The Ultimatum on Poor Credit Scores—Essential Pivots for Poor Credit Scores

With Economic Equality, We All Benefit

01/21/2022

Do Tradelines Really Work?

02/15/2022Credit scores are an important part of your financial health. They tell lenders how worthy you are to borrow money based on your previous history of paying it back. There are many different credit scoring models in use, but they’re all based on data from the credit reporting agencies, the three largest credit bureaus being Equifax, Experian, and TransUnion.

Unfortunately, there is a lot of confusion and misinformation about credit scores among consumers, and understandably so. The rules of credit scoring are numerous, complex, and sometimes counterintuitive. Not only that, but credit scoring models are proprietary, so there are some details that are not available to the public.

However, it’s crucial to understand credit scores if you want to set yourself up for financial success in life. Keep reading to find out why credit scores matter, how having a poor credit score can limit opportunities, and what you can do to improve poor credit scores and even help others get their credit on track, too.

What Does a Credit Score Allow You to Do?

A good credit score opens the doors to a wide variety of opportunities, even some that are less obvious than others. It allows you to:

- Get a Cellphone Without Prepaying for Your Account

If you have a bad credit score, a phone company might require you to prepay your phone plan or make a security deposit before you can access it. This requires handing over more cash upfront and it can potentially keep you from getting an essential service in some cases.

- Access Utilities

Utility companies also often run a credit check when setting you up with your services for the first time. According to the Federal Trade Commission, “Getting utility services…has a lot to do with your credit history. The better your credit history, the easier it will be for you to get services.”

- Increase Your Housing Options

It’s a well-known fact that your credit affects your ability to acquire solid housing. When you have a low credit score, your applications for rental units are more likely to be rejected and you may have to pay a higher deposit or provide an additional month’s worth of rent money upfront. Good credit, on the other hand, gives you access to housing options that may not be available to those with poor credit or no credit.

- Get Approved for Higher Credit Limits and Lower Interest Rates

This is one of the most important reasons to keep your credit score high. With a good credit score, you’re able to get approved for higher credit limits on your credit cards. This provides more buying power if you need it, and also helps keep your credit utilization metrics low. Not only that, but your interest rates will be lower on the credit cards you have. Conversely, if you don’t have good credit, your credit limits will be lower and your interest rates will be higher if you can get approved for a credit card at all.

- Save on Insurance

Your good credit saves you money in other ways, too. You’ll often get better rates on car insurance and homeowner’s insurance if you have high credit scores. Keeping your credit looking good will keep you on good terms with your insurance providers.

What Is the Poor Credit Score Range?

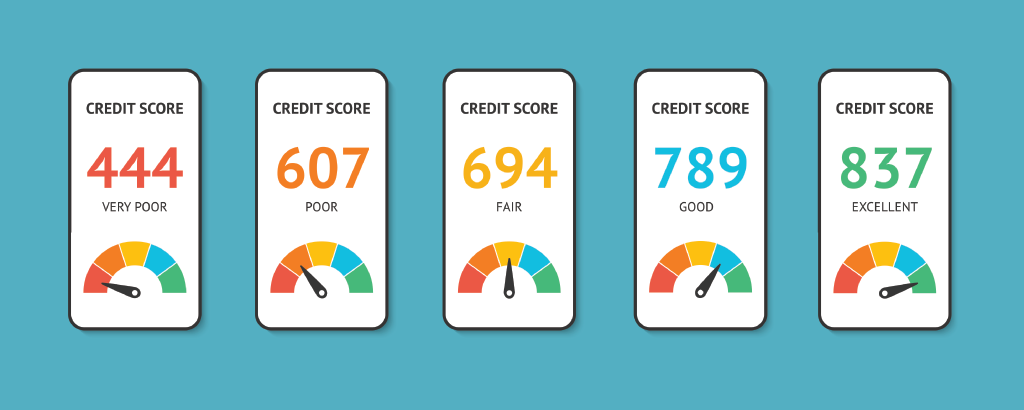

A poor credit score range is the range that lenders will steer clear of. This generally includes credit scores that range from 300 to 579 in FICO scoring systems. VantageScore credit scoring models consider scores below 600 to be poor or very poor. However, it is ultimately up to lenders to decide what they deem to be poor credit. According to NerdWallet, any score below 630 on a scale of 300-850 can be considered a poor credit score.

A score in this range usually indicates major credit problems, like bankruptcy or delinquency.

If your credit score is in this range, you might only qualify for secured credit cards. These are cards that require a cash deposit that contributes to or is equal to the card’s spending limit. The lender can use this security deposit to recoup their losses if you do not pay off your credit card purchases. Secured cards can be helpful for those starting out in building credit, but they do require a payment upfront.

Which Groups Fall Into the Poor Credit Score Range?

