Credit Reports: What You Need to Know

Derogatory Credit Marks—Grow From Bad to Great Credit

09/29/2023What Is a Good Credit Score? 7 Must-know Essentials

10/10/2023

Nearly half of Americans believe a credit score and a credit report are the same thing, according to a study by the American Bankers Association. That’s a big problem because it means many of us are seriously misinformed about how the credit system works.

Since credit is such an integral part of our financial ecosystem, it affects nearly all of us at some point in our lives. Your credit health can determine not only your access to credit and the cost of using credit but also employment opportunities, housing options, and more. Not understanding how credit works, therefore, can have serious consequences.

We want to help address this problem by making it easy to understand what your credit report is and why it’s important, the difference between your credit report and credit score, how to get a free credit report, and how to dispute errors on your credit report.

What Is a Credit Report and Why Is It Important?

A credit report is a detailed report on your credit history prepared by a credit reporting agency, also known as a credit bureau. The three main credit bureaus are Experian, Equifax, and TransUnion, and we will discuss the process for getting your credit reports from each bureau below. What is in your credit report can be different for each bureau, since they are private companies that do not share information.

Your credit report is important because the information it contains is used to calculate your credit scores, which lenders use to evaluate your credit risk when deciding whether or not to issue you credit. Insurance providers, landlords, and even utility providers may also look at your credit score.

In addition, a significant percentage of employers do credit checks on prospective employees, so a credit report with derogatory items on it could potentially cost you your dream job.

For these reasons, it’s important to be aware of what is in your credit report.

What Is in a Credit Report?

Credit reports contain identifying information such as your name, social security number, and current and previous addresses. They also contain a detailed summary of your credit history, which includes items such as the following:

Credit reports include a list of your credit accounts and financial records.

- A list of current and past tradelines (credit accounts), along with the date opened, credit limit, balance, and payment history of each account

- Inquiries into your credit history

- Public records of bankruptcies, foreclosures, tax liens, etc.

- Accounts in collections

How Far Back Do Credit Reports Go?

- The information in your credit report usually goes back about 7-10 years.

- Current accounts should show up on your credit report as long as they are open.

- Negative information, such as collections, will fall off your credit report seven years after the delinquency occurred.

- Closed accounts that were closed in good standing fall of your credit report in 10-11 years.

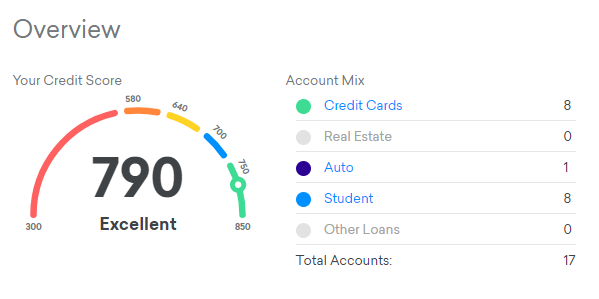

What Is the Difference Between a Credit Report and a Credit Score?

| Credit Report | Credit Score |

| Prepared by each of the major credit bureaus | Many different credit scores |

| A list of all your credit accounts and related personal information | A three-digit number between 300 and 850 meant to represent your creditworthiness |

| Information in your credit report is used to calculate your credit score | Reflects the information in your credit report |

| You are legally entitled to get a free credit report from each bureau once a week | You are not legally entitled to check your credit score for free (although some credit card companies may offer this to customers) |

| Does not include your credit score | Does not include information on your credit history |

Does Checking My Credit Report Hurt My Score?

While this is a common misconception, you can rest assured that checking your credit report won’t lower your credit score. Checking your own credit is what’s known as a “soft inquiry” or “soft pull,” which doesn’t hurt your credit. “Hard” inquiries can ding your score, but these are used by creditors when making lending decisions, not for checking your own credit report.

Video: Why Is It So Important to Check Your Credit Reports?

Find out why credit experts say checking your credit reports regularly is essential in the Credit Countdown video below.

How to Get a Free Credit Report

By law, everyone is entitled to receive one free credit report from each of the three major credit bureaus once every 12 months. However, in 2020, the credit bureaus started offering free credit reports weekly to help consumers protect their credit during the COVID pandemic—and recently announced that this policy is now permanent.

Although it’s probably not necessary to check your credit reports every single week, it is a good idea to check them at least once a month, as stated by credit expert John Ulzheimer. Check your credit reports frequently will allow you to catch fraud or mistakes on your credit report early and get them resolved quickly before they take a toll on your finances.

The process for retrieving your free weekly credit reports remains the same. Go to annualcreditreport.com to view yours.

You can order all three at the same time or order each individual report one at a time. If you haven’t looked at your credit reports before, then it’s a good idea to check all three of them so that you can identify any discrepancies immediately.

Your credit reports from the three major credit bureaus may be slightly different, due to each bureau having access to different data sets furnished by creditors. Each credit bureau is a private, for-profit company, and they don’t share information with each other, so you can have errors on one of your credit reports but not the others. However, for the most part, they should look similar, especially if you have already corrected anything that was reported inaccurately.

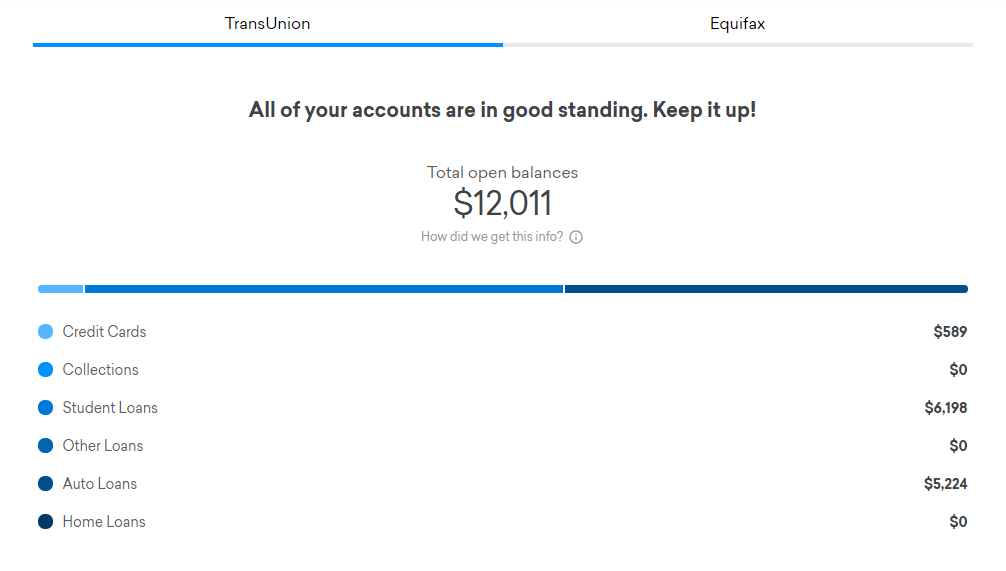

Free credit monitoring websites like CreditKarma provide free credit reports and scores.

The best way to check your credit report for free is to order your free credit report from annualcreditreport.com. In fact, this is the only website authorized to provide the annual free credit report you are legally entitled to, according to the FTC—so beware of other sites claiming to offer free credit reports or free trials, especially if they ask for your credit card information.

However, there are now several free credit report websites that earn money through advertising and are thereby able to offer free credit monitoring services. Sites that offer completely free credit report summaries include:

When Else Can I Get a Free Credit Report?

You are entitled to a free credit report if you are unemployed and applying for jobs.

You can also check your credit report for free if you have been denied credit because of the information in your credit report. You are entitled to get a free credit report from the bureau that provided the report that the lender used to make their decision.

For example, if the lender who denied you credit looked at your Experian credit report, you can request your Experian free credit report. The adverse action letter informing you of the reason for your denial should have instructions on how to request your free credit report.

