: You can offer to walk dogs, house sit, babysit, handle chores, and more. Consider checking out TaskRabbit to get started or spread the word through family and friends.

- Build an online side hustle: You can earn money through freelance writing, blogging, managing social media channels, and more. If you are tech-savvy, an online side hustle might be the perfect fit.

Of course, this is just a starting point for building extra income streams. Don’t be afraid to get creative when searching for a new income source that suits your needs and interests.

Make a Plan for After a Layoff

If you experience a layoff, it will likely come with a wave of emotions. It’s often difficult to make the right decisions amidst an emotional rollercoaster ride. With that, it’s a good idea to map out your post-layoff plans before you receive a notice.

Here are some steps to consider in your layoff plan:

- Consider your healthcare options: After a layoff, your healthcare is one of the biggest issues that comes to mind. Take some time to research your healthcare options. You might sign up for COBRA (Consolidated Omnibus Budget Reconciliation Act), but it’s an expensive option. Other healthcare plans might be more affordable.

Apply for unemployment benefits: Do some research on how to apply for unemployment benefits in your state. Find the application’s website and determine what information you’ll need to have on hand.

Apply for unemployment benefits: Do some research on how to apply for unemployment benefits in your state. Find the application’s website and determine what information you’ll need to have on hand.- Reach out to your network: Gather a list of contacts to reach out to about new job prospects. Of course, you don’t have to reach out until after the layoff. But it’s usually good to have some of your top contacts lined up.

- Have an emergency expense-cutting plan: When you are laid off, it’s smart to tighten your belt significantly. Make a list of extra items that you could live without until you have shored up your income situation. This might involve cutting all discretionary spending on a temporary basis.

A layoff won’t be a fun experience. But with a little bit of planning, you can walk into the situation as prepared as you can be.

The Bottom Line

While a layoff won’t directly impact your credit score, the financial implications of a layoff could push your credit score down.

If you anticipate a potential layoff in your future, consider taking action to create a smooth financial journey. Increasing your savings and building extra income streams can make all the difference to your credit score after a layoff.

Even if you don’t foresee a layoff, you never know what life might throw your way. Working through the steps above can help you protect your credit score from many kinds of emergencies. Whether you experience a temporary gap in work or have to cover a major unexpected expense, these tips can help you stay afloat.

What did you think of this article? If you found this info on preparing for a possible layoff helpful, or if you have any tips you would add, comment below to let us know!