Unfortunately, not everyone is granted equal access to credit. And this creates a huge disparity in credit scores in America. About a third of Americans have bad or subprime credit, according to BadCredit.org. This statistic is magnified when you look to communities of color. According to a report done by CNBC, 54 percent of Black Americans and 41 percent of Hispanic Americans have bad credit or no credit at all. In contrast, 37 percent of white Americans have bad credit.

When asked why their communities had bad to no credit, 30 percent of Hispanic Americans and Black Americans responded that they believed it was because the system keeps them financially behind. Due to past and present inequalities, many people of color can only access lower-paying jobs and live paycheck to paycheck. They also have higher student loan debt balances to pay back and are less likely to carry a credit card, which can both have important impacts on credit scores.

The Cost of Having a Poor Credit Score

When your credit score is good, it opens doors in many areas of life, but credit scores are a double-edged sword. Good credit keeps your options open, but bad credit can keep you from meeting your basic human needs, like solid housing. The Fool did a recent case study on how much you lose out on financially if you have bad credit, and they estimated that having bad credit costs approximately $2,717 per year.

When your credit score is good, it opens doors in many areas of life, but credit scores are a double-edged sword. Good credit keeps your options open, but bad credit can keep you from meeting your basic human needs, like solid housing. The Fool did a recent case study on how much you lose out on financially if you have bad credit, and they estimated that having bad credit costs approximately $2,717 per year.

That’s a lot of money to be missing out on. But bad credit also puts you in a precarious situation. If your car breaks down, and you don’t have the cash to afford a new one, you’ll have to find alternative funding to purchase a new car. Oftentimes, this means turning to family or predatory lenders in order to finance the vehicle. And predatory lenders cost much more than they lead consumers to believe.

The same thing is true for housing. Most apartments will not rent to people with bad credit because they need to protect their financial interests.

How Does Someone Get Poor Credit?

Poor credit is acquired when you do not repay your credit obligations on time or do something else that negatively affects your credit. Paying bills late, filing for bankruptcy, charge-offs, and loan defaults are things that will cause your score to drop. This is because your credit score is a representation of your track record of paying back bills and is considered an overall marker of your financial health.

For this reason, creditors look at this when considering whether or not to grant you a loan, and the worse your credit is, the more likely they are to say no.

There is, however, another type of people who have trouble securing loans, renting apartments, and doing other things that require credit. Those are people who have no credit. They’re often called credit invisibles, and they make up about 30 percent of low-income neighborhoods and 11 percent of the general public.

Another group that has trouble accessing credit consists of unscorable consumers. These are people who do not have enough data to create a credit score, either because they have too few accounts or because they do not have recent enough credit history. They make up about 18 percent of low income households, and 8.3 percent of the general population.

Poor Credit Score Personal Stories

While it can be helpful to talk about the theoretics of poor credit, I find it helpful to look at actual stories of bad credit and how it affected people. I asked my followers on Twitter to share their stories and they did.

While it can be helpful to talk about the theoretics of poor credit, I find it helpful to look at actual stories of bad credit and how it affected people. I asked my followers on Twitter to share their stories and they did.

Mackenzie from Life @ 23k was almost homeless because of her poor credit. The house that she was renting was sold out from underneath her and she didn’t know what to do. She tried applying to apartments, but either the credit check was denied or the deposits were too high.

She eventually ran into the right person who was renting a unit and didn’t ask for a credit check. But when she tried to finance her move, she was denied because of her poor credit score. The sudden move caused an immense amount of stress for her and it could have been avoided if her credit score was high.

Angie had to put her dreams of motherhood on hold because of her credit. She was unable to finance her IVF because she couldn’t find a company that was willing to lend her the money. She searched for 4 years until she found an IVF clinic that offered in-house financing and accepted her slowly recovering credit. But it pushed back her ability to have her first child from her very early 30s to being 39 when her first was born.

Nick was a first responder who was shot in the line of duty. After he left the force, he struggled to make ends meet for him and his son. As bills piled up that he couldn’t afford to pay, he ignored them and that led to even bigger problems. Before he knew it, he had multiple items in collections and creditors were calling him day and night.

To pay off the debts, he took three and four jobs at a time to try and make ends meet. Slowly, he started to see progress but his credit score was still in the high 500-low 600 range. He finally got out of his situation by the kind fortune of the woman he fell in love with. When they moved in together, she sold her house and used the profits to pay off their debts and to pay for the wedding.

How to Respond to Poor Credit Scores

Having a bad credit score is not the end of the world. There are many ways to work on your credit score and increase it from a bad score to a fair or even good score. It will take work—for Nick it took about 5 years to really reap the benefits of his hard work—but if you ever need to take our a line of credit, rent an apartment, or buy insurance, it will be worth the effort you put into improving your credit score.

