How to Protect Your Finances and Credit During the Pandemic

What Is Piggybacking for Credit?

06/27/2020Are Tradelines Legal?

08/24/2020

This article was last updated on July 31st, 2020.

The COVID-19 pandemic has suddenly thrown the entire country into a state of fear and uncertainty. Most businesses are closed or restricted and many Americans are unable to work, which means millions of people are going without the paychecks they need to support their families.

According to a poll conducted by TransUnion on March 17th and 18th, over half of Americans said that the coronavirus outbreak has resulted in a loss of household income, and nearly three quarters said they were concerned about paying their bills and loans in the coming month—and that was before the unbelievable surge of over 30 million unemployment claims that were filed in the following five weeks.

In times like this, it’s hard to know what you should do when it comes to managing your finances. When your income has completely dried up and there is no light at the end of the tunnel, your credit score may be the last thing on your mind. But your credit health is perhaps now more important than ever, because you may need some help making ends meet until this crisis is over—which could be a long time from now.

Unfortunately, with the state of the economy and the job market quickly declining, it’s likely that many consumers will see their credit score plummet as some bills fall by the wayside.

If you’re concerned about how you’re going to manage your credit and your finances during this stressful time, we hope that this guide on how to protect your credit during uncertain times can help.

Table of Contents

1. Stay Calm and Try Not to Panic

2. Contact Your Employer

3. Cut Optional Expenses From Your Budget

4. Talk to Your Landlord If You Will Have Trouble Paying Rent

5. Call Your Creditors and Utility Providers

6. Pause Your Federal Student Loan Payments

7. Prioritize Your Bill Payments

8. Sign Up for Food Assistance

9. File for Unemployment Insurance Benefits or Disability Insurance Benefits

10. Look For a New Job

11. Start a Side Hustle

12. Boost Your Emergency Fund (If You Can)

13. Figure Out Your Health Insurance Coverage

14. Make Sure You Get Your $1,200 Stimulus Check

15. File Your Tax Return

16. Have a Plan for Your Stimulus Money

17. Monitor Your Credit and Use It Wisely

18. Take Advantage of Promotional Offers With Reduced Interest and Fees

19. Look Into Getting a Personal Loan

20. Temporarily Pause Your Retirement Contributions

21. Stay the Course With Your Investments

22. Cash in on Your Home Equity

23. Research Refinancing Options to Take Advantage of Low Interest Rates

24. Consider Borrowing From Your Retirement Savings—But Only as a Last Resort

25. Don’t Get Scammed

26. Consider Credit Counseling

27. Avoid Payday Loans

28. Seek Support From Your Community

Conclusion on Managing Your Finances and Protecting Your Credit During Uncertain Times

Additional Resources

1. Stay Calm and Try Not to Panic

The first and most important step to getting a handle on your finances during the coronavirus pandemic is to keep your cool. The current situation definitely merits concern and caution, but panicking will only make things more difficult. When emotions are running high, they can affect your judgment, and you are not likely to make the best financial decisions.

It may help to remember that we are all being affected by this disruption to the economy and our lives. Because of this, many lenders are making certain allowances to relieve consumers who are struggling, some of which we will discuss further below.

Many consumers have turned to panic-buying and stockpiling groceries and household goods to give them a sense of control and security. This is exactly the kind of emotional decision-making that you should try to avoid.

Avoid stockpiling groceries and supplies, which drains your own financial resources and may prevent others from getting what they need.

This type of behavior not only depletes resources that others desperately need but is also financially unsound. Instead of spending your money on giant packages of toilet paper, gallons of hand sanitizer, and all of the dry goods in the store, buy only what you need and save as much money as you can for emergencies and future needs.

In addition, try to avoid making any important financial decisions when you are upset or severely stressed, or else you might do something that you will regret later.

2. Contact Your Employer

Employers everywhere are implementing new policies to deal with the coronavirus outbreak.

For example, many employees have transitioned to working from home, and some businesses have decided to provide paid leave for sick employees or employees to have to stay home to care for children.

Many companies have temporarily increased wages for employees who must continue to go to work while others self-isolate at home. Some are even handing out cash bonuses to workers.

If you haven’t done so already, contact your company’s human resources department or your supervisor and ask what accommodations can be made if you need to miss work. If you are ill or caring for someone who is, it’s good business for your employer to provide some support so that you are not forced to try to go to work, where you may unwittingly spread the virus.

3. Cut Optional Expenses From Your Budget

In times of financial instability, it’s crucial to cut your budget down to just the essentials. Forgoing luxury items and services allows you to keep more money in the bank to help you and your family stay afloat if you lose your job or get sick.

In addition, you may need to reallocate some of the money in your budget to purchase food and household essentials. Options for buying groceries have been extremely limited due to high demand, so prices may be higher than usual. If you order grocery items to be delivered to your home, you also need to pay a delivery fee and a tip for the driver (a generous tip, if you can).

Since many of us are self-isolating at home for the foreseeable future, experts have recommended stocking up on things like important medications, so you may also need to spend more money than usual on healthcare right now.

Resist the urge to shop online for now so that you can save as much money as possible for the uncertain future.

To reduce your spending in other areas, check your bank statement for subscription services that you don’t need, and cancel things like gym memberships or classes that you likely won’t be able to use while people are staying at home and businesses are closed.

Social distancing rules also mean that we’re not going out to bars, clubs, festivals, or the movies, which means you can easily cut those expenses from your budget and reallocate them to a different category.

Consider cooking more of your meals at home instead of ordering takeout, especially if you now have more time on your hands. To save on entertainment costs, look for free or low-cost content online instead of paying for cable or for multiple different streaming services. For example, many public library systems offer free digital rentals of movies, music, books, audiobooks, and more.

Consumers who are self-isolating at home might be tempted to turn to online shopping to pass the time, and retailers are certainly aware of this. Your email inbox is probably full of offers from companies who are having sales to take advantage of the situation, but it’s best to try to resist the urge to make unnecessary purchases. To reduce the temptation to shop, it might help to unsubscribe from the marketing emails.

If you can cut back on the “fun” portions of your budget temporarily, this will leave you with more wiggle room to deal with any unexpected issues.

4. Talk to Your Landlord If You Will Have Trouble Paying Rent

It’s understandable that a lot of consumers are going to have trouble coming up with the money to pay rent right now.

A report from Apartment List found that about one in four renters and homeowners were behind on their housing payments at the beginning of April, and that number increased to one in three at the beginning of May.

Eviction Bans

If there’s a possibility that you won’t be able to make rent next month, talk to your landlord to work out a plan.

Depending on where you live, your state or local government may have passed some policies that are designed to protect tenants who are struggling due to the coronavirus. This may include those who have been laid off or had their hours reduced as well as those who have to stay home to care for children who are home from school or a sick family member.