There are a few more cases in which you can qualify for an additional free credit report, including:

- If you are unemployed and planning to look for work.

- If you receive government assistance.

- If you are a victim of identity theft.

Although experts recommend checking your credit reports at least once a year, the Consumer Financial Protection Bureau (CFPB) estimates that less than one in five consumers get copies of their credit reports each year. Don’t miss out on this opportunity to get your credit report for free so you can make sure your credit report is accurate and identify any problems before they get worse.

Can I Get a Free Credit Report Directly From the Credit Bureaus?

You can also get your credit report directly from each of the credit bureaus, but you may have to pay a fee if you go this route. If you want to get a credit report for free, your best bet is to order it from annualcreditreport.com.

If you cannot access your credit reports this way or want to check your credit reports more than once per week, we’ll discuss additional options for obtaining your credit reports below.

Experian Credit Report

You can get a free Experian credit report that refreshes every 30 days through Experian’s website. They also offer paid options that come with additional information. The Experian free credit report does not include a free credit score.

You can get your TransUnion and Equifax free credit reports on third-party websites.

Equifax Credit Report

While you cannot get an Equifax free credit report from the bureau directly, you can pay a fee to access your Equifax credit report and score. To get your Equifax credit report, visit their website.

You can also view your free Equifax credit report and score through CreditKarma, which updates once a week.

TransUnion Credit Report

Accessing your TransUnion credit report requires signing up for a paid monthly subscription service with TransUnion. However, you can get a free TransUnion credit report from CreditKarma or NerdWallet.

How to Dispute Errors on Your Credit Report

Unfortunately, studies have shown that as many as one in five consumers may have errors on their credit reports, and about one in 20 have errors that are significant enough to potentially lower their credit scores. This means it is crucial to monitor your credit reports regularly and be aware of how to fix errors on your credit report.

The credit bureaus offer online forms to submit credit report disputes, but experts warn against using this option, as it does not allow you to write a detailed explanation of why you are disputing the information or provide sufficient supporting evidence. This leaves room for the credit reporting agency to deny your claim because you did not provide enough information.

It’s important to check your credit report for errors regularly and dispute any inaccuracies you find.

The best way to dispute a credit report is to write a detailed credit report dispute letter and mail it to the bureau along with plenty of documentation verifying your identity and supporting your claim.

Once a dispute has been filed, the bureaus typically have 30 days to investigate the claim. If they verify that the item is accurate, it will remain on your report; if not, they must either update the item with the correct information or delete it entirely.

Errors on your credit report can, unfortunately, lead to bad credit. For this reason, checking your credit report regularly and disputing any errors is an essential step in maintaining your financial health.

Check out additional tips in our article about the most common credit report errors and how to fix them.

If you have a lot of errors on your credit report or if you have been the victim of identity theft, it may also be worth considering hiring a reputable credit repair service to assist you in the dispute process.

[Disclosure: This article contains affiliate links. We may earn a small commission if you sign up using our link.]

Which Errors Can You Dispute?

The law requires that the information in your credit reports must be accurate, complete, timely, and verifiable. Anything that does not meet these requirements can be disputed.

Technically, you can dispute anything in your credit file, but that doesn’t mean you should try to dispute things that are accurate. The credit bureaus are allowed to ignore “frivolous” claims, and if they verify something to be true, it will stay on your credit report.

For more tips on how to dispute a credit report, check out this article from creditcards.com.

Quick Credit Report Facts

- A credit report is a detailed report on your credit history prepared by one of the credit bureaus: Experian, Equifax, and TransUnion.

- The information in your credit reports is used to calculate your credit scores.

- Checking your credit reports does not hurt your scores.

- You are entitled to a free credit report from each of the credit bureaus once a week, which you can order from annualcreditreport.com.

- You can dispute errors on your credit report by mailing a credit report dispute letter and supporting documentation to the credit bureau.

Do you have questions about credit reports? Leave a comment below. Plus, check out our playlist of videos all about credit reports on YouTube!