1. Get a copy of your credit report.

Getting a copy of your credit report will help you see exactly what your credit looks like. Sites like Credit Karma can give you certain versions of your score and a summary of your credit report disclosure, but getting your actual credit report from annualcreditreport.com will allow you to see the details of what is negatively impacting your score.

2. Dispute any incorrect information on your credit report.

Another good reason to get your credit report is to see if there are any errors on your report. According to the Washington Post, more than one-third of all consumers found errors on their credit reports. An error on your report could be negatively impacting your score and can be corrected to raise your credit score.

3. Bring your accounts current.

Another easy way to improve your credit score is to pay any late or past due amounts. Any current delinquencies on your accounts will weigh heavily on your credit score. If you can’t pay your current outstanding balances, consider looking into a debt consolidation or debt settlement program. These programs might have fees, but they may be able to help you get to a place where you can pay off your debt. And most people who go through a program like that report that their credit score ended up being higher than when they started.

Kristen Knight encourages people going through this process to realize you aren’t the first person to do it. Utilize your resources, like the internet, to figure out your steps. Keep detailed records when you contact banks or collections. Don’t agree to anything on the phone. Have everything written down and signed by both parties.

4. Increase your credit limits.

If you’re able to, increasing your credit card credit limits on your existing credit cards can be a great way to improve your credit score. However, only do this if you’re confident you’re not going to spend the additional credit. You don’t want to find yourself in more debt with worse credit when you were trying to accomplish the opposite. If you know you can’t handle the higher credit limit, then skip this step. While having higher credit limits is a helpful way to increase your credit score, it’s not worth it if you’re at risk of financially self-sabotaging.

5. Open a new card.

This is another “use with caution” tool to help improve your credit. Opening a new credit card can increase your credit limit and improve your balance to limit ratio, or utilization ratio, which is taken into account when determining your credit score. But if you’re not responsible enough to keep the card from being used, it’s not worth it to increase your credit.

6. Pay balances on time.

Paying off your balances on time is essential to having a good credit score. Paying balances on time lets future creditors, apartment rentals, and insurance companies know that you’re serious about your financial commitments. It’s a track record to prove that you have the capability to take on more debt because you’ve been responsible for the debt you already have.

7. Become an authorized user.

Becoming an authorized user is a great way to build your credit. You piggyback on a credit card belonging to someone else and see the account’s credit history reflected in your own. It’s a great way to establish yourself with good credit.

How to Help Other People With Poor Credit Scores

One possible cause of poor credit scores is financial illiteracy, and helping others increase their financial literacy will give them the knowledge to improve their credit scores. According to surveys, over half of Americans report being anxious about their finances, and 3 in 5 adults say they don’t use a budget. It’s imperative to be financially literate in order to increase your credit score and become less financially anxious.

One possible cause of poor credit scores is financial illiteracy, and helping others increase their financial literacy will give them the knowledge to improve their credit scores. According to surveys, over half of Americans report being anxious about their finances, and 3 in 5 adults say they don’t use a budget. It’s imperative to be financially literate in order to increase your credit score and become less financially anxious.

John F Kennedy once said a rising tide lifts all boats. Meaning here that what is good for the financially illiterate will be good for the economy as a whole. If we can strengthen those who are at risk, we can make the total economy more resilient—and we will all benefit.

If you’re financially literate, sharing your wealth of knowledge with your community can help those who are less financially literate than yourself in order to boost the economy as a whole and help them with their credit scores. You can do this in a variety of ways.

1. Recommend financial books and podcasts.

Media is a great way for people to learn about money. And there are tons of great books out there. Have 3 to 5 of your favorite books and podcasts in mind to suggest to people. Make sure that they’re made for beginners and try not to recommend highbrow knowledge that would intimidate someone who is just starting out.

2. Talk to people about budgeting.

Budgets are one of the best tools in the toolbox of financial success. Budgeting helps people track their money and get their financial life in order. But some people don’t know how to budget, and it can be intimidating to talk to someone about budgeting. But if they’re prepared to have the conversation, it’s not a bad idea to sit down with someone and help them create a budget that empowers them to work toward their financial goals.

3. Provide support for financial change in someone’s life.

Everyone has skills that they can offer. If a friend is struggling to make ends meet, reach out to your network to try and help the friend. Sometimes it’s less about the skills someone has with finances and more that their resources are tapped. If you can help someone get a leg up financially, it’s an awesome way to give back to your community.

In offering support to others, don’t be overbearing. While it’s important to create a society of financially literate individuals, you don’t want to alienate a friend by being forceful. Be kind and respectful to those who might not know as much as you and those who hold different opinions about their finances.

Conclusions on Poor Credit Scores

There are plenty of ways people can change their credit scores and better their financial life. Know something we haven’t covered? Share your tips down below, and don’t forget to share this article on social media to help others learn the importance of credit scores.