For example, landlords in some cities have been ordered to waive late fees for those who cannot pay on time as a result of the virus. In some areas, evictions have temporarily been banned altogether, although tenants will have to make up for missing rent payments eventually.

The federal government has also stated that they will temporarily stop all evictions until the end of April.

However, there may be restrictions on who can qualify for these benefits, such as a requirement to provide documented proof of financial hardship.

Check with your state and local government officials about what rights you may be entitled to as a tenant who is experiencing financial hardship.

Negotiate With Your Landlord

Even if your government has laid out a plan to provide relief to tenants affected by the coronavirus, it’s still a good idea to talk to your landlord directly about your situation.

They may be able to set up a payment plan with you, defer payments temporarily, or even reduce your rent for a few months.

5. Call Your Creditors and Utility Providers

If you know you’re going to have trouble paying all of your bills, it’s a good idea to contact your lenders as soon as possible.

Most of them will understand the situation that you’re in and will be willing to work with you if you can’t make your usual payment.

Financial Hardship Programs

Your credit card issuers likely have financial hardship options available, so give them a call and ask for what you need, whether that’s a reduced interest rate, suspended payments, or something else.

Lenders typically offer financial hardship programs for those in need, which are now being expanded to accommodate the sudden disruption in income that millions of consumers are currently facing.

For example, some lenders may allow you to defer payments for a few months until you get back on your feet. You would still have to pay them back for those deferred payments, either by “catching up” the amount due when you start paying again or by extending the term of the loan by the number of months you missed, effectively tacking those payments onto the end of your loan.

If your lender doesn’t want to defer your payments in full, perhaps they would agree to temporarily accept partial payments and allow you to make up the difference later. Alternatively, they may be able to waive late fees for a few months.

For example, Bankrate has reported that if you request it, Discover will not report late payments to the credit bureaus for two months.

Keep in mind that your balances may still continue to accrue interest in this time period. Ask your lender if you are not sure whether they will be waiving interest charges.

It’s also worth asking them to lower your interest rate for a while so that you have a chance to actually pay down some of the principal balance instead of having most of your payment go toward charges interest every month.

Many banks are offering other breaks for customers, such as waived service fees and overdraft fees, waived penalties for early certificate of deposit withdrawals, and increased credit limits. In addition, several banks are temporarily suspending collection activity, foreclosures, evictions, and repossessions.

Some credit unions are even providing generous financial aid programs such as 0% interest loans for certain consumers.

Some of these perks have been rolled out across the board, while others may be offered on a case-by-case basis, so check with your banks and credit card issuers to see what financial hardship options are available to you.

Although many evictions and foreclosures have been temporarily paused, it’s still a good idea to contact your lender if you need help with paying your mortgage.

Relief for Homeowners

In addition to the suspension of foreclosures and evictions that many major banks have promised, the Department of Housing and Urban Development (HUD) announce that it would also suspend evictions and foreclosures on properties backed by the HUD until the end of April, which has since been extended until the end of August.

The suspension applies to single-family homeowners with mortgages for primary residences and reverse mortgages that are insured by the Federal Housing Administration.

Fannie Mae and Freddie Mac have also extended their moratorium on evictions and foreclosures for on single-family homes until August 31st, 2020.

However, this does not mean that you should simply stop paying your mortgage without contacting your lender. Let them know as soon as possible if you know you are going to be short on funds when your payment is due so that they can connect you with an assistance program.

Financial Assistance for Utilities

Utility providers also offer some financial assistance programs, so reach out to your utility companies to see if you can defer payments or come to some other type of agreement.

Get clear on the terms of any agreements you make with your creditors so that you don’t end up with penalty fees or negative marks on your credit report.

Get Started Now

The most important thing to remember is that you should contact each of the lenders that you can’t afford to pay right away. If you have a conversation with them before your payment due date, they will be in a much better position to make an arrangement with you that won’t destroy your credit.

In fact, the new law that was passed to provide coronavirus relief states that if your account is current right now and you set up an agreement with your creditor, they must continue to report your account as current, as long as you are complying with the terms of the agreement. This requirement extends for 120 days after March 27, 2020, or 120 days after the coronavirus national emergency ends, whichever is later.

However, what you definitely don’t want to do is simply let your due dates go by without making payments and without giving your lenders a heads up in advance, which could result in derogatory marks on your credit report.

In addition, take care to make sure you understand exactly what agreements you are making and how these agreements could affect your credit report and your credit score.

6. Pause Your Federal Student Loan Payments

During the COVID-19 pandemic, the Coronavirus Aid, Relief, and Economic Security Act (also known as the CARES Act) was passed to bolster the economy. Among many other provisions, the CARES Act included breaks for those with federally-held student loan debt.

After the pandemic, the Consumer Financial Protection Bureau continues to provide student loan payback advice.

The CFPB notes that if anyone asks you for a fee to help you with your federal student loans, it is a scam.

It is also important to note that these policies only apply to federally-held student loans. They do not apply to private loans or some federal loans serviced by private companies, so make sure you know which of your student loans are eligible for these benefits and which ones may have different requirements.

What About Private Student Loans?

Although the automatic, interest-free payment deferrals granted by the CARES Act only apply to federal student loans, some private student loan companies have also begun to offer their own financial assistance programs, including Sallie Mae, Navient (which also services federal student loans), Discover, and Citizens Bank, among others.

Many loan servicers are allowing borrowers to request payment deferments (which may be interest-free) or forbearance (in which your loan accrues interest, thus increasing the amount that you owe).

Contact your private student loan servicers to see what options may be available to you.

Optional: Consider Continuing to Pay Down Interest-Free Loans

On the other hand, if your budget can still accommodate it, you might consider continuing to make payments on any loans that are eligible for a temporary break on interest. When the interest starts accruing again in October, the balance of the loan will be lower, so you’ll pay less toward interest overall.

7. Prioritize Your Bill Payments

Ideally, you would be able to keep up with all of your bill payments, but in reality, that is going to be difficult or impossible for many people.

When you’re short on cash, it’s important to prioritize your bills so you can figure out which ones need to be paid first when spending your limited resources.

Now that you have contacted your lenders to get an idea of which bills you may be able to temporarily stop payments on as well as those that don’t allow that option, you can organize your bills based on urgency and importance.

When prioritizing your expenses, your basic survival needs (food, shelter, transportation to work, and necessary medication) come first.

First, of course, make sure you have your basic survival needs covered, such as housing, utilities, food, medication, and transportation to work. Then, you will need to triage the rest of your obligations based on what you can afford and what the consequences will be if you are not able to keep up.

If you need to, take advantage of any deferments or other allowances your lenders have offered to provide relief to consumers who have been affected by the coronavirus outbreak. That way, you can redirect that cash toward other essential payments that don’t have as much leeway. Try to keep making the minimum payments on all the debts you owe (with the exception of those that will allow deferred payments).

If worse comes to worst, keep in mind that many lenders are likely working with reduced staffing, so the chances are low that they will be aggressively trying to collect past-due payments. In addition, most courts are currently closed, so legal action against you is a lower risk as well.

You can learn more about benefits of the CARES Act that may provide some help with paying your bills at usa.gov.

8. Sign Up for Food Assistance

Another way to get some help with covering your expenses is to enroll in government food assistance programs.

The SNAP and WIC programs provide food assistance benefits to low-income families.

If your income is low these days, you may be eligible for benefits from the Supplemental Nutrition Assistance Program (SNAP, previously referred to as “food stamps”). The Special Supplemental Nutrition Program for Women, Infants and Children (WIC) program offers additional help to low-income women and children.

Other programs are available to benefit school-age children, senior citizens, and disaster victims.

Like many other government programs, food assistance benefits have been expanded in light of the current coronavirus pandemic. Importantly, SNAP and WIC are “providing administrative flexibilities” in order to make sure everyone can still follow social distancing rules, according to the USDA. Many states have been authorized to issue additional food benefits during this national emergency.

For those who qualify, these benefits can help you feed your family on a low income, which can help you stay afloat without taking on more debt than you need to right now.

9. File for Unemployment Insurance Benefits or Disability Insurance Benefits

If you have lost your job recently, consider filing for unemployment insurance. You certainly wouldn’t be alone in doing so—over 30 million Americans filed for unemployment within just a six-week span in March and April 2020, a record-shattering number.

The Federal Reserve Bank of St. Louis estimates that around 47 million Americans will eventually have lost their jobs due to the pandemic, so it’s probably wise to get your application in as soon as possible.

More Unemployed and Underemployed Workers May Be Able to Qualify

Many states have loosened the requirements to qualify due to the unusual circumstances related to COVID-19. For example, some states have waived the requirement to be applying for new jobs while you receive unemployment benefits.

The CARES Act passed by the federal government greatly expands eligibility for self-employed workers, such as freelancers and gig workers, who previously could not qualify for unemployment benefits. In addition, workers who still have jobs but have had their hours reduced may now be able to have some of their lost wages replaced.

Those who have been laid off due to the coronavirus can file for unemployment insurance and potentially receive an extra $600 from the federal government in addition to state benefits.

Bigger Unemployment Checks

The CARES Act also temporarily increases the amount of compensation that unemployed workers could potentially receive by $600 a week and extends the window of time in which people can get paid.

The extra $600 is money from the federal government to supplement the state benefits you would normally receive. So, for example, if you qualify for $350 a week in your state, you would receive unemployment benefit payments of $950 a week until July 31, 2020, when the added benefits are set to expire.

After that, you would continue receiving $350 from your state for as long as the law allows in your state, which is 26 weeks (half a year) in most states. States have also been permitted to grant extended benefits for up to an additional 13 weeks.

Check with your state’s unemployment insurance program to find out whether you may be eligible to receive benefits, what information you will need when filling out your application, and how much you could get paid.

Short-Term Disability Benefits

If you haven’t been laid off but you cannot work because you have been exposed to COVID-19, you may be able to apply for short-term disability insurance benefits with your state. Keep in mind that you will likely have to provide documentation from a medical professional in order to be eligible.

Apply Online

The fastest way to apply for these programs is to go through their online application portals. CNBC has published a helpful guide to applying for unemployment during the coronavirus pandemic.

Hope for the Best, Prepare for the Worst

Unfortunately, not everyone gets approved for unemployment benefits, and many states’ unemployment systems are struggling to keep up with the unprecedented surge in demand. Research how the situation is being handled in your state and prepare yourself for the possibility that it might take a long time to successfully file your claim and to receive benefits.

In addition, if your former employer wants to bring you back to work as businesses start to open up, keep in mind that a “general fear” of potentially being exposed to the coronavirus is not typically considered a good enough reason to quit your job or decline to work, at least in terms of qualifying for unemployment benefits.

Workers who can prove that they have been put in unsafe working conditions, however, may be able to quit their jobs and still receive benefits, although this depends on the regulations in your state.

10. Look For a New Job

Despite everything that’s going on in our country, people still need to buy groceries, which means grocery stores are still open—and they are hiring. If you are desperate for work, consider applying to work at some of your local grocery stores.

Grocery and food delivery services are also experiencing a surge in demand, so they are looking to take on more contractors to shop for and deliver orders.

Retailers who sell products online definitely need help fulfilling and delivering orders as well. Many are offering higher pay to compensate for the increased hazard of working while the coronavirus is still spreading.

However, if you get sick, that could potentially be very costly (and dangerous to your health), so you may want to ask any prospective employers what measures they are taking to protect the health and safety of their employees.

Examples of side hustles you can do at home include taking online surveys and participating in virtual focus groups.

For those looking for work, here is a list of the top companies who are hiring and the top jobs that are available right now.

11. Start a Side Hustle

If there’s a side hustle idea you’ve been interested in trying but haven’t made the time for yet, now is a great time to give it a try.

There are tons of ways to bring in some extra income, from making crafts to sell on Etsy to auctioning off gently used clothes, electronics, and household items online. Other creative ideas include tutoring or teaching online, participating in market research surveys, advertising freelance gigs on apps like Fiverr, and more.

These side hustles won’t necessarily bring in a ton of money, especially if you’re just starting out, but if you can boost your income by even a little bit, you can put the extra money toward bills, necessities, or your emergency fund.

12. Boost Your Emergency Fund (If You Can)

If you do have any income right now, try your best to divert some of it into a high-yield savings account as part of your emergency fund. The easiest way to do this is to set up direct deposit and split your paycheck so that a portion of your wages automatically goes into your savings account without you ever seeing the money in your checking account.

How Much Should You Have In An Emergency Fund?

Experts recommend aiming to save enough funds to cover at least three to six months’ worth of expenses, which would allow you some time to get back on your feet if you were to lose your job, get sick or injured, or have some other kind of emergency. If your income is variable or if you don’t have much job security, it’s safer to shoot for the higher end of that scale.

Some people may even feel that six months’ to a year’s worth of income is appropriate, especially given the economic instability we are currently experiencing.

Add as much as you can to your emergency fund to help protect yourself from financial setbacks.

For many reasons, most Americans don’t have that much money saved, so don’t beat yourself up if you’re not there yet. However, it’s a good goal to work toward, especially in these uncertain and unstable times.

Take Baby Steps to Start Saving

The most important thing is to start saving whatever you can. Research has shown that having even just a few hundred dollars set aside for emergencies can help you get past setbacks that would otherwise put you at risk of missing important payments and getting evicted.

Plus, if you have some cash set aside, then you can avoid charging up your credit cards and carrying that high-interest debt at the first sign of trouble.

If you don’t have an emergency savings account yet, open one now, even if you can only deposit a few dollars at a time. It will be easier to build momentum once you get into the habit of saving regularly. There are plenty of options for high-yield savings accounts that you can apply for and open online in just a few minutes.

There are even apps that use algorithms to detect whenever you have a little extra room in your budget and automatically transfer money to your savings account for you.

The more you can add to your emergency savings, the less you will have to rely on costly high-interest debt in a worst-case scenario.

13. Figure Out Your Health Insurance Coverage

As millions of Americans lose their jobs, that means millions are also losing their health insurance, since nearly half of the country’s population receives health insurance through their employer.

There’s never a good time to lose your health insurance coverage, but one of the worst possible times to not have insurance is while we’re in the middle of a pandemic disease outbreak. If you end up needing to go to the hospital for COVID-19 and you don’t have health insurance, you could end up owing almost $75,000 in medical bills.

Consider all of your health insurance options and take advantage of telemedicine to reduce healthcare costs.

It’s no wonder that medical issues are the primary driver behind two thirds of bankruptcies in the United States. Unfortunately, having health insurance doesn’t necessarily mean that you won’t go bankrupt from medical bills…but it will at least help cover some of your costs. According to CNBC, medical insurance could bring the cost of treatment for coronavirus patients down to a portion of $38,221, on average.

If you cannot pay your hospital bills, there is a good chance they will be sent to collections. Accounts in collection can have a devastating impact on your credit, which could make it more difficult to qualify for credit in the future.

So what can you do to get health insurance if you no longer have coverage through work?

Get Coverage Through COBRA

First, consider signing up for medical coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA allows you to stay on the same health insurance plan you had with your employer for up to 18 months after you are let go.

However, this may be too expensive for some, especially if you had been relying on your employer subsidizing your premiums, as you are responsible for the full cost of your plan with COBRA.

For those who are interested in continuing your healthcare coverage with COBRA, contact your employer or your insurance company to see if you are eligible. Those who do not qualify for COBRA, which is a federal program, can check to see if your state offers a program that is less restrictive.

Enroll in a Plan From the Health Insurance Marketplace

If your previous plan would be too expensive to pay for on your own, you can look for a more affordable plan on the health insurance marketplace. Losing your job counts as a “qualifying life event,” which means you can change plans outside of open enrollment periods.

You should also check to see whether you may qualify for Medicaid. States have temporarily been authorized to expand income-based eligibility and coverage under Medicaid.

Additional options to look into include being added to your parents’ health insurance plan if you are under the age of 26 or getting added to your spouse’s plan within 30 days of losing coverage if you have a spouse.

Use Telemedicine

If you simply cannot afford or obtain insurance for whatever reason, take advantage of telehealth programs that allow you to talk with a nurse or doctor over a phone call or video call.

A quick telehealth visit could potentially save you a trip to the doctor or even to the emergency room and only costs an average of $43 for people who do not have insurance.

14. Make Sure You Get Your $1,200 Stimulus Check

As part of the CARES Act, the government will be sending most American adults a one-time “economic impact payment” of up to $1,200, which is intended to mitigate the negative economic effects of the COVID-19 outbreak and provide financial relief to American families.

According to the IRS, the payments, which are technically tax rebates, will be automatically calculated and disbursed using the information on your 2019 tax return. For those who have not filed their 2019 tax returns yet, they will use the information on your 2018 tax return.

How Much Will You Receive?

Those who reported less than $75,000 a year as individuals or $150,000 a year as married couples on their 2018 or 2019 tax returns will receive the full $1,200, and the payment amount will be reduced by $5 for each $100 you made above those thresholds. Those who reported more than $99,000 in income individually or $198,000 jointly will not receive a payment.

Most Americans are automatically receiving a $1,200 economic impact payment from the government.

Parents will also receive $500 for each child under the age of 17. Adults who are claimed as a dependant on someone else’s tax return are not eligible.

Recipients of Social Security, disability, or survivor benefits are eligible and will receive their payments automatically.

If you want to know how much you will get for your stimulus payment, try this stimulus check calculator.

Unfortunately, if you made too much to qualify on your last tax return but your income in 2020 has been reduced below the threshold because of the coronavirus, the only option available to you right now is to claim it as a tax credit when filing your 2020 taxes so that you get a tax refund in 2021.

On the other hand, if you qualify based on the previous year’s income but then you end up making more than $99,000 in 2020, you will not have to pay back the money, according to the Tax Foundation.

Do You Have to Apply to Get the Economic Impact Payment?

As long as you filed your 2018 or 2019 tax return and the information on your last tax return is up to date, then you don’t have to do anything to get your check.

If you included your bank account information for direct deposit the last time you filed your taxes, then the economic impact payment will be deposited into the same bank account. If not, then a check will be sent to the address you provided on your tax return.

Some people may have closed their old bank accounts or moved to a new address since the last time they filed their taxes. If either of those situations applies to you, you probably want to file your tax 2019 return as soon as possible to minimize delays in getting your payment due to the IRS not having the correct information.

If you are required to file a tax return but haven’t filed one for the past two years, then you will need to file one now in order to receive the payout. If you filed in 2018 but the address or bank account information is now outdated, then you should file your 2019 return with the current information so that the IRS can send your money to the right bank account or address.

The Treasury Department says that recipients of Social Security benefits do not need to file a tax return and that the payments will be sent out in the same way as they normally receive their benefits. Citizens who do not meet the income requirement to file tax returns can enter their payment information on the Non-Filers page.

The IRS recommends submitting your direct deposit information at the Get My Payment website so that you can receive your payment faster. It will take longer to receive your money if they have to print out a paper check and send it to you in the mail.

If you do expect to receive your check in the mail, be sure to check your mailbox regularly so that your check does not get stolen.

When Will the Economic Impact Payments Be Sent?

Those who have the correct direct deposit information on file with the IRS are already starting to receive their payments. Those receiving checks in the mail, however, might not get their money until September.

If you have not received yours yet, you can go to the IRS’s Get My Payment website to check the status of your payment. In addition, you can provide your direct deposit information if you didn’t provide it on your tax return so that you can receive your payment sooner.

The IRS says that if the payment has already been processed and it is being sent to the wrong bank account, there is not much you can do except wait for the IRS to mail you a paper check to the address they have on file for you after the bank rejects the incorrect payment. There is no way to modify your bank account information or to reroute the payment after the IRS has already processed it.

The deadline for submitting your 2019 taxes has been postponed until July 15, 2020, but you may want to file sooner than that if you have not filed already.

For those receiving a paper check, you may still be able to update your address information by filing your 2019 tax return if you have not done so already. Unfortunately, you cannot change your mailing address through the Get My Payment site.

It is not clear at this point what you should do if the IRS uses incorrect information for both your bank account and your mailing address when they subsequently attempt to send you a paper check or if there are other problems preventing you from receiving your stimulus check.

The IRS says that phone assistance is not available to help people with payment issues.

Check out these frequently asked questions on the IRS website for more information.

15. File Your Tax Return

Although the deadline for filing your 2019 tax return has been extended to July 15, 2020, there are a few reasons why it might still be a good idea to submit your return as soon as you can.

Ensure the IRS Has Your Current Contact and Banking Information

As we discussed above, since the IRS is using the information on your tax return to send out the economic impact payments, it’s possible that the information they have on file for you is outdated. Filing your 2019 tax return gives you a chance to provide the IRS with your current direct deposit information and/or mailing address.

Qualifying for the Economic Impact Payment

If you earned too much income in 2018 to qualify for an economic impact payment, but you can qualify based on your 2019 income, then, of course, you would want to make sure your 2019 taxes are sent in as soon as possible so that the IRS can calculate your payment based on your income in 2019.

On the other hand, if the situation is reversed, meaning you earned too much to qualify in 2019 but not in 2018, then it’s not as urgent to submit your 2019 tax return to the IRS early.

Receive Your Tax Refund Sooner

Another reason to file last year’s tax return early applies to those who are expecting to receive a refund from the government.

The sooner you file your taxes, the sooner you will receive your tax refund, which can provide a little extra cushion during this time of financial instability. The U.S. Treasury Secretary tweeted, “I encourage all taxpayers who may have tax refunds to file now to get your money.”

Even if you think you will owe money instead of getting a refund, you can still file now and schedule your payment for any time before July 15. You can work out a payment plan with the IRS or possibly even settle for less than what you owe if you are experiencing financial hardship and can’t come up with all the money on time.

Another reason to file your 2019 tax return now is so that you can ensure that the government has the correct information about where to send your stimulus check, which brings us to the next point.

16. Have a Plan for Your Stimulus Money

A $1,200 check could really help a lot of people, but it’s important to decide what you will do with the money so that you can stretch it as far as you can.

Having a plan for how to use your economic impact payment can help you get the most value out of it.

It may seem like a lot of money at first, but it’s not clear how long the economy will need to be shut down in order to slow the exponential growth of the COVID-19 outbreak. Because of this, it’s a good idea to hold onto that money for as long as you can until you really need it.

Spend It on Bills and Necessities

If you are already overextended financially, you can use the money to pay for the necessities and any immediate bills that must be paid. Try to keep paying at least the minimum payment on all of your debts (or whatever amount your lender has agreed to accept) in order to prevent your credit score from deteriorating.

Put It in Savings

For any funds that are leftover, the best place to put that money for most people is going to be in your emergency savings account. That way you will have something to fall back on if things take a turn for the worse.

Pay off High-Interest Debt

Alternatively, you could pay down some high-interest debt so that you can save some money on interest charges.

Some argue that paying off high-interest debt should be a higher priority than saving, since in the long run, you will spend less paying interest. However, others make the argument that in uncertain times like this, you might want to scale back on your debt repayment so you can keep some more cash in the bank in case you run into expenses that cannot be paid with credit.

The decision comes down to what you are comfortable with and what makes the most financial sense for you.

Spend a Small Portion of It

Ellevest suggests allowing yourself to spend a small portion of the money (around 10%) on something that will bring you joy or help you feel less stressed during this time of financial strain and social isolation, such as ordering takeout from your favorite local restaurants for a few meals.

If you are not pressed for cash right now, then you might consider using the stimulus money to invest in the market to take advantage of exceptionally low prices.

Also, if you can afford it, consider donating to charities that are supporting response efforts to the COVID-19 outbreak and the economic instability it has caused, such as the CDC Foundation or your local food bank.

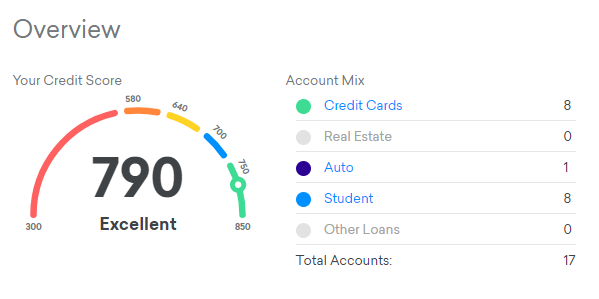

17. Monitor Your Credit and Use It Wisely

Even in a pandemic, it’s still important to monitor your credit score and credit report and make smart credit decisions. In fact, it’s even more important to closely guard your credit in times of uncertainty because you don’t want to be surprised by fraudulent activity or incorrect items on your credit report at a time when you may desperately need credit to keep you going.

Check Your Credit Reports Frequently—At Least Once a Month

Previously, consumers were only able to access their credit report for free once a year at each of the major credit bureaus. However, there has recently been an exciting change to this policy.

Due to the financial stress that COVID-19 is causing, Equifax, Experian and TransUnion have announced that they are now providing free credit reports to everyone on a weekly basis for the next year (until April 20, 2021).

Yes, you read that correctly—you will be able to get your full credit report from all three major credit bureaus for free every single week for a year.

All consumers can now access a copy of their credit report for free every week.

The CEOs from each of the three companies said in a joint statement that they are “uniting as an industry to help people know the facts about their financial data” and “making credit reports more accessible more often so people can better manage their finances and take necessary steps to protect their credit standing” during this period of change and uncertainty.

Just like your annual free credit reports, you can now obtain your weekly free credit reports at annualcreditreport.com. Consider saving a copy of your report as a PDF file on your computer so that you don’t have to print it out on a huge stack of paper every time.

Even if you don’t think you need to check your credit report every week, it is still highly encouraged that you check them at least once a month. John Ulzheimer, a nationally recongnized credit expert, recently told Nerdwallet, “This move by the credit bureaus is a great idea because we really should be checking our credit reports once every statement cycle, which is basically once a month.”

Use Free Credit Monitoring Services

In addition, it doesn’t hurt to keep an eye on your credit using a reputable free monitoring service, such as Credit Karma, especially when April 2021 comes around, when consumers will no longer be able to access their credit reports on a weekly basis.

You can also see a summary of your credit report and get your VantageScore from reputable free sites like Credit Karma.

Some credit card companies also come with free credit monitoring services.

Regardless of how you check your credit, make it a point to do so regularly, which will help you catch inaccuracies on your credit report or fraudulent activity before it ruins your credit score.

If you find anything that needs to be updated or should not be on your credit report, you will need to fix the error by filing a dispute with the credit bureau(s). It’s also a good idea to contact the creditor so that they stop reporting the incorrect information. You can learn more about this process in How to Fix the Most Common Credit Report Errors.

Know How Much Available Credit You Have

Another way in which you should monitor your credit is to be aware of the credit limits and utilization ratios of each of your credit cards or other revolving lines of credit. This is so that you know exactly how much credit you have available to use if you get to a point where you need to utilize it.

Check Your Interest Rates and Consider Asking for a Lower Rate

You will also want to make sure you know the interest rates of each of your accounts so that when you need to leverage your credit, you can start with the accounts that have the lowest interest rates first and only use your accounts with high interest rates as a last resort.

Don’t forget that most credit card issuers would be willing to consider lowering your interest rates if you ask. The more you can minimize interest charges, the less you will have to divert from your cash flow toward paying off debts later.

18. Take Advantage of Promotional Offers With Reduced Interest and Fees

Now is a great time to take advantage of promotional offers that can save you some money on purchases you would already be making.

Credit Card Sign-Up Bonuses

Many credit cards come with introductory bonus cash back offers, but it’s best to only take advantage of these offers if you don’t have to increase your spending to meet the minimum spend requirements.

There are plenty of cards on the market that offer bonus rewards for spending a certain amount of money on the card after you first sign up.

Several cards offer introductory cash back bonuses of up to $200 and some offer travel rewards worth even more than that. Each card has a minimum spending requirement that must be met, usually within a few months of opening the account, in order to receive the bonus.

Going for a sign-up bonus offer only makes sense if you know you can meet the minimum spend by using the card to pay for necessities that you would have to buy anyway. If the promise of a bonus reward makes you feel inclined to spend extra money on things you don’t need, then you would probably be better off without applying for one of these cards.

Low Interest on Purchases

Many credit cards offer special introductory interest rate promotions. For example, several cards give you a 0% APR for 12 to 18 months.

A lot of consumers will likely find themselves needing to use credit cards for purchases and carrying a balance for a while when cash is tight. If that happens to you, you’ll certainly pay less in interest charges if you can use a card with 0% APR for a year instead of a card that has a typical APR of between 12% and nearly 30%.

Don’t forget that you will still need to make at least your minimum payments on these cards every month in order to maintain a solid payment history, which is the most valuable component of your credit score.

A balance transfer offer could be a good way to pay less in interest if you have to carry some credit card debt.

Also, make sure you know when your introductory rate period ends and what the regular APR will be once that happens, especially if you will not be able to pay off the balance before the end of the promotion.

Low Interest on Balance Transfers

Those who already have significant credit card debt may not be able to pay down those debts as quickly as they would like to due to a reduction in income. In this case, you might want to look for a balance transfer offer so that you can transfer high-interest balances to a card with a lower interest rate for a period of time.

Most balance transfer cards offer a minimum of 12 months with 0% APR, and some even offer an introductory low-rate period of up to 21 months, which gives you nearly two years to pay down your debt without having to pay any interest.

All of the above credit card offers are typically reserved for consumers who have good to excellent credit. However, if you can’t qualify for a balance transfer card, it’s possible that some of your existing credit cards have balance transfer offers available, so check with your credit card issuers.

Check out our article on balance transfers if you want to know more about how they work and whether a balance transfer might be right for you.

Pickup and Delivery Service Discounts

Produce box delivery services may offer referral bonuses or introductory promotions.

It’s not just credit cards that have perks for new customers. You can also take advantage of promotions offered by pickup and delivery services to get discounts on groceries and take-out meals.

Try searching for promo codes for services and apps like Walmart grocery pickup and delivery, Shipt, Instacart, Postmates, Uber Eats, etc. They frequently have perks for new customers such as discounts on your first order or reduced delivery fees. Produce box delivery services also often run referral or sign-up promotions.

Using these discounts can help you spend less on food, but be wary of deals that encourage you to buy things you normally wouldn’t buy or subscriptions that you might forget to cancel, and make it a point to avoid spending more money than you need to.

19. Look Into Getting a Personal Loan

Although taking on more debt isn’t ideal, it may be unavoidable for many Americans, particularly those whose incomes have decreased or stopped completely as a result of the coronavirus crisis.

When you find that you do need to use credit to make ends meet temporarily, consider applying for a personal loan.

Getting a personal loan to consolidate debt or cover expenses may be a good idea, depending on the terms and the interest rate.

Personal loans are installment loans, so they do not have as much of an impact on credit scores as revolving accounts, such as credit cards. (Keep in mind, however, that personal loans could actually get your score penalized if the new FICO 10 credit scoring model eventually gets adopted by lenders.)

Another advantage of personal loans is that they usually—but not always—charge lower interest rates than the interest rates that you would pay with credit cards. Your credit score will likely influence the interest rate you can qualify for, so this strategy makes the most sense for those with good to excellent credit.

If you can get a personal loan with a decent interest rate, you can use it to consolidate higher-interest debts to save money on interest charges, or if necessary, to pay for other bills and everyday necessities.

You’ll need to do the math first to determine whether this is a strategy that makes financial sense for you.

Consider researching several different lenders to see where you can get the best terms. Double-check the terms of the offers carefully before making it official so you don’t get surprised by any high fees or penalties later.

20. Temporarily Pause Your Retirement Contributions

Although it’s not ideal, it might be necessary to temporarily stop contributing to your retirement fund and save that money for emergencies instead.

How do you know if this move is right for you?

It depends on how much you already have saved up in your emergency fund. A certified financial planner recommends pausing your retirement contributions until you have at least three to six months’ worth of cash in your emergency savings account, as we discussed above, if not more.

Once you feel that you’re on more secure footing financially, then you can resume contributing to your retirement accounts without worrying about how to get by right now.

If you are already in a comfortable place and you don’t have to worry about tightening your belt too much, then go ahead and keep contributing as much as you can.

21. Stay the Course With Your Investments

For most people, the best way to handle your investments right now is to just leave them alone and keep investing regularly if you have the cash flow. Panic-selling stocks when prices are crashing will lock in losses and hurt your ability to recover.

Investors may be concerned about the volatility of the stock market and the sharp declines it has seen in recent weeks, but the absolute worst thing you could do is panic and sell your stocks while the market is at a historic low. That would lock in your losses, whereas staying invested would give your investments a chance to regain value as the market recovers.

The worst days for the stock market tend to be followed by the best days not long after, and you don’t want to miss out on those gains.

In addition, stock market indexes generally tend to increase over time when looking at longer time scales. As reported by Nerdwallet, the market has seen yearly positive growth about 70% of the time and has provided an average annual return of about 10% over the past century.

Staying the course is the best way to ensure maximum return on your investments long-term. That means leaving your investments alone and continuing to contribute to your investment accounts regularly if you are able to.

22. Cash in on Your Home Equity

If you are a homeowner, you may be able to take advantage of the equity you have in your home, which amounts to the market value of your home minus your outstanding mortgage balance.

Home Equity Line of Credit (HELOC)

One way to do this is to take out a home equity line of credit (HELOC). A HELOC is a revolving account that you can borrow from as needed and pay back over time.

It’s similar to a credit card in that you can carry a balance from month to month and you can choose to make only the minimum payment, although you will pay interest if you revolve a balance. Also like a credit card, it has a credit limit, and you can use it over and over as long as you have enough available credit.

HELOCs typically have variable interes rates, which means your interest rate and your monthly payment could fluctuate depending on the market.

A HELOC can be a valuable resource to draw on in times of need. However, it should not be used with abandon to make purchases that you cannot pay back. Your home is the collateral for the HELOC, so if you can’t pay back what you borrowed, you could lose your house or have a lien placed on it.

Homeowners may have the option to leverage the value of their homes via a HELOC or home equity loan.

Home Equity Loan

A home equity loan also borrows against the value of your home, but unlike a HELOC, it is an installment loan. This means that a home equity loan is disbursed as a lump sum and you make monthly payments that are the same every month for the duration of the loan.

In addition, home equity loans have fixed interest rates, in contrast to the variable rate you would get with a HELOC.

Reverse Mortgage

Homeowners who are age 62 or older can consider a reverse mortgage, which is a loan against the homeowner’s home equity that doesn’t require them to make any payments.

How does this work?

According to Investopedia, the homeowner may receive the funds as a lump sum, a line of credit, a fixed payment each month, or a combination of fixed monthly payments and a line of credit that can be used if necessary.

Rather than making monthly payments to pay the loan back, the entire amount of the loan must be paid when the homeowner dies, sells their home, or permanently moves somewhere else.

If the loan balance becomes higher than the value of the home, because the home’s market value has decreased, for example, then the homeowner or their estate does not have to pay the difference, because “negative equity protection” is required by federal law.

A reverse mortgage can be an option to consider for older adults who want to leverage the value of their homes to put more cash in their pockets. However, they may involve costly fees and interest as well as other risks and complications.

A cash-out refinance is another method of turning home equity into money in your pocket.

In addition, homeowners should beware of scammers who may try to take advantage of borrowers by helping them get reverse mortgages so they can steal the money.

Cash-Out Refinance

With a “cash-out” refinance, you replace your existing mortgage with a new, larger mortgage, and you are paid the difference, effectively converting some of your home equity into cash.

Investopedia has stated that the cash payment is not considered income by the government, so you don’t have to pay taxes on it.

However, one of the downsides of a cash-out refinance is that you may pay a higher interest rate than you would get than if you were to do a rate-and-term refinance, where the balance of your mortgage stays the same.

23. Research Refinancing Options to Take Advantage of Low Interest Rates

Now that interest rates have hit rock-bottom, a rate-and-term refinance may be an attractive option for those looking to get better interest rates and lower monthly payments on their installment loans.

Mortgage Loans

Interest rates on mortgages, for example, are currently hovering around 3% for 15-year loans and around 3.5% for 30-year loans, which is significantly lower than they were a year ago, when average mortgage rates were 3.84% for a 15-year loan and 4.41% on a 30-year loan, according to Money Under 30.

Refinancing your mortgage to get a better interest rate may help you save a lot of money on interest over the course of the loan, but don’t forget to account for the costs of refinancing.

That might not seem like a big difference, but even a slightly lower interest rate could potentially save you tens of thousands of dollars over the course of a loan and free up hundreds of dollars in cash flow each month.

However, it’s also important to keep in mind that there are fees to pay, such as origination fees and appraisal fees, that can drive up the closing costs of refinancing a mortgage by 2% to 6% of the loan amount. LendingTree reports that the average mortgage refinancing cost is $3,344 not including taxes and $5,779 with taxes included.

In order to decide whether refinancing your mortgage makes sense, you need to do the math and consider whether you will still end up saving money after the fees have been accounted for.

In addition, it may be more difficult to get approved for a refinance as creditors increase lending standards in this uncertain economy, especially if your family has lost income recently.

Student Loans

Refinancing student loans isn’t always a good idea, particularly if they are federal student loans. Those have already had their interest rates reduced to 0% until September anyway, and refinancing could cancel some of the benefits associated with your federal loans, such as income-driven repayment plans and public service loan forgiveness.

On the other hand, if you have private student loans, you might consider refinancing if you can find a lower interest rate.

Personal Loans

Although personal loan rates may not fall as quickly as other types of credit, as mentioned by Grow, it might still be worth shopping around to see if you can find a better deal. Again, make sure to consider the costs and benefits before making the decision.

24. Consider Borrowing From Your Retirement Savings—But Only as a Last Resort

Those who have retirement savings in the form of 401(k) accounts and IRA accounts may benefit from recent changes that were made to the rules that govern Americans’ retirement savings.

No Early Withdrawal Penalty up to $100,000

Normally, if you withdraw money from your retirement accounts early (generally before the age of 59½), you are required to pay an extra penalty tax of 10% of the amount you withdrew, on top of the taxes you would already be paying to the IRS. This is to discourage people from drawing on their retirement savings for other purposes, although there are some exceptions.

Now, however, the government has acknowledged that the current crisis may present a need for some people to take money out of their retirement accounts early.

You can withdraw from your retirement accounts early or take a loan out of your retirement funds if you need it to make ends meet, but be aware of the consequences of taking this money out early.

Consequently, the CARES act included a provision that allows Americans to withdraw up to $100,000 from their retirement accounts without having to pay the 10% penalty tax.

An obvious problem with this policy is that it does nothing to help the millions of Americans who do not have retirement savings to lean on, such as young adults and low-income individuals, who need the most financial help right now.

If you have a sizable retirement fund saved up, however, then that could serve as a source of cash to draw from in an emergency. However, most financial experts recommend only using this strategy as a short-term fix and as a last resort.

For one thing, investments are not worth as much right now since the market is down, which means you might have to take out a larger portion of your account’s current balance. Taking money out now means you will be missing out on gains when the market eventually recovers.

In addition, you would be losing time in which that money could be earning compound interest, which helps your money grow faster over time. As a result, an early withdrawal could seriously impact the amount you will have saved when you reach retirement, especially if it takes you a long time to pay it back.

Plus, although you would not have to pay the 10% penalty tax, you would still have to pay the regular tax rate on your withdrawal.

A 401(k) Loan May Be an Alternative Option

Taking a loan out of your 401(k) might be a better option because it would not be taxed, according to CNBC. However, you can only take out the lesser of either half of your account balance or $50,000, and you must repay the loan with interest within five years.

Roth IRA Withdrawal

If you have a Roth IRA, you can withdraw from there without any penalties or tax consequences, although you would still be missing out on potential gains by not having that money invested.

Ultimately, it’s best to allow your retirement funds to stay invested, but it might help you feel more comfortable to know that you have a resource that you can use if all else fails.

25. Don’t Get Scammed

Unfortunately, there are some people in the world who are trying to take advantage of the coronavirus pandemic by scamming vulnerable people.

Fraudulent coronavirus “cures” are not only a waste of money, but some of them may be dangerous to your health.

Fake Coronavirus Cures

They may try to sell you foods and supplements that supposedly prevent or cure the novel coronavirus, such as colloidal silver, essential oils, and fake masks or vaccines. Some may even suggest clearly ridiculous ideas like drinking bleach to kill the virus.

Of course, scientists and health officials agree that there are no known cures or ways to prevent COVID-19 except for keeping your distance from others, washing your hands frequently and thoroughly, and not touching your face with unwashed hands.

There is no need to waste your money on snake oil solutions promoted by those who are trying to profit off of the suffering of others, especially since most of us need to be saving as much as we can right now.

Not only that, but many of these supposed miracle cures are actually dangerous to your health, including the aforementioned colloidal silver (which can block absorption of some drugs and permanently turn your skin a blue-gray color) and essential oils (which can be irritating to the skin and poisonous if ingested).

Financial scams trying to take advantage of the pandemic are very common. Be skeptical of anyone that asks for your personal information.

Financial Fraud Schemes

In addition to these snake oil products, there are plenty of scammers trying to steal people’s money or identifying information, using fear and desperation to their advantage.

Watch out for phishing attempts via emails, text messages, and robocalls, which may purport to be from government employees and ask for your personal and financial information under the guise of sending you your stimulus check.

The government will not call, email, or text you to ask for your Social Security number or bank account information. You do not need to apply to get the check you do not have to pay a fee. If anyone asks you to do these things, it is almost certainly a scam.

We may also see an increase in scammers trying to convince distressed investors to fund fraudulent products that really turn out to be Ponzi schemes, as well as debt relief scams and fake charities trying to collect donations.

Protect yourself by carefully vetting any messages asking for your money or your personal information, and report suspicious activity to the Federal Trade Commission.

26. Consider Credit Counseling

Consumers who are still drowning in unserviceable debt even after trying to negotiate with creditors and trying to bring in extra income may need to seek help from a credit counseling professional.

A certified credit counselor can work with your creditors and help you build a plan to pay off your debt sooner. Credit counseling agencies, which are typically nonprofit organizations, can also provide education and referrals to other resources and organizations.

Make sure to do your due diligence in choosing a credit counseling agency by researching each organization that you are considering working with and asking questions about their services, fees, and qualifications.

Experian states that credit counseling does not affect your credit per se, but your credit score could be affected if you decide to go the route of entering into a formal debt management plan (DMP).

27. Avoid Payday Loans

Taking out a payday loan is more likely to trap you in a cycle of debt than it is to help you get by.

If you’re really short on cash and need some to help you get by immediately, you might feel like payday loans are the only option left. Unfortunately, payday loans come with sky-high interest rates and fees, which means it is extremely difficult for most borrowers to pay back those loans in full and on time.

The CFPB has stated that the annual percentage rate (APR) of a typical payday loan is nearly 400%! This is much higher than even the highest interest rates you will find on credit cards, which can range from around 12% APR to around 30% APR.

The CFPB also found that most payday loan borrowers end up paying more in fees than they originally borrowed, which means they are paying back more than twice the amount they received in credit.

If you were to take out a payday loan and then not have enough cash to pay it back, you’d just be deeper in debt and even more desperate than you were before. You might find yourself repeating the process by getting another payday loan to cover the first one, trapping yourself in a debt spiral that would be very hard to get out of.

Taking out a payday loan is a very risky move that is likely to do more harm than good to your financial situation.

Similarly, getting a car title loan is also not a good idea. Not only are they extremely expensive, with APRs in the hundreds, but they put your car at risk of being repossessed if you cannot pay back the loan in time.

What to Do Instead of Taking Out a Risky Small-Dollar Loan

Ideally, you could find a way to bring in extra income, like the ideas we talked about above, or negotiate with whoever you owe to come up with a payment plan.

Look into getting a personal loan from your local credit union, who might be more willing to work with you than a big bank. An installment loan that you can pay back over the course of multiple months will be easier to manage than a short-term loan that you have to pay back all at once.

Even using a credit card is preferable to getting a payday loan.

Do everything you can to avoid these predatory and expensive loans.

For occasional small emergencies, consider looking into paycheck advance apps like Earnin, which are marketed as more affordable alternatives to payday loans. However, they should not be considered a replacement for an emergency fund. Relying on paycheck advances regularly can still lead to the formation of bad financial habits and a cycle of debt that is difficult to reverse.

28. Seek Support From Your Community

Connect with others in your community (safely) for resources and support.

In this stressful time especially, it’s helpful to remember the importance of community. Although many of us are spending most of our time isolated at home, this doesn’t mean that you have to go through this difficult time alone.

Consider connecting digitally with members of your local community through social media or apps like Nextdoor. You might find that some of your neighbors would be happy to lend a helping hand.

For example, if you cannot get out of the house to get groceries or supplies because you or someone in your family is ill, someone else may be able to pick up what you need and leave it at your doorstep. If you’re struggling to afford the necessities, those with more resources might be willing to share some of what they have to help you get by.

Any family members who can provide support could also be a valuable resource in this period of financial stress.

Those who belong to a church could consider reaching out to their congregations for assistance.

You can also get in touch with a local food bank as well as organizations that offer help with rent and other bills, such as United Way.

Conclusion on Protecting Your Finances and Credit During Uncertain Times

We are in a time of extreme uncertainty and rapid change, and one of the areas under the most stress right now is our finances.

Whether you are out of work, have medical bills to pay, have children that need caring for, or are just feeling unsure of what the future holds (or all of the above), we hope that these steps can help you manage your finances and protect your credit as the economy changes quickly.

There is help out there for those who ask, so don’t be afraid to reach out to your bank, your lenders, your landlord, government assistance programs, and your community if you need support.

Try to continue to practice good financial and credit habits to the extent that you can, but don’t be too hard on yourself if you have to let some things go in order to prioritize the health and safety of yourself and your family.

We are in this together. Remember that no matter how bad things get, they will get better.

Additional Resources

Here are some additional resources from the CFPB that you may find useful:

Protect yourself financially from the impact of the coronavirus