Knowledge Center

07/26/2024

Published by Moriah Chace at 07/26/2024

Categories

I’m going to let you in on a secret. Most people aren’t bad at handling their money. Most people are bad at handling their emotions about money. When you can hone in on your emotions, your finances fall into line.

07/17/2024

Published by Ellen Johnson at 07/17/2024

Could inquiry "bumpage" and "choppage" improve your credit? Find out from an expert who has spent three decades in the industry, John Ulzheimer.

07/11/2024

Published by Moriah Chace at 07/11/2024

Categories

Identity theft is no laughing matter. When your identity is stolen, it can affect your entire financial life, from your credit to your ability to apply for loans. You want to make sure that you’re protected from identity theft.

07/11/2024

Published by Sarah Sharkey at 07/11/2024

Categories

It’s no secret that keeping a roof over your head can get expensive quickly. On average, households spend over a quarter of their household income on housing costs each year, and housing costs are on the rise.

06/27/2024

Published by Ellen Johnson at 06/27/2024

Categories

The “date of last activity,” also known as the DLA, is often discussed within the field of credit repair in a way that is inaccurate or misleading. Because of this, many consumers do not understand the DLA as it relates to their credit reports and credit scores.

06/21/2024

Published by Sarah Sharkey at 06/21/2024

Categories

Personal loans have grown in popularity over the years. As more Americans take out personal loans, many households are adding another monthly payment to their budgets.

06/06/2024

Published by Ellen Johnson at 06/06/2024

While credit mix only makes up 10% of your FICO score, it’s still important to consider when building credit. Check out our infographic about mix of credit and types of credit.

05/30/2024

Published by Ellen Johnson at 05/30/2024

Categories

Derogatory items can stay on your credit report and damage your credit scores for years. We’ll help you understand minor and major derogatories, how derogatory items affect your credit score, and what you can do about them.

05/20/2024

Published by Sarah Sharkey at 05/20/2024

Categories

Whether you got a bonus at work or won the lottery, a financial windfall is always welcome. After all, who doesn’t love when extra funds hit their bank account? What you do with those funds can have a big impact on your financial situation.

05/10/2024

Published by Sarah Sharkey at 05/10/2024

Categories

money myths can cause significant financial damage if you follow through on the ideas. As you navigate your own financial situation, it’s helpful to understand which often-repeated money ideas are actually just myths.

05/03/2024

Published by Moriah Chace at 05/03/2024

Categories

Limiting beliefs are beliefs that keep you from doing something. Some limiting beliefs are helpful because they keep you safe (e.g. you believe you can’t fly, […]

04/22/2024

Published by Sarah Sharkey at 04/22/2024

Categories

Credit card debt is common. Many households are facing a growing credit card balance. But this type of debt, with notoriously high interest rates, is one of the hardest to climb out of. Once you slide into credit card debt, it can be difficult to pull yourself back out.

04/08/2024

Published by Sarah Sharkey at 04/08/2024

Categories

A credit-builder loan can help you improve your credit, but it is critical that you understand exactly what it is and how this type of loan could impact your credit. Let’s explore credit-builder loans so you can decide if this tool is right for you.

04/07/2024

Published by Ellen Johnson at 04/07/2024

Categories

If you monitor your credit using a free website, chances are, you’ve seen your VantageScore. However, you may not have realized that this credit score is not the same as your FICO score.

04/01/2024

Published by Moriah Chace at 04/01/2024

Categories

Have you ever thought that budgeting just isn't for you? If so, you're not alone. Many feel that budgets are too restrictive or find budget planning to be a chore—but it doesn't have to be.

03/24/2024

Published by Ellen Johnson at 03/24/2024

Nearly one in five American adults do not have a credit score. Find out what it means to be "credit invisible" and how consumers can become credit visible.

03/19/2024

Published by Ellen Johnson at 03/19/2024

Categories

The debt snowball and the debt avalanche are the two most popular methods for paying off debt. We explain how they work, the pros and cons of each approach, and how to decide which debt payoff strategy is right for you.

03/15/2024

Published by Moriah Chace at 03/15/2024

Categories

One of the most distressing problems in America today is people living without roofs over their heads. However, knowing the factors that lead to homelessness can help you avoid becoming homeless.

03/11/2024

Published by Ellen Johnson at 03/11/2024

Categories

Credit cards are not only a useful payment method for making purchases but also an essential component of a solid credit-building strategy. When you have the knowledge to use credit cards to your advantage rather than to your detriment, they can be an extremely powerful financial tool to have in your arsenal.

03/04/2024

Published by Ellen Johnson at 03/04/2024

Categories

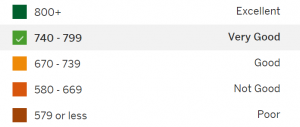

The vast majority of lenders use your FICO credit score to evaluate your credit risk as a consumer when they are deciding whether or not to extend credit to you. And yet, historically, it has been costly for consumers to access their own FICO scores.

03/04/2024

Published by Sarah Sharkey at 03/04/2024

Categories

When you think of credit cards, unsecured credit cards likely come to mind first. While some financial gurus preach about the dangers of opening an unsecured credit card, the reality is that an unsecured credit card can be a useful financial tool.

02/25/2024

Published by Sarah Sharkey at 02/25/2024

Categories

It’s a good idea to use your tax refund to get ahead financially. But where should you allocate these funds? Let’s take a closer look at how you can use your tax refund to move toward your financial goals.

02/23/2024

Published by Sarah Sharkey at 02/23/2024

Categories

Back in 2020, the federal government gave student loan borrowers a payment reprieve. The temporary measure was designed to help borrowers with federal student loans get through the financial uncertainty caused by the pandemic. But the federal student loan payment pause came to an end in fall 2023.

02/09/2024

Published by Sarah Sharkey at 02/09/2024

Categories

When you need a vehicle to get around, you might feel pressure to spring for more than you can truly afford. Whether your financial situation has changed or you felt pressure to overspend at the dealership, being stuck with a car payment that you cannot afford is an uncomfortable situation.

02/04/2024

Published by Ellen Johnson at 02/04/2024

Everyone wants to get a higher credit score, but not all of the “hacks” or tips being promoted actually help you get more credit score points. Credit expert John Ulzheimer answers some common questions about ways to get more credit score points.

01/21/2024

Published by Ellen Johnson at 01/21/2024

Categories

Being an authorized user on someone else’s credit card can often be a valuable strategy for consumers who are looking to build credit. However, it is not true that everyone will benefit from authorized user accounts in every situation.

01/18/2024

Published by Sarah Sharkey at 01/18/2024

Categories

A secured credit card gives cardholders an opportunity to build credit. While you’ll have to make a security deposit to serve as collateral, this can serve as your entry point into building credit.

01/15/2024

Published by Ellen Johnson at 01/15/2024

Credit sweeps are a heavily advertised and promoted service among credit repair companies. John Ulzheimer explains why you need to watch out for credit sweep scams in an episode of Credit Countdown.

01/10/2024

Published by Sam Hawrylack at 01/10/2024

Categories

These credit cards allow you to apply despite having a low credit score. Read this guide to learn about the best-rated credit cards for bad credit in 2024!

01/05/2024

Published by Sarah Sharkey at 01/05/2024

Categories

You can find financial advice almost everywhere you turn. Whether you are hearing advice from TikTok stars or friends and family, you’ve likely heard more than a few financial myths thrown into the